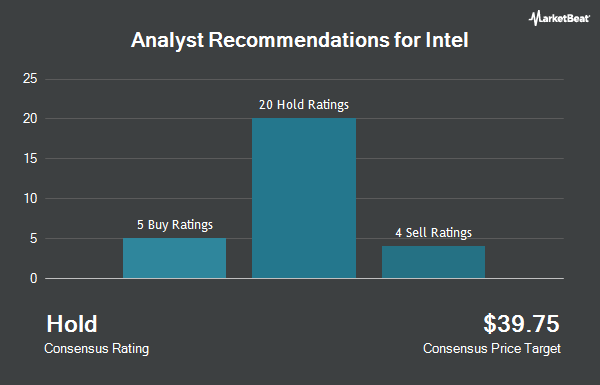

Intel Co. (NASDAQ:INTC - Get Free Report) has been assigned a consensus recommendation of "Reduce" from the thirty-two ratings firms that are currently covering the firm, Marketbeat Ratings reports. Three investment analysts have rated the stock with a sell rating, twenty-eight have given a hold rating and one has assigned a buy rating to the company. The average 12-month price objective among brokerages that have issued a report on the stock in the last year is $25.58.

A number of equities analysts recently weighed in on INTC shares. Wells Fargo & Company lowered their price objective on shares of Intel from $28.00 to $25.00 and set an "equal weight" rating on the stock in a research report on Friday, January 31st. Rosenblatt Securities restated a "sell" rating and issued a $20.00 price objective on shares of Intel in a research report on Thursday, January 30th. Mizuho lowered their price target on shares of Intel from $23.00 to $21.00 and set a "neutral" rating for the company in a report on Friday, January 10th. Truist Financial dropped their target price on shares of Intel from $22.00 to $21.00 and set a "hold" rating for the company in a research report on Friday, January 31st. Finally, Stifel Nicolaus decreased their price objective on shares of Intel from $25.00 to $21.00 and set a "hold" rating for the company in a research note on Friday, January 31st.

View Our Latest Research Report on INTC

Hedge Funds Weigh In On Intel

Several hedge funds and other institutional investors have recently modified their holdings of INTC. Vanguard Group Inc. lifted its stake in Intel by 1.7% in the fourth quarter. Vanguard Group Inc. now owns 369,099,204 shares of the chip maker's stock valued at $7,400,439,000 after buying an additional 6,143,164 shares during the period. Geode Capital Management LLC boosted its holdings in Intel by 3.2% in the 4th quarter. Geode Capital Management LLC now owns 95,488,444 shares of the chip maker's stock worth $1,909,761,000 after buying an additional 2,978,346 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its holdings in Intel by 8.2% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 63,263,339 shares of the chip maker's stock valued at $1,268,430,000 after buying an additional 4,793,927 shares in the last quarter. Norges Bank purchased a new stake in Intel in the 4th quarter worth approximately $1,246,569,000. Finally, Northern Trust Corp raised its holdings in shares of Intel by 15.5% in the 4th quarter. Northern Trust Corp now owns 45,811,555 shares of the chip maker's stock valued at $918,522,000 after acquiring an additional 6,157,853 shares in the last quarter. Institutional investors own 64.53% of the company's stock.

Intel Trading Up 4.8 %

INTC stock traded up $0.95 during mid-day trading on Tuesday, hitting $20.69. 15,248,813 shares of the company were exchanged, compared to its average volume of 77,677,238. The business has a fifty day simple moving average of $22.37 and a 200-day simple moving average of $22.08. The firm has a market capitalization of $90.20 billion, a P/E ratio of -4.65 and a beta of 1.13. Intel has a 12-month low of $17.67 and a 12-month high of $37.16. The company has a quick ratio of 0.98, a current ratio of 1.33 and a debt-to-equity ratio of 0.44.

Intel (NASDAQ:INTC - Get Free Report) last released its quarterly earnings results on Thursday, January 30th. The chip maker reported ($0.02) EPS for the quarter, missing the consensus estimate of $0.12 by ($0.14). Intel had a negative return on equity of 3.27% and a negative net margin of 35.32%. On average, equities research analysts predict that Intel will post -0.11 earnings per share for the current fiscal year.

About Intel

(

Get Free ReportIntel Corporation designs, develops, manufactures, markets, and sells computing and related products and services worldwide. It operates through Client Computing Group, Data Center and AI, Network and Edge, Mobileye, and Intel Foundry Services segments. The company's products portfolio comprises central processing units and chipsets, system-on-chips (SoCs), and multichip packages; mobile and desktop processors; hardware products comprising graphics processing units (GPUs), domain-specific accelerators, and field programmable gate arrays (FPGAs); and memory and storage, connectivity and networking, and other semiconductor products.

Read More

Before you consider Intel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intel wasn't on the list.

While Intel currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.