Segall Bryant & Hamill LLC decreased its stake in shares of InterDigital, Inc. (NASDAQ:IDCC - Free Report) by 24.6% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 32,028 shares of the Wireless communications provider's stock after selling 10,446 shares during the quarter. Segall Bryant & Hamill LLC owned about 0.13% of InterDigital worth $6,204,000 at the end of the most recent quarter.

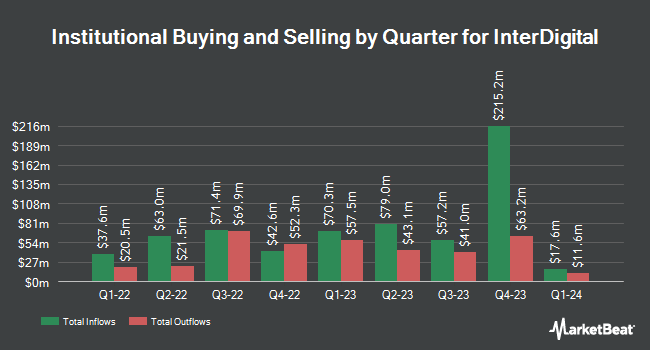

Several other hedge funds have also added to or reduced their stakes in the stock. Natixis Advisors LLC bought a new position in shares of InterDigital during the third quarter valued at $1,427,000. Flagship Harbor Advisors LLC bought a new stake in InterDigital during the 4th quarter valued at about $338,000. Kovitz Investment Group Partners LLC purchased a new position in InterDigital in the third quarter worth about $380,000. Reinhart Partners LLC. lifted its stake in shares of InterDigital by 83.8% in the fourth quarter. Reinhart Partners LLC. now owns 360,238 shares of the Wireless communications provider's stock worth $69,785,000 after buying an additional 164,223 shares in the last quarter. Finally, Amundi grew its holdings in shares of InterDigital by 57.0% during the fourth quarter. Amundi now owns 20,897 shares of the Wireless communications provider's stock valued at $3,989,000 after buying an additional 7,586 shares during the last quarter. 99.83% of the stock is owned by institutional investors.

InterDigital Stock Down 1.6 %

Shares of IDCC traded down $3.29 on Monday, hitting $206.75. 671,808 shares of the stock traded hands, compared to its average volume of 426,669. The company has a market capitalization of $5.31 billion, a PE ratio of 17.17, a P/E/G ratio of 1.57 and a beta of 1.45. InterDigital, Inc. has a one year low of $95.33 and a one year high of $231.97. The company has a debt-to-equity ratio of 0.02, a quick ratio of 1.70 and a current ratio of 1.70. The business has a 50 day simple moving average of $205.04 and a 200 day simple moving average of $183.68.

InterDigital Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, April 23rd. Stockholders of record on Wednesday, April 9th will be paid a $0.60 dividend. The ex-dividend date is Wednesday, April 9th. This represents a $2.40 annualized dividend and a dividend yield of 1.16%. This is a boost from InterDigital's previous quarterly dividend of $0.45. InterDigital's payout ratio is currently 19.93%.

Insider Transactions at InterDigital

In related news, CTO Rajesh Pankaj sold 700 shares of InterDigital stock in a transaction dated Thursday, March 20th. The stock was sold at an average price of $218.08, for a total value of $152,656.00. Following the completion of the sale, the chief technology officer now directly owns 71,606 shares in the company, valued at approximately $15,615,836.48. This trade represents a 0.97 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Eeva K. Hakoranta sold 350 shares of the company's stock in a transaction dated Tuesday, February 18th. The shares were sold at an average price of $214.51, for a total transaction of $75,078.50. Following the transaction, the insider now owns 30,537 shares in the company, valued at $6,550,491.87. This represents a 1.13 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 13,833 shares of company stock worth $2,954,830 over the last quarter. 2.30% of the stock is currently owned by insiders.

InterDigital Company Profile

(

Free Report)

InterDigital, Inc operates as a global research and development company with focus primarily on wireless, visual, artificial intelligence (AI), and related technologies. The company engages in the design and development of technologies that enable connected in a range of communications and entertainment products and services, which are licensed to companies providing such products and services, including makers of wireless communications, consumer electronics, IoT devices, and cars and other motor vehicles, as well as providers of cloud-based services, such as video streaming.

Further Reading

Before you consider InterDigital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InterDigital wasn't on the list.

While InterDigital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.