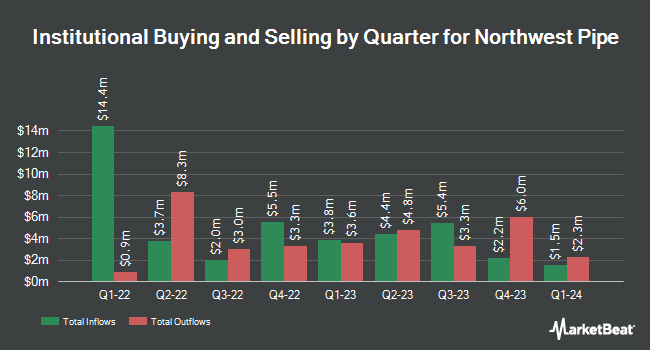

Integrated Quantitative Investments LLC bought a new stake in shares of Northwest Pipe (NASDAQ:NWPX - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund bought 6,971 shares of the industrial products company's stock, valued at approximately $336,000. Integrated Quantitative Investments LLC owned approximately 0.07% of Northwest Pipe at the end of the most recent quarter.

Several other hedge funds and other institutional investors also recently modified their holdings of NWPX. Jane Street Group LLC bought a new position in Northwest Pipe in the third quarter worth $944,000. JPMorgan Chase & Co. increased its position in Northwest Pipe by 34.2% during the 3rd quarter. JPMorgan Chase & Co. now owns 56,371 shares of the industrial products company's stock valued at $2,544,000 after buying an additional 14,374 shares in the last quarter. Barclays PLC raised its stake in Northwest Pipe by 272.8% during the third quarter. Barclays PLC now owns 13,001 shares of the industrial products company's stock valued at $586,000 after buying an additional 9,514 shares during the last quarter. Y Intercept Hong Kong Ltd bought a new stake in Northwest Pipe in the fourth quarter worth $381,000. Finally, AlphaQuest LLC purchased a new stake in shares of Northwest Pipe in the fourth quarter worth $31,000. Hedge funds and other institutional investors own 80.63% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts have recently issued reports on NWPX shares. Sidoti upgraded shares of Northwest Pipe to a "hold" rating in a research note on Tuesday, February 25th. StockNews.com downgraded shares of Northwest Pipe from a "buy" rating to a "hold" rating in a research report on Tuesday, January 14th. Finally, Northland Securities upped their price objective on Northwest Pipe from $50.00 to $55.00 and gave the company a "market perform" rating in a research report on Friday, January 3rd.

View Our Latest Research Report on NWPX

Insiders Place Their Bets

In related news, CFO Aaron Wilkins sold 1,000 shares of the company's stock in a transaction on Monday, March 24th. The shares were sold at an average price of $44.00, for a total value of $44,000.00. Following the completion of the transaction, the chief financial officer now owns 23,467 shares of the company's stock, valued at approximately $1,032,548. This represents a 4.09 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Company insiders own 3.30% of the company's stock.

Northwest Pipe Stock Performance

Shares of NASDAQ:NWPX traded down $0.91 during midday trading on Thursday, hitting $41.23. The company had a trading volume of 29,452 shares, compared to its average volume of 53,214. Northwest Pipe has a 12-month low of $31.16 and a 12-month high of $57.76. The company has a fifty day moving average of $44.87 and a two-hundred day moving average of $47.71. The company has a market cap of $409.62 million, a price-to-earnings ratio of 13.90, a PEG ratio of 2.85 and a beta of 0.94. The company has a debt-to-equity ratio of 0.17, a current ratio of 3.20 and a quick ratio of 2.27.

Northwest Pipe Company Profile

(

Free Report)

Northwest Pipe Company, together with its subsidiaries, engages in the manufacture and supply of water-related infrastructure products in North America. It operates in two segments, Engineered Steel Pressure Pipe (SPP) and Precast Infrastructure and Engineered Systems (Precast). The SPP segment offers large-diameter and high-pressure steel pipeline systems for use in water infrastructure applications, which are primarily related to drinking water systems.

Featured Articles

Before you consider Northwest Pipe, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Northwest Pipe wasn't on the list.

While Northwest Pipe currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.