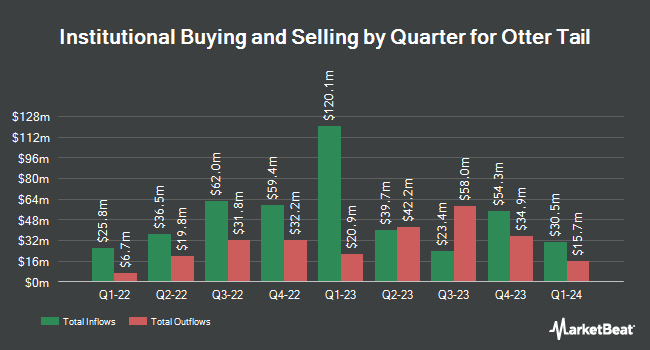

Intech Investment Management LLC purchased a new stake in Otter Tail Co. (NASDAQ:OTTR - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 8,740 shares of the utilities provider's stock, valued at approximately $683,000.

A number of other large investors have also added to or reduced their stakes in OTTR. Atticus Wealth Management LLC acquired a new position in Otter Tail during the second quarter worth about $33,000. Hoese & Co LLP bought a new position in Otter Tail during the 3rd quarter worth approximately $39,000. Allworth Financial LP lifted its holdings in Otter Tail by 132.8% in the third quarter. Allworth Financial LP now owns 547 shares of the utilities provider's stock valued at $43,000 after buying an additional 312 shares during the period. GAMMA Investing LLC lifted its stake in shares of Otter Tail by 46.3% in the 2nd quarter. GAMMA Investing LLC now owns 657 shares of the utilities provider's stock valued at $58,000 after purchasing an additional 208 shares during the period. Finally, Quarry LP increased its holdings in Otter Tail by 1,811.4% in the second quarter. Quarry LP now owns 669 shares of the utilities provider's stock worth $59,000 after purchasing an additional 634 shares in the last quarter. Institutional investors and hedge funds own 61.32% of the company's stock.

Otter Tail Stock Down 0.3 %

OTTR stock traded down $0.24 during midday trading on Friday, reaching $80.64. 119,876 shares of the company's stock traded hands, compared to its average volume of 264,230. Otter Tail Co. has a 52 week low of $73.43 and a 52 week high of $100.84. The company has a market cap of $3.37 billion, a price-to-earnings ratio of 11.14 and a beta of 0.52. The firm's fifty day moving average price is $79.06 and its 200-day moving average price is $84.77. The company has a quick ratio of 1.66, a current ratio of 2.17 and a debt-to-equity ratio of 0.58.

Otter Tail (NASDAQ:OTTR - Get Free Report) last issued its quarterly earnings data on Monday, November 4th. The utilities provider reported $2.03 EPS for the quarter, topping analysts' consensus estimates of $1.97 by $0.06. The firm had revenue of $338.03 million during the quarter, compared to analyst estimates of $362.20 million. Otter Tail had a return on equity of 19.84% and a net margin of 22.70%. During the same period in the previous year, the company posted $2.19 EPS. As a group, sell-side analysts forecast that Otter Tail Co. will post 7.01 earnings per share for the current fiscal year.

Otter Tail Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 10th. Stockholders of record on Friday, November 15th will be issued a $0.468 dividend. The ex-dividend date is Friday, November 15th. This represents a $1.87 annualized dividend and a dividend yield of 2.32%. Otter Tail's dividend payout ratio is currently 25.83%.

Wall Street Analyst Weigh In

Several analysts have recently weighed in on OTTR shares. StockNews.com upgraded shares of Otter Tail from a "sell" rating to a "hold" rating in a research note on Thursday, November 14th. Siebert Williams Shank upgraded Otter Tail from a "strong sell" rating to a "hold" rating in a research note on Wednesday, November 6th.

Read Our Latest Research Report on Otter Tail

About Otter Tail

(

Free Report)

Otter Tail Corporation, together with its subsidiaries, engages in electric utility, manufacturing, and plastic pipe businesses in the United States. It operates through three segments: Electric, Manufacturing, and Plastics. The Electric segment produces, transmits, distributes, and sells electric energy in Minnesota, North Dakota, and South Dakota; and operates as a participant in the Midcontinent Independent System Operator markets.

Featured Stories

Before you consider Otter Tail, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Otter Tail wasn't on the list.

While Otter Tail currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.