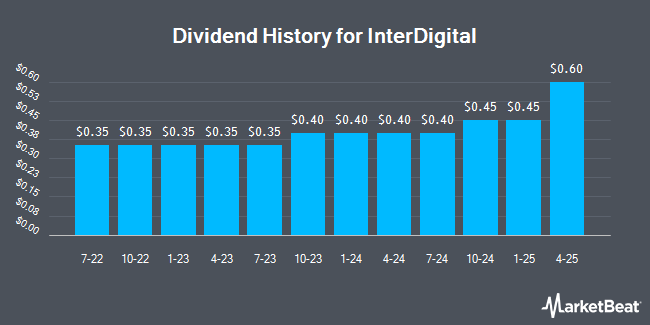

InterDigital, Inc. (NASDAQ:IDCC - Get Free Report) declared a quarterly dividend on Friday, December 6th,Wall Street Journal reports. Investors of record on Wednesday, January 8th will be given a dividend of 0.45 per share by the Wireless communications provider on Wednesday, January 22nd. This represents a $1.80 dividend on an annualized basis and a yield of 0.91%. The ex-dividend date is Wednesday, January 8th.

InterDigital has increased its dividend payment by an average of 1.2% per year over the last three years. InterDigital has a payout ratio of 38.9% indicating that its dividend is sufficiently covered by earnings. Equities research analysts expect InterDigital to earn $5.82 per share next year, which means the company should continue to be able to cover its $1.80 annual dividend with an expected future payout ratio of 30.9%.

InterDigital Trading Up 1.9 %

NASDAQ IDCC traded up $3.72 on Friday, reaching $196.83. The stock had a trading volume of 263,757 shares, compared to its average volume of 449,973. InterDigital has a 12-month low of $95.33 and a 12-month high of $203.90. The company has a quick ratio of 1.62, a current ratio of 1.62 and a debt-to-equity ratio of 0.03. The stock has a fifty day moving average price of $167.59 and a two-hundred day moving average price of $140.20. The firm has a market capitalization of $4.99 billion, a price-to-earnings ratio of 20.81, a P/E/G ratio of 0.84 and a beta of 1.44.

Analysts Set New Price Targets

A number of brokerages recently weighed in on IDCC. StockNews.com cut shares of InterDigital from a "buy" rating to a "hold" rating in a report on Monday, November 4th. Roth Mkm boosted their price objective on InterDigital from $146.00 to $160.00 and gave the stock a "buy" rating in a research report on Wednesday, September 11th.

Check Out Our Latest Stock Report on InterDigital

Insider Activity at InterDigital

In related news, CTO Rajesh Pankaj sold 700 shares of the business's stock in a transaction that occurred on Monday, October 7th. The shares were sold at an average price of $142.78, for a total value of $99,946.00. Following the completion of the sale, the chief technology officer now directly owns 54,984 shares in the company, valued at approximately $7,850,615.52. The trade was a 1.26 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director John A. Kritzmacher sold 2,500 shares of the firm's stock in a transaction that occurred on Friday, September 20th. The shares were sold at an average price of $138.72, for a total transaction of $346,800.00. Following the completion of the transaction, the director now owns 20,279 shares in the company, valued at $2,813,102.88. The trade was a 10.98 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 3,340 shares of company stock worth $472,253 in the last quarter. Company insiders own 2.30% of the company's stock.

InterDigital Company Profile

(

Get Free Report)

InterDigital, Inc operates as a global research and development company with focus primarily on wireless, visual, artificial intelligence (AI), and related technologies. The company engages in the design and development of technologies that enable connected in a range of communications and entertainment products and services, which are licensed to companies providing such products and services, including makers of wireless communications, consumer electronics, IoT devices, and cars and other motor vehicles, as well as providers of cloud-based services, such as video streaming.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider InterDigital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InterDigital wasn't on the list.

While InterDigital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.