Intech Investment Management LLC boosted its stake in shares of Essent Group Ltd. (NYSE:ESNT - Free Report) by 112.0% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 27,064 shares of the financial services provider's stock after purchasing an additional 14,300 shares during the quarter. Intech Investment Management LLC's holdings in Essent Group were worth $1,740,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

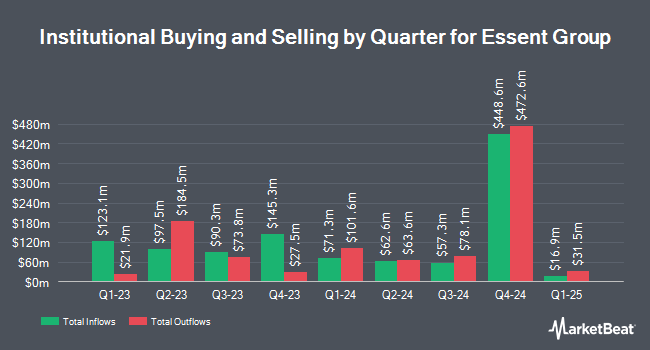

A number of other institutional investors also recently added to or reduced their stakes in ESNT. Dimensional Fund Advisors LP raised its stake in Essent Group by 10.5% in the second quarter. Dimensional Fund Advisors LP now owns 4,680,074 shares of the financial services provider's stock valued at $262,973,000 after buying an additional 445,853 shares during the last quarter. AQR Capital Management LLC raised its stake in Essent Group by 68.8% in the second quarter. AQR Capital Management LLC now owns 436,009 shares of the financial services provider's stock valued at $24,499,000 after buying an additional 177,700 shares during the last quarter. Susquehanna Fundamental Investments LLC purchased a new stake in Essent Group in the second quarter valued at about $4,748,000. Hsbc Holdings PLC purchased a new stake in Essent Group in the second quarter valued at about $4,416,000. Finally, Panagora Asset Management Inc. purchased a new stake in Essent Group in the second quarter valued at about $3,721,000. Institutional investors own 93.00% of the company's stock.

Insider Activity at Essent Group

In related news, CFO David B. Weinstock sold 2,000 shares of the business's stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $63.59, for a total transaction of $127,180.00. Following the completion of the transaction, the chief financial officer now directly owns 25,416 shares of the company's stock, valued at $1,616,203.44. The trade was a 7.30 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Company insiders own 3.20% of the company's stock.

Analyst Ratings Changes

ESNT has been the subject of several research analyst reports. Keefe, Bruyette & Woods upgraded Essent Group from a "market perform" rating to an "outperform" rating and raised their price objective for the stock from $65.00 to $70.00 in a research note on Monday, August 5th. Barclays reduced their price target on Essent Group from $72.00 to $69.00 and set an "overweight" rating for the company in a research report on Monday, November 4th. The Goldman Sachs Group reduced their price target on Essent Group from $68.00 to $60.00 and set a "neutral" rating for the company in a research report on Tuesday, November 5th. Royal Bank of Canada reduced their price target on Essent Group from $73.00 to $67.00 and set an "outperform" rating for the company in a research report on Monday, November 4th. Finally, BTIG Research lifted their price target on Essent Group from $61.00 to $64.00 and gave the company a "buy" rating in a research report on Monday, August 5th. Four equities research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $65.00.

View Our Latest Report on Essent Group

Essent Group Stock Down 0.6 %

NYSE:ESNT traded down $0.37 on Tuesday, reaching $57.75. The company's stock had a trading volume of 566,914 shares, compared to its average volume of 532,416. Essent Group Ltd. has a 12-month low of $47.56 and a 12-month high of $65.33. The firm has a market cap of $6.13 billion, a price-to-earnings ratio of 8.37, a price-to-earnings-growth ratio of 2.65 and a beta of 1.12. The stock has a 50 day moving average price of $60.45 and a 200 day moving average price of $59.53.

Essent Group (NYSE:ESNT - Get Free Report) last posted its earnings results on Friday, November 1st. The financial services provider reported $1.65 EPS for the quarter, missing analysts' consensus estimates of $1.73 by ($0.08). Essent Group had a net margin of 60.15% and a return on equity of 13.81%. The business had revenue of $3.17 billion during the quarter, compared to analysts' expectations of $316.80 million. During the same quarter in the prior year, the firm earned $1.66 EPS. Essent Group's revenue for the quarter was up 969.2% compared to the same quarter last year. Equities research analysts expect that Essent Group Ltd. will post 6.95 EPS for the current fiscal year.

Essent Group Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 11th. Investors of record on Monday, December 2nd will be issued a $0.28 dividend. The ex-dividend date is Monday, December 2nd. This represents a $1.12 annualized dividend and a dividend yield of 1.94%. Essent Group's dividend payout ratio is presently 16.23%.

About Essent Group

(

Free Report)

Essent Group Ltd., through its subsidiaries, provides private mortgage insurance and reinsurance for mortgages secured by residential properties located in the United States. Its mortgage insurance products include primary, pool, and master policy. The company also provides information technology maintenance and development services; customer support-related services; underwriting consulting; and contract underwriting services, as well as risk management products and title insurance and settlement services.

Featured Stories

Before you consider Essent Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Essent Group wasn't on the list.

While Essent Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.