Stifel Financial Corp lowered its position in shares of Intel Co. (NASDAQ:INTC - Free Report) by 19.2% during the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 1,850,433 shares of the chip maker's stock after selling 439,114 shares during the period. Stifel Financial Corp's holdings in Intel were worth $43,411,000 at the end of the most recent reporting period.

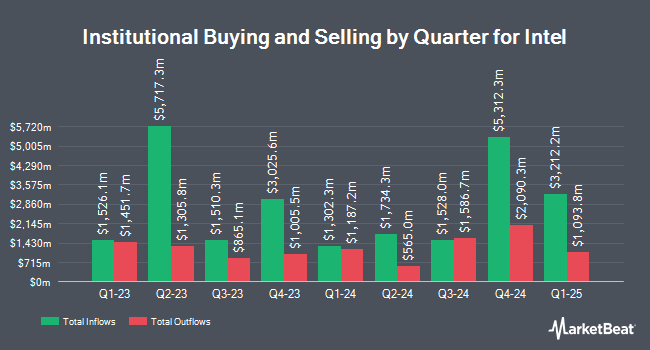

Several other institutional investors and hedge funds have also made changes to their positions in the company. RFG Advisory LLC grew its position in Intel by 23.0% during the 2nd quarter. RFG Advisory LLC now owns 31,524 shares of the chip maker's stock worth $976,000 after purchasing an additional 5,893 shares during the last quarter. Ballast Inc. grew its holdings in shares of Intel by 35.4% during the second quarter. Ballast Inc. now owns 30,623 shares of the chip maker's stock worth $948,000 after buying an additional 8,010 shares during the last quarter. Financial Partners Group LLC increased its position in Intel by 30.2% in the 2nd quarter. Financial Partners Group LLC now owns 50,978 shares of the chip maker's stock valued at $1,579,000 after acquiring an additional 11,816 shares during the period. Occidental Asset Management LLC raised its stake in Intel by 8.5% during the 2nd quarter. Occidental Asset Management LLC now owns 8,034 shares of the chip maker's stock valued at $249,000 after acquiring an additional 628 shares during the last quarter. Finally, RFG Holdings Inc. lifted its position in Intel by 98.1% during the 2nd quarter. RFG Holdings Inc. now owns 14,608 shares of the chip maker's stock worth $452,000 after acquiring an additional 7,233 shares during the period. 64.53% of the stock is owned by hedge funds and other institutional investors.

Intel Price Performance

Shares of NASDAQ INTC traded up $0.12 during trading on Friday, reaching $20.92. The company had a trading volume of 78,235,227 shares, compared to its average volume of 69,731,120. The company has a current ratio of 1.31, a quick ratio of 0.97 and a debt-to-equity ratio of 0.44. The stock has a market capitalization of $90.23 billion, a PE ratio of -5.62 and a beta of 1.05. Intel Co. has a twelve month low of $18.51 and a twelve month high of $51.28. The stock has a 50-day moving average price of $23.34 and a two-hundred day moving average price of $25.55.

Intel (NASDAQ:INTC - Get Free Report) last released its earnings results on Thursday, October 31st. The chip maker reported ($0.46) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.02) by ($0.44). The firm had revenue of $13.30 billion during the quarter, compared to analysts' expectations of $13.02 billion. Intel had a negative net margin of 29.42% and a negative return on equity of 1.71%. Intel's revenue for the quarter was down 6.3% on a year-over-year basis. During the same quarter last year, the company posted $0.28 earnings per share. As a group, sell-side analysts predict that Intel Co. will post -0.87 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of research firms have recently issued reports on INTC. The Goldman Sachs Group dropped their target price on Intel from $22.00 to $21.00 and set a "sell" rating on the stock in a report on Thursday, October 17th. Northland Securities dropped their price objective on shares of Intel from $42.00 to $28.00 and set an "outperform" rating on the stock in a research note on Friday, November 1st. Mizuho raised their target price on shares of Intel from $22.00 to $23.00 and gave the stock a "neutral" rating in a research note on Friday, November 1st. Daiwa America upgraded shares of Intel to a "hold" rating in a research note on Monday, August 26th. Finally, Rosenblatt Securities reissued a "sell" rating and set a $17.00 price target on shares of Intel in a report on Tuesday, October 29th. Six research analysts have rated the stock with a sell rating, twenty-five have issued a hold rating and one has assigned a buy rating to the stock. According to MarketBeat, Intel has a consensus rating of "Hold" and a consensus target price of $30.04.

Check Out Our Latest Stock Report on INTC

Insider Buying and Selling

In other news, EVP Michelle Johnston Holthaus sold 25,000 shares of the stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $26.00, for a total transaction of $650,000.00. Following the transaction, the executive vice president now directly owns 273,258 shares in the company, valued at $7,104,708. This represents a 8.38 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. 0.04% of the stock is owned by company insiders.

Intel Company Profile

(

Free Report)

Intel Corporation designs, develops, manufactures, markets, and sells computing and related products and services worldwide. It operates through Client Computing Group, Data Center and AI, Network and Edge, Mobileye, and Intel Foundry Services segments. The company's products portfolio comprises central processing units and chipsets, system-on-chips (SoCs), and multichip packages; mobile and desktop processors; hardware products comprising graphics processing units (GPUs), domain-specific accelerators, and field programmable gate arrays (FPGAs); and memory and storage, connectivity and networking, and other semiconductor products.

Further Reading

Before you consider Intel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intel wasn't on the list.

While Intel currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.