Robeco Institutional Asset Management B.V. trimmed its holdings in InterDigital, Inc. (NASDAQ:IDCC - Free Report) by 23.9% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 163,351 shares of the Wireless communications provider's stock after selling 51,432 shares during the quarter. Robeco Institutional Asset Management B.V. owned approximately 0.64% of InterDigital worth $31,644,000 as of its most recent SEC filing.

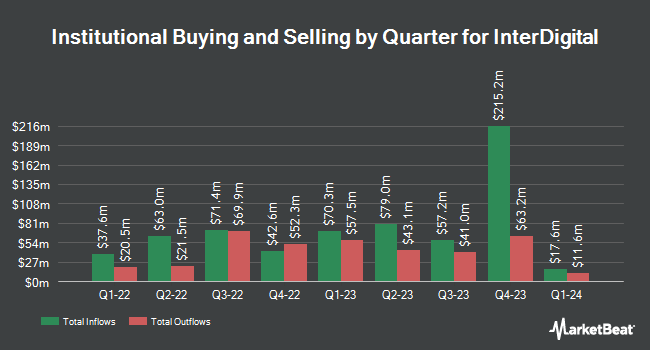

A number of other institutional investors have also added to or reduced their stakes in the stock. Transcendent Capital Group LLC bought a new position in InterDigital during the third quarter valued at approximately $25,000. V Square Quantitative Management LLC purchased a new stake in shares of InterDigital during the 3rd quarter worth approximately $26,000. Mendota Financial Group LLC boosted its position in shares of InterDigital by 14,500.0% during the 4th quarter. Mendota Financial Group LLC now owns 292 shares of the Wireless communications provider's stock valued at $57,000 after acquiring an additional 290 shares during the last quarter. R Squared Ltd purchased a new position in shares of InterDigital in the fourth quarter valued at $70,000. Finally, Nisa Investment Advisors LLC grew its holdings in shares of InterDigital by 58.8% in the third quarter. Nisa Investment Advisors LLC now owns 629 shares of the Wireless communications provider's stock valued at $89,000 after purchasing an additional 233 shares in the last quarter. 99.83% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Separately, StockNews.com downgraded shares of InterDigital from a "buy" rating to a "hold" rating in a research note on Monday, November 4th.

View Our Latest Research Report on InterDigital

InterDigital Trading Down 1.0 %

IDCC stock traded down $1.78 during midday trading on Friday, reaching $182.98. 206,371 shares of the company traded hands, compared to its average volume of 336,192. The firm has a market capitalization of $4.64 billion, a price-to-earnings ratio of 19.55, a P/E/G ratio of 2.05 and a beta of 1.44. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.62 and a current ratio of 1.62. The business has a 50 day moving average of $189.00 and a 200-day moving average of $160.95. InterDigital, Inc. has a 52-week low of $95.33 and a 52-week high of $207.08.

InterDigital Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, January 22nd. Shareholders of record on Wednesday, January 8th were paid a dividend of $0.45 per share. This represents a $1.80 annualized dividend and a yield of 0.98%. The ex-dividend date of this dividend was Wednesday, January 8th. InterDigital's payout ratio is 19.23%.

Insider Buying and Selling

In related news, CTO Rajesh Pankaj sold 700 shares of the business's stock in a transaction on Monday, January 6th. The stock was sold at an average price of $204.13, for a total transaction of $142,891.00. Following the completion of the transaction, the chief technology officer now owns 52,997 shares in the company, valued at $10,818,277.61. The trade was a 1.30 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Lawrence Liren Chen sold 5,891 shares of the company's stock in a transaction on Monday, December 23rd. The shares were sold at an average price of $189.12, for a total value of $1,114,105.92. Following the completion of the transaction, the chief executive officer now directly owns 158,652 shares in the company, valued at $30,004,266.24. This trade represents a 3.58 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 12,622 shares of company stock valued at $2,433,251. Company insiders own 2.30% of the company's stock.

InterDigital Profile

(

Free Report)

InterDigital, Inc operates as a global research and development company with focus primarily on wireless, visual, artificial intelligence (AI), and related technologies. The company engages in the design and development of technologies that enable connected in a range of communications and entertainment products and services, which are licensed to companies providing such products and services, including makers of wireless communications, consumer electronics, IoT devices, and cars and other motor vehicles, as well as providers of cloud-based services, such as video streaming.

Recommended Stories

Before you consider InterDigital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InterDigital wasn't on the list.

While InterDigital currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.