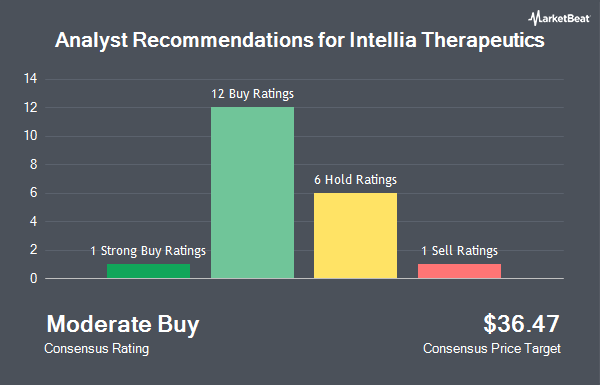

Shares of Intellia Therapeutics, Inc. (NASDAQ:NTLA - Get Free Report) have earned a consensus rating of "Moderate Buy" from the eighteen analysts that are currently covering the firm, MarketBeat.com reports. Six analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the company. The average 1 year target price among brokerages that have covered the stock in the last year is $54.94.

A number of equities research analysts have issued reports on NTLA shares. Robert W. Baird cut their target price on Intellia Therapeutics from $24.00 to $18.00 and set a "neutral" rating on the stock in a research note on Friday, October 25th. The Goldman Sachs Group decreased their price target on shares of Intellia Therapeutics from $31.00 to $20.00 and set a "neutral" rating for the company in a report on Friday, October 25th. Wedbush reiterated a "neutral" rating and issued a $14.00 target price on shares of Intellia Therapeutics in a research report on Monday, November 18th. Royal Bank of Canada reiterated an "outperform" rating and set a $54.00 price objective on shares of Intellia Therapeutics in a report on Thursday, September 19th. Finally, Citigroup dropped their target price on Intellia Therapeutics from $25.00 to $19.00 and set a "neutral" rating on the stock in a research report on Friday, October 25th.

Check Out Our Latest Stock Report on NTLA

Intellia Therapeutics Trading Down 4.6 %

Intellia Therapeutics stock traded down $0.67 during mid-day trading on Wednesday, reaching $14.05. The company's stock had a trading volume of 1,025,596 shares, compared to its average volume of 1,752,188. The firm has a market cap of $1.43 billion, a price-to-earnings ratio of -2.71 and a beta of 1.76. Intellia Therapeutics has a twelve month low of $12.82 and a twelve month high of $34.87. The business has a 50 day moving average price of $16.40 and a 200-day moving average price of $20.80.

Intellia Therapeutics (NASDAQ:NTLA - Get Free Report) last issued its earnings results on Thursday, November 7th. The company reported ($1.34) EPS for the quarter, beating analysts' consensus estimates of ($1.37) by $0.03. The company had revenue of $9.10 million during the quarter, compared to analyst estimates of $8.28 million. The business's revenue was down 24.1% on a year-over-year basis. During the same quarter in the previous year, the firm earned ($1.38) earnings per share. On average, equities analysts expect that Intellia Therapeutics will post -5.12 EPS for the current fiscal year.

Insider Activity

In other Intellia Therapeutics news, CAO Michael P. Dube sold 2,012 shares of the stock in a transaction dated Wednesday, October 2nd. The stock was sold at an average price of $19.01, for a total value of $38,248.12. Following the completion of the sale, the chief accounting officer now directly owns 47,012 shares in the company, valued at $893,698.12. This represents a 4.10 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 3.20% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the stock. Franklin Resources Inc. boosted its holdings in shares of Intellia Therapeutics by 10.3% in the 3rd quarter. Franklin Resources Inc. now owns 16,405 shares of the company's stock valued at $320,000 after buying an additional 1,538 shares during the last quarter. Sanctuary Advisors LLC grew its position in shares of Intellia Therapeutics by 147.9% in the 3rd quarter. Sanctuary Advisors LLC now owns 53,590 shares of the company's stock valued at $1,101,000 after acquiring an additional 31,976 shares during the period. Virtu Financial LLC acquired a new position in shares of Intellia Therapeutics during the 3rd quarter worth about $417,000. Geode Capital Management LLC raised its holdings in shares of Intellia Therapeutics by 2.2% in the 3rd quarter. Geode Capital Management LLC now owns 2,343,310 shares of the company's stock valued at $48,164,000 after purchasing an additional 49,367 shares during the period. Finally, Barclays PLC increased its holdings in shares of Intellia Therapeutics by 17.7% during the 3rd quarter. Barclays PLC now owns 292,795 shares of the company's stock worth $6,017,000 after acquiring an additional 44,022 shares during the last quarter. Institutional investors own 88.77% of the company's stock.

About Intellia Therapeutics

(

Get Free ReportIntellia Therapeutics, Inc, a genome editing company, focuses on the development of curative therapeutics. The company's in vivo programs include NTLA-2001, which is in Phase 1 clinical trial for the treatment of transthyretin amyloidosis; NTLA-2002 for the treatment of hereditary angioedema; and NTLA-3001 for alpha-1 antitrypsin deficiency associated lung disease.

Further Reading

Before you consider Intellia Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intellia Therapeutics wasn't on the list.

While Intellia Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.