Integrated Quantitative Investments LLC bought a new stake in Brf S.A. (NYSE:BRFS - Free Report) during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund bought 256,100 shares of the company's stock, valued at approximately $1,042,000.

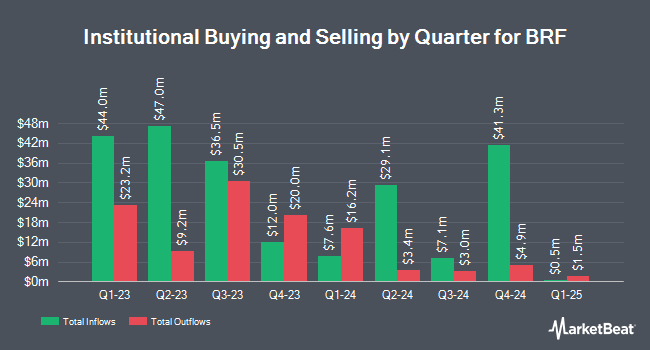

Other institutional investors have also recently made changes to their positions in the company. Arrowstreet Capital Limited Partnership bought a new stake in BRF in the 4th quarter valued at about $9,258,000. Connor Clark & Lunn Investment Management Ltd. lifted its stake in shares of BRF by 75.6% during the 4th quarter. Connor Clark & Lunn Investment Management Ltd. now owns 2,121,828 shares of the company's stock valued at $8,636,000 after buying an additional 913,453 shares in the last quarter. American Century Companies Inc. boosted its holdings in BRF by 5.3% in the 4th quarter. American Century Companies Inc. now owns 1,019,237 shares of the company's stock worth $4,148,000 after buying an additional 51,581 shares during the period. State Street Corp grew its stake in BRF by 2.3% in the 3rd quarter. State Street Corp now owns 1,006,059 shares of the company's stock valued at $4,396,000 after buying an additional 22,608 shares in the last quarter. Finally, Norges Bank bought a new stake in BRF during the 4th quarter valued at $1,601,000. Hedge funds and other institutional investors own 4.76% of the company's stock.

BRF Price Performance

Shares of BRFS traded down $0.14 during mid-day trading on Monday, reaching $3.14. 4,703,996 shares of the stock traded hands, compared to its average volume of 2,488,651. The company has a market cap of $3.39 billion, a price-to-earnings ratio of 7.29, a price-to-earnings-growth ratio of 0.19 and a beta of 1.51. Brf S.A. has a 1 year low of $2.99 and a 1 year high of $4.87. The firm has a fifty day moving average price of $3.42 and a 200 day moving average price of $3.96. The company has a current ratio of 1.45, a quick ratio of 0.93 and a debt-to-equity ratio of 1.05.

BRF (NYSE:BRFS - Get Free Report) last posted its quarterly earnings data on Wednesday, February 26th. The company reported $0.07 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.18 by ($0.11). The business had revenue of $3 billion for the quarter, compared to the consensus estimate of $2.72 billion. BRF had a net margin of 6.52% and a return on equity of 19.66%. As a group, equities research analysts predict that Brf S.A. will post 0.45 earnings per share for the current year.

Wall Street Analysts Forecast Growth

BRFS has been the subject of a number of analyst reports. Citigroup raised BRF from a "hold" rating to a "strong-buy" rating in a report on Wednesday, January 22nd. StockNews.com downgraded BRF from a "strong-buy" rating to a "buy" rating in a research note on Thursday, March 20th. Two research analysts have rated the stock with a hold rating, three have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $10.70.

Get Our Latest Stock Analysis on BRFS

BRF Profile

(

Free Report)

BRF SA raises, produces, and slaughters poultry and pork for processing, production, and sale of fresh meat, processed products, pasta, margarine, pet food, and other products. The company provides frozen whole and cut chicken, frozen pork, and turkey, and halal products for Islamic markets; processed foods, such as marinated, frozen, seasoned whole, and cut chicken, roosters, sausages, ham products, bologna, frankfurters, salamis, bacons, cold meats, and other smoked products; and hamburgers, steaks, breaded meat products, kibbeh, and meatballs, as well as chicken sausages, hot dogs, and chicken bologna.

Featured Articles

Before you consider BRF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BRF wasn't on the list.

While BRF currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.