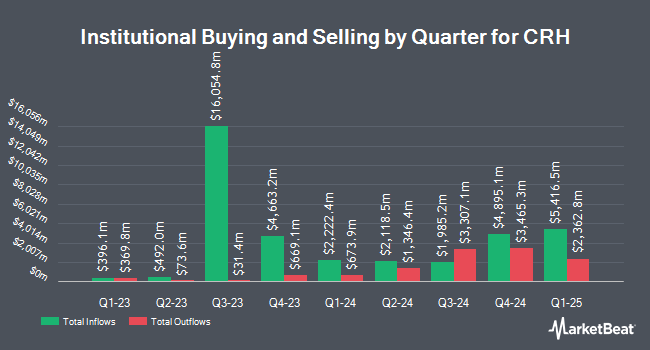

Intech Investment Management LLC cut its holdings in shares of CRH plc (NYSE:CRH - Free Report) by 38.2% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 46,929 shares of the construction company's stock after selling 29,059 shares during the period. Intech Investment Management LLC's holdings in CRH were worth $4,342,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds also recently bought and sold shares of CRH. Heck Capital Advisors LLC purchased a new stake in CRH during the 4th quarter worth approximately $32,000. Meeder Asset Management Inc. purchased a new stake in shares of CRH during the third quarter worth $35,000. Whipplewood Advisors LLC purchased a new stake in shares of CRH during the fourth quarter worth $38,000. Deseret Mutual Benefit Administrators increased its position in shares of CRH by 87.7% during the fourth quarter. Deseret Mutual Benefit Administrators now owns 505 shares of the construction company's stock worth $47,000 after acquiring an additional 236 shares during the period. Finally, Spire Wealth Management purchased a new stake in shares of CRH during the fourth quarter worth $57,000. 62.50% of the stock is currently owned by hedge funds and other institutional investors.

CRH Trading Down 2.9 %

Shares of NYSE CRH traded down $2.80 during mid-day trading on Friday, reaching $94.79. The company had a trading volume of 37,706,618 shares, compared to its average volume of 5,006,019. The firm has a 50 day simple moving average of $99.81 and a two-hundred day simple moving average of $96.36. The stock has a market cap of $64.16 billion, a P/E ratio of 18.96, a PEG ratio of 1.15 and a beta of 1.30. CRH plc has a 52-week low of $71.18 and a 52-week high of $110.97.

CRH Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, April 16th. Investors of record on Friday, March 14th will be paid a dividend of $0.37 per share. This represents a $1.48 dividend on an annualized basis and a yield of 1.56%. The ex-dividend date of this dividend is Friday, March 14th. This is an increase from CRH's previous quarterly dividend of $0.23. CRH's dividend payout ratio (DPR) is currently 15.51%.

Wall Street Analyst Weigh In

CRH has been the topic of several recent research reports. StockNews.com upgraded CRH from a "hold" rating to a "buy" rating in a report on Thursday, February 27th. JPMorgan Chase & Co. cut their target price on shares of CRH from $118.00 to $114.00 and set an "overweight" rating on the stock in a research note on Tuesday, March 11th. Berenberg Bank set a $120.00 price objective on shares of CRH in a research report on Friday, February 28th. Finally, Citigroup dropped their price objective on shares of CRH from $120.00 to $115.00 and set a "buy" rating on the stock in a research report on Monday, January 6th. One equities research analyst has rated the stock with a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Buy" and a consensus price target of $109.64.

Get Our Latest Stock Analysis on CRH

CRH Company Profile

(

Free Report)

CRH plc, together with its subsidiaries, provides building materials solutions in Ireland and internationally. It operates through four segments: Americas Materials Solutions, Americas Building Solutions, Europe Materials Solutions, and Europe Building Solutions. The company provides solutions for the construction and maintenance of public infrastructure and commercial and residential buildings; and produces and sells aggregates, cement, readymixed concrete, and asphalt, as well as provides paving and construction services.

Featured Stories

Before you consider CRH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CRH wasn't on the list.

While CRH currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.