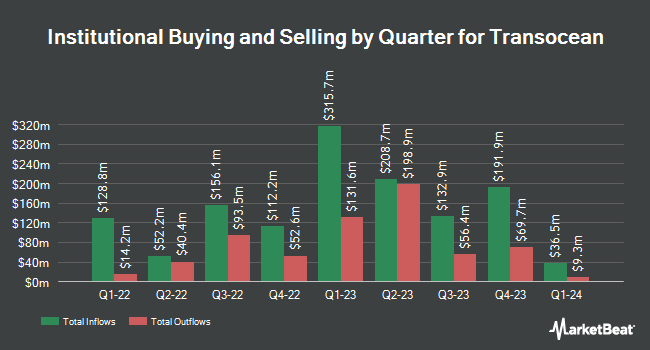

Intech Investment Management LLC purchased a new stake in Transocean Ltd. (NYSE:RIG - Free Report) in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund purchased 157,754 shares of the offshore drilling services provider's stock, valued at approximately $670,000.

Other institutional investors and hedge funds have also bought and sold shares of the company. Northwestern Mutual Wealth Management Co. raised its position in shares of Transocean by 138.8% in the 2nd quarter. Northwestern Mutual Wealth Management Co. now owns 4,633 shares of the offshore drilling services provider's stock worth $25,000 after purchasing an additional 2,693 shares during the last quarter. Nisa Investment Advisors LLC purchased a new position in shares of Transocean during the second quarter valued at about $30,000. SG Americas Securities LLC bought a new stake in Transocean in the second quarter worth $64,000. Atria Investments Inc purchased a new stake in Transocean during the third quarter valued at approximately $51,000. Finally, Epiq Partners LLC bought a new stake in shares of Transocean in the 2nd quarter worth about $86,000. 67.73% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Transocean news, EVP Roderick James Mackenzie sold 20,000 shares of the firm's stock in a transaction that occurred on Monday, November 18th. The stock was sold at an average price of $4.29, for a total value of $85,800.00. Following the sale, the executive vice president now owns 310,857 shares of the company's stock, valued at $1,333,576.53. This trade represents a 6.04 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, Director Perestroika purchased 1,500,000 shares of the business's stock in a transaction on Thursday, September 12th. The shares were acquired at an average price of $4.13 per share, with a total value of $6,195,000.00. Following the purchase, the director now owns 91,074,894 shares of the company's stock, valued at approximately $376,139,312.22. This trade represents a 1.67 % increase in their ownership of the stock. The disclosure for this purchase can be found here. 13.16% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

RIG has been the subject of a number of research reports. Benchmark lowered shares of Transocean from a "buy" rating to a "hold" rating in a research note on Tuesday, October 15th. DNB Markets upgraded shares of Transocean from a "hold" rating to a "buy" rating in a research report on Tuesday, September 3rd. Barclays decreased their price target on shares of Transocean from $6.00 to $4.50 and set an "equal weight" rating on the stock in a research note on Wednesday, October 23rd. Morgan Stanley boosted their target price on Transocean from $5.00 to $6.00 and gave the stock an "equal weight" rating in a report on Thursday, October 3rd. Finally, Susquehanna reduced their price objective on shares of Transocean from $7.00 to $6.50 and set a "positive" rating on the stock in a report on Friday, November 1st. Two investment analysts have rated the stock with a sell rating, four have issued a hold rating and three have given a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and an average price target of $6.43.

Check Out Our Latest Analysis on Transocean

Transocean Stock Performance

NYSE RIG traded up $0.10 during trading hours on Friday, reaching $4.40. The company's stock had a trading volume of 6,855,704 shares, compared to its average volume of 18,208,976. The stock has a market cap of $3.85 billion, a PE ratio of -5.87 and a beta of 2.78. The business has a 50-day simple moving average of $4.31 and a 200 day simple moving average of $4.89. The company has a current ratio of 1.64, a quick ratio of 1.34 and a debt-to-equity ratio of 0.64. Transocean Ltd. has a 52 week low of $3.85 and a 52 week high of $6.88.

Transocean Company Profile

(

Free Report)

Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. The company operates a fleet of mobile offshore drilling units, consisting of ultra-deepwater floaters and harsh environment floaters.

Further Reading

Before you consider Transocean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transocean wasn't on the list.

While Transocean currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.