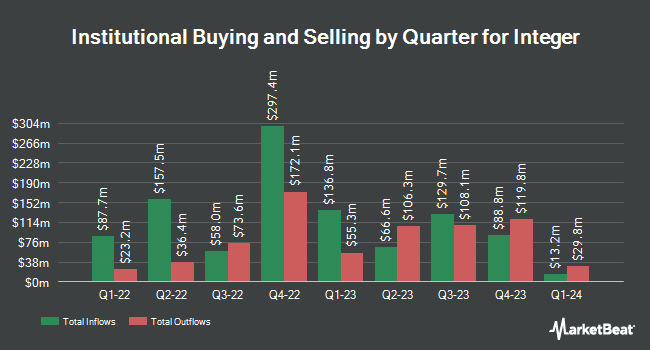

Jane Street Group LLC boosted its position in shares of Integer Holdings Co. (NYSE:ITGR - Free Report) by 23.3% in the third quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 151,397 shares of the medical equipment provider's stock after buying an additional 28,572 shares during the quarter. Jane Street Group LLC owned approximately 0.45% of Integer worth $19,682,000 as of its most recent filing with the Securities & Exchange Commission.

Other institutional investors have also added to or reduced their stakes in the company. Contravisory Investment Management Inc. boosted its holdings in Integer by 55.9% in the third quarter. Contravisory Investment Management Inc. now owns 223 shares of the medical equipment provider's stock valued at $29,000 after acquiring an additional 80 shares in the last quarter. Huntington National Bank boosted its stake in shares of Integer by 8,933.3% during the 3rd quarter. Huntington National Bank now owns 271 shares of the medical equipment provider's stock valued at $35,000 after purchasing an additional 268 shares in the last quarter. Quest Partners LLC increased its position in shares of Integer by 3,688.9% during the second quarter. Quest Partners LLC now owns 341 shares of the medical equipment provider's stock valued at $39,000 after buying an additional 332 shares during the period. GAMMA Investing LLC raised its stake in Integer by 74.1% in the third quarter. GAMMA Investing LLC now owns 653 shares of the medical equipment provider's stock worth $85,000 after buying an additional 278 shares in the last quarter. Finally, Innealta Capital LLC purchased a new stake in Integer in the second quarter worth about $110,000. Hedge funds and other institutional investors own 99.29% of the company's stock.

Integer Stock Up 1.0 %

Shares of NYSE:ITGR traded up $1.35 during trading on Tuesday, reaching $139.66. 304,138 shares of the stock traded hands, compared to its average volume of 304,783. The stock has a market cap of $4.68 billion, a P/E ratio of 43.10, a price-to-earnings-growth ratio of 2.00 and a beta of 1.12. The company has a debt-to-equity ratio of 0.67, a quick ratio of 2.09 and a current ratio of 3.28. The stock has a 50-day moving average of $132.80 and a two-hundred day moving average of $125.29. Integer Holdings Co. has a 52-week low of $89.65 and a 52-week high of $142.76.

Integer (NYSE:ITGR - Get Free Report) last issued its earnings results on Thursday, October 24th. The medical equipment provider reported $1.43 EPS for the quarter, beating the consensus estimate of $1.36 by $0.07. The business had revenue of $431.42 million for the quarter, compared to the consensus estimate of $440.59 million. Integer had a return on equity of 11.63% and a net margin of 6.70%. The company's revenue was up 8.7% compared to the same quarter last year. During the same period last year, the business posted $1.27 EPS. As a group, sell-side analysts expect that Integer Holdings Co. will post 5.33 earnings per share for the current fiscal year.

Analysts Set New Price Targets

ITGR has been the subject of a number of research reports. Truist Financial decreased their price objective on Integer from $150.00 to $147.00 and set a "buy" rating for the company in a report on Friday, October 25th. Citigroup increased their price target on shares of Integer from $124.00 to $130.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 1st. KeyCorp boosted their price objective on shares of Integer from $139.00 to $144.00 and gave the stock an "overweight" rating in a research note on Tuesday, October 15th. Bank of America raised their target price on shares of Integer from $135.00 to $145.00 and gave the company a "buy" rating in a research note on Tuesday, October 1st. Finally, Wells Fargo & Company reiterated an "overweight" rating and set a $160.00 target price on shares of Integer in a report on Tuesday, December 3rd. One investment analyst has rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $142.00.

Get Our Latest Research Report on ITGR

Integer Profile

(

Free Report)

Integer Holdings Corporation operates as a medical device outsource manufacturer in the United States, Puerto Rico, Costa Rica, and internationally. It operates through two segments, Medical and Non-Medical. The company offers products for interventional cardiology, structural heart, heart failure, peripheral vascular, neurovascular, interventional oncology, electrophysiology, vascular access, infusion therapy, hemodialysis, non-vascular, urology, and gastroenterology procedures.

Read More

Before you consider Integer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Integer wasn't on the list.

While Integer currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.