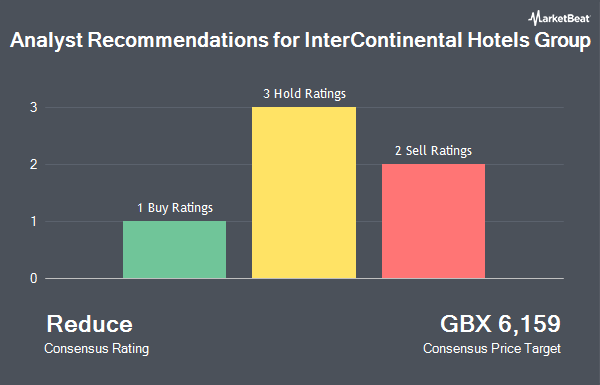

Shares of InterContinental Hotels Group PLC (LON:IHG - Get Free Report) have received an average recommendation of "Reduce" from the six analysts that are covering the stock, Marketbeat Ratings reports. Two investment analysts have rated the stock with a sell recommendation, three have given a hold recommendation and one has given a buy recommendation to the company. The average twelve-month target price among brokerages that have issued a report on the stock in the last year is GBX 6,159 ($81.89).

Several analysts have weighed in on the company. Jefferies Financial Group reiterated a "hold" rating and issued a GBX 95 ($1.26) price objective on shares of InterContinental Hotels Group in a research report on Tuesday, February 18th. JPMorgan Chase & Co. reiterated an "underweight" rating and set a GBX 7,800 ($103.71) price target on shares of InterContinental Hotels Group in a report on Thursday, February 20th. Deutsche Bank Aktiengesellschaft raised shares of InterContinental Hotels Group to a "hold" rating and raised their price target for the stock from GBX 7,750 ($103.04) to GBX 8,000 ($106.37) in a report on Monday. Finally, Citigroup lowered their price objective on shares of InterContinental Hotels Group from GBX 8,900 ($118.34) to GBX 7,500 ($99.72) and set a "sell" rating for the company in a research note on Tuesday.

Get Our Latest Stock Analysis on InterContinental Hotels Group

InterContinental Hotels Group Trading Down 0.7 %

Shares of LON IHG traded down GBX 52 ($0.69) during midday trading on Tuesday, reaching GBX 7,592 ($100.94). The company had a trading volume of 645,992 shares, compared to its average volume of 4,296,355. The firm's fifty day moving average price is GBX 8,794.08 and its 200-day moving average price is GBX 9,235.92. The company has a quick ratio of 1.35, a current ratio of 0.85 and a debt-to-equity ratio of -162.30. InterContinental Hotels Group has a one year low of GBX 7,032 ($93.50) and a one year high of £109.75 ($145.92). The stock has a market cap of £15.22 billion, a PE ratio of 24.92, a price-to-earnings-growth ratio of 1.69 and a beta of 0.98.

InterContinental Hotels Group Increases Dividend

The business also recently announced a dividend, which will be paid on Thursday, May 15th. Stockholders of record on Thursday, April 3rd will be given a $1.14 dividend. This represents a dividend yield of 1.03%. This is a boost from InterContinental Hotels Group's previous dividend of $0.53. The ex-dividend date is Thursday, April 3rd. InterContinental Hotels Group's dividend payout ratio (DPR) is currently 41.03%.

Insider Activity at InterContinental Hotels Group

In other news, insider Byron Elmer Grote purchased 400 shares of the company's stock in a transaction that occurred on Friday, February 21st. The shares were bought at an average cost of £127.25 ($169.19) per share, for a total transaction of £50,900 ($67,677.17). 5.99% of the stock is owned by corporate insiders.

InterContinental Hotels Group Company Profile

(

Get Free ReportOur presence

IHG® Hotels & Resorts is a global hospitality company,

with 19 hotel brands, one of the industry's largest

loyalty programmes, over 6,300 open hotels in more

than 100 countries, and a further 1,800 hotels in our

development pipeline.

Our ambition

To deliver industry-leading growth in our scale,

enterprise platform and performance, doing so

sustainably for all stakeholders, including our hotel

owners, guests and society as a whole.

Our strategy

To use our scale and expertise to create the

exceptional guest experiences and owner returns

needed to grow our brands in the industry's most

valuable markets and segments.

See Also

Before you consider InterContinental Hotels Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InterContinental Hotels Group wasn't on the list.

While InterContinental Hotels Group currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.