Natixis Advisors LLC cut its stake in InterContinental Hotels Group PLC (NYSE:IHG - Free Report) by 6.2% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 690,083 shares of the company's stock after selling 45,959 shares during the quarter. Natixis Advisors LLC owned about 0.43% of InterContinental Hotels Group worth $76,247,000 as of its most recent SEC filing.

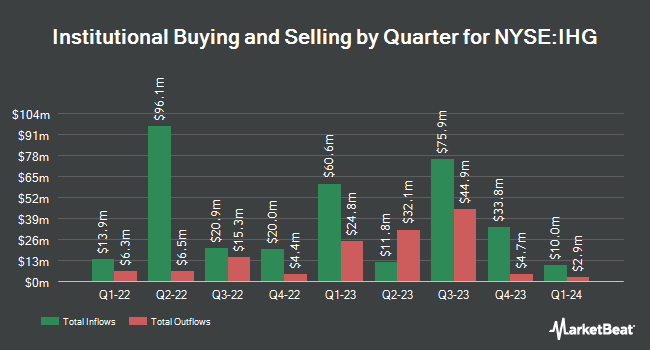

Several other institutional investors and hedge funds also recently bought and sold shares of IHG. Russell Investments Group Ltd. grew its stake in shares of InterContinental Hotels Group by 46.9% during the first quarter. Russell Investments Group Ltd. now owns 332 shares of the company's stock valued at $35,000 after buying an additional 106 shares during the last quarter. Rothschild Investment LLC purchased a new stake in InterContinental Hotels Group in the second quarter worth $36,000. EverSource Wealth Advisors LLC lifted its position in shares of InterContinental Hotels Group by 65.2% during the first quarter. EverSource Wealth Advisors LLC now owns 484 shares of the company's stock worth $48,000 after purchasing an additional 191 shares during the last quarter. Allspring Global Investments Holdings LLC purchased a new stake in shares of InterContinental Hotels Group during the first quarter valued at $48,000. Finally, Transcendent Capital Group LLC bought a new position in shares of InterContinental Hotels Group in the second quarter worth about $50,000. 15.09% of the stock is owned by hedge funds and other institutional investors.

InterContinental Hotels Group Stock Performance

IHG stock opened at $121.20 on Friday. InterContinental Hotels Group PLC has a 1-year low of $74.82 and a 1-year high of $122.78. The business has a 50-day moving average price of $111.70 and a 200 day moving average price of $105.01.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on IHG shares. The Goldman Sachs Group upgraded shares of InterContinental Hotels Group from a "neutral" rating to a "buy" rating in a report on Wednesday, September 18th. Barclays upgraded InterContinental Hotels Group from an "equal weight" rating to an "overweight" rating in a report on Friday. One investment analyst has rated the stock with a sell rating, three have issued a hold rating and two have issued a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Hold".

Read Our Latest Report on IHG

InterContinental Hotels Group Company Profile

(

Free Report)

InterContinental Hotels Group PLC owns, manages, franchises, and leases hotels in the Americas, Europe, Asia, the Middle East, Africa, and Greater China. The company operates hotels under the Six Senses, Regent, InterContinental Hotels & Resorts, Vignette Collection, Kimpton Hotels & Restaurants, Hotel Indigo, voco, HUALUXE, Crowne Plaza, Iberostar Beachfront Resorts, EVEN, Holiday Inn Express, Holiday Inn, Garner, avid hotels, Atwell Suites, Staybridge Suites, Iberostar Beachfront Resorts, Holiday Inn Club Vacations, and Candlewood Suites brand names.

Featured Articles

Before you consider InterContinental Hotels Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InterContinental Hotels Group wasn't on the list.

While InterContinental Hotels Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.