Intech Investment Management LLC lifted its position in Sonos, Inc. (NASDAQ:SONO - Free Report) by 157.3% during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 63,375 shares of the company's stock after buying an additional 38,740 shares during the period. Intech Investment Management LLC owned approximately 0.05% of Sonos worth $779,000 at the end of the most recent reporting period.

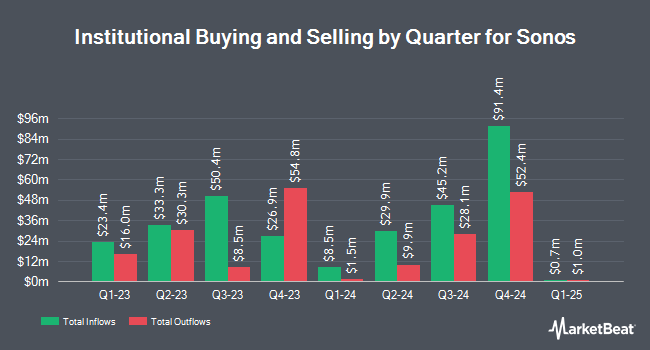

Other hedge funds and other institutional investors also recently modified their holdings of the company. Gladius Capital Management LP bought a new stake in shares of Sonos in the 3rd quarter worth $30,000. Point72 Asia Singapore Pte. Ltd. bought a new stake in shares of Sonos in the 2nd quarter worth $46,000. Quest Partners LLC raised its stake in shares of Sonos by 138.8% in the 2nd quarter. Quest Partners LLC now owns 4,850 shares of the company's stock worth $72,000 after buying an additional 2,819 shares in the last quarter. KBC Group NV raised its position in shares of Sonos by 52.5% during the third quarter. KBC Group NV now owns 4,852 shares of the company's stock worth $60,000 after purchasing an additional 1,670 shares during the period. Finally, nVerses Capital LLC acquired a new stake in shares of Sonos during the second quarter worth $81,000. Institutional investors own 85.82% of the company's stock.

Sonos Stock Performance

Shares of SONO stock traded down $0.03 on Friday, reaching $13.61. 1,055,049 shares of the company's stock traded hands, compared to its average volume of 1,931,396. Sonos, Inc. has a 12-month low of $10.23 and a 12-month high of $19.76. The company has a market capitalization of $1.66 billion, a P/E ratio of -41.24 and a beta of 2.04. The business's 50 day moving average price is $12.86 and its two-hundred day moving average price is $13.46.

Sonos (NASDAQ:SONO - Get Free Report) last issued its quarterly earnings results on Wednesday, November 13th. The company reported ($0.44) earnings per share for the quarter, missing analysts' consensus estimates of ($0.22) by ($0.22). Sonos had a negative net margin of 2.51% and a negative return on equity of 4.97%. The business had revenue of $255.38 million for the quarter, compared to analysts' expectations of $247.92 million. During the same quarter in the prior year, the firm posted ($0.21) EPS. The business's quarterly revenue was down 16.3% compared to the same quarter last year. Research analysts predict that Sonos, Inc. will post -0.3 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of equities research analysts have recently issued reports on the company. Morgan Stanley lowered Sonos from an "overweight" rating to an "underweight" rating and cut their target price for the stock from $25.00 to $11.00 in a research report on Thursday, September 26th. Craig Hallum lowered Sonos from a "buy" rating to a "hold" rating and cut their target price for the stock from $25.00 to $10.00 in a research report on Thursday, August 8th.

Get Our Latest Report on SONO

Sonos Company Profile

(

Free Report)

Sonos, Inc, together with its subsidiaries, designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It offers wireless, portable, and home theater speakers; components; and accessories. The company offers its products through approximately 10,000 third-party retail stores, including custom installers of home audio systems; and e-commerce retailers, as well as through its website.

Recommended Stories

Before you consider Sonos, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sonos wasn't on the list.

While Sonos currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.