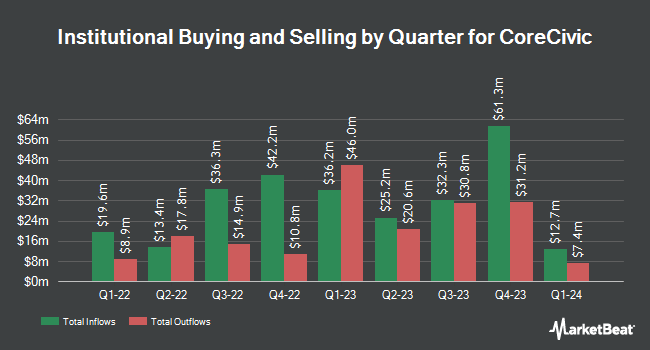

Intech Investment Management LLC boosted its holdings in shares of CoreCivic, Inc. (NYSE:CXW - Free Report) by 485.4% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 87,737 shares of the real estate investment trust's stock after buying an additional 72,750 shares during the quarter. Intech Investment Management LLC owned 0.08% of CoreCivic worth $1,110,000 as of its most recent SEC filing.

Other large investors also recently modified their holdings of the company. Headlands Technologies LLC purchased a new position in shares of CoreCivic in the 2nd quarter valued at $29,000. nVerses Capital LLC acquired a new stake in shares of CoreCivic in the 2nd quarter worth $40,000. GAMMA Investing LLC lifted its stake in shares of CoreCivic by 77.7% in the 3rd quarter. GAMMA Investing LLC now owns 3,733 shares of the real estate investment trust's stock worth $47,000 after acquiring an additional 1,632 shares during the period. Innealta Capital LLC acquired a new stake in shares of CoreCivic in the 2nd quarter worth $87,000. Finally, Chesapeake Capital Corp IL acquired a new stake in shares of CoreCivic in the 3rd quarter worth $139,000. 85.13% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In related news, CFO David Garfinkle sold 50,000 shares of CoreCivic stock in a transaction on Monday, November 11th. The stock was sold at an average price of $24.20, for a total value of $1,210,000.00. Following the transaction, the chief financial officer now owns 276,528 shares in the company, valued at approximately $6,691,977.60. This trade represents a 15.31 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Anne L. Mariucci sold 10,000 shares of the firm's stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $24.00, for a total value of $240,000.00. Following the completion of the transaction, the director now owns 101,936 shares in the company, valued at approximately $2,446,464. This trade represents a 8.93 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 110,000 shares of company stock worth $2,490,520. 2.21% of the stock is owned by company insiders.

Analysts Set New Price Targets

CXW has been the subject of several recent analyst reports. Wedbush reiterated a "neutral" rating and issued a $14.00 price objective on shares of CoreCivic in a research note on Friday, September 13th. Northland Securities raised their target price on shares of CoreCivic from $17.00 to $32.00 and gave the company an "outperform" rating in a report on Friday, November 8th.

Get Our Latest Analysis on CXW

CoreCivic Trading Up 2.5 %

Shares of CoreCivic stock traded up $0.55 during trading hours on Thursday, reaching $22.49. 1,672,886 shares of the company's stock were exchanged, compared to its average volume of 1,012,526. CoreCivic, Inc. has a 52-week low of $10.74 and a 52-week high of $24.99. The company has a fifty day moving average of $15.97 and a 200-day moving average of $14.44. The company has a current ratio of 1.51, a quick ratio of 1.51 and a debt-to-equity ratio of 0.66. The firm has a market capitalization of $2.48 billion, a price-to-earnings ratio of 33.57 and a beta of 0.86.

CoreCivic Company Profile

(

Free Report)

CoreCivic, Inc owns and operates partnership correctional, detention, and residential reentry facilities in the United States. It operates through three segments: CoreCivic Safety, CoreCivic Community, and CoreCivic Properties. The company provides a range of solutions to government partners that serve the public good through corrections and detention management, a network of residential reentry centers to help address America's recidivism crisis, and government real estate solutions.

Further Reading

Before you consider CoreCivic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CoreCivic wasn't on the list.

While CoreCivic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.