Integrated Quantitative Investments LLC purchased a new stake in Ooma, Inc. (NYSE:OOMA - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm purchased 21,461 shares of the technology company's stock, valued at approximately $302,000. Integrated Quantitative Investments LLC owned about 0.08% of Ooma at the end of the most recent reporting period.

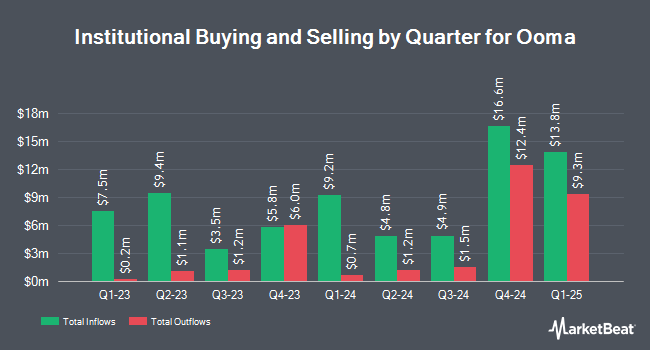

A number of other hedge funds and other institutional investors also recently modified their holdings of OOMA. Arrowstreet Capital Limited Partnership raised its stake in Ooma by 284.7% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 253,016 shares of the technology company's stock valued at $3,557,000 after acquiring an additional 187,245 shares during the period. Alliancebernstein L.P. raised its position in shares of Ooma by 674.1% in the fourth quarter. Alliancebernstein L.P. now owns 128,430 shares of the technology company's stock valued at $1,806,000 after purchasing an additional 111,840 shares during the period. Norges Bank bought a new position in shares of Ooma in the fourth quarter valued at about $1,067,000. Vanguard Group Inc. lifted its stake in shares of Ooma by 5.6% during the 4th quarter. Vanguard Group Inc. now owns 1,338,725 shares of the technology company's stock worth $18,822,000 after buying an additional 71,247 shares during the last quarter. Finally, Connor Clark & Lunn Investment Management Ltd. boosted its holdings in shares of Ooma by 40.4% during the 4th quarter. Connor Clark & Lunn Investment Management Ltd. now owns 229,221 shares of the technology company's stock worth $3,223,000 after buying an additional 66,009 shares during the period. Institutional investors own 80.42% of the company's stock.

Ooma Stock Performance

NYSE OOMA traded down $0.01 during trading on Friday, reaching $11.99. The company's stock had a trading volume of 161,789 shares, compared to its average volume of 124,921. The firm has a 50 day moving average price of $13.78 and a 200 day moving average price of $13.61. Ooma, Inc. has a 12 month low of $6.50 and a 12 month high of $17.00. The firm has a market capitalization of $330.81 million, a price-to-earnings ratio of -32.39 and a beta of 1.06. The company has a current ratio of 1.08, a quick ratio of 0.82 and a debt-to-equity ratio of 0.04.

Analyst Upgrades and Downgrades

Several research firms have weighed in on OOMA. Lake Street Capital lowered their price target on shares of Ooma from $18.00 to $17.00 and set a "buy" rating on the stock in a report on Wednesday, March 5th. Benchmark increased their target price on Ooma from $17.00 to $20.00 and gave the stock a "buy" rating in a research note on Wednesday, March 5th. One investment analyst has rated the stock with a hold rating, four have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, Ooma has an average rating of "Buy" and an average price target of $17.63.

Read Our Latest Stock Report on Ooma

Ooma Profile

(

Free Report)

Ooma, Inc provides communications services and related technologies for businesses and consumers in the United States and Canada. The company's products and services include Ooma Office, a cloud-based multi-user communications system for small and medium-sized businesses; Ooma Connect, which delivers fixed wireless internet connectivity; and Ooma Enterprise, a unified-communications-as-a-service (UCaaS) solution.

Further Reading

Before you consider Ooma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ooma wasn't on the list.

While Ooma currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.