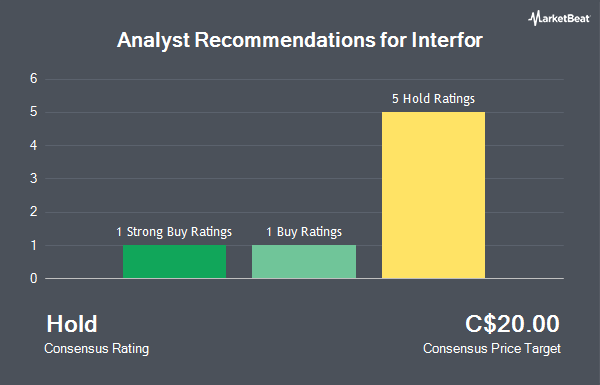

Shares of Interfor Co. (TSE:IFP - Get Free Report) have been given a consensus rating of "Moderate Buy" by the seven research firms that are presently covering the company, MarketBeat Ratings reports. Four equities research analysts have rated the stock with a hold rating, one has given a buy rating and two have assigned a strong buy rating to the company. The average 12-month price target among analysts that have updated their coverage on the stock in the last year is C$23.67.

A number of equities research analysts recently commented on the company. Scotiabank lowered Interfor from an "outperform" rating to a "sector perform" rating in a research report on Monday, March 3rd. CIBC lowered their target price on shares of Interfor from C$22.00 to C$20.00 in a report on Tuesday, February 18th. Royal Bank of Canada decreased their price objective on shares of Interfor from C$27.00 to C$26.00 and set an "outperform" rating for the company in a report on Friday, December 20th. Finally, Raymond James decreased their price objective on Interfor from C$30.00 to C$26.00 and set a "strong-buy" rating for the company in a research report on Thursday, January 30th.

View Our Latest Stock Analysis on IFP

Interfor Price Performance

IFP stock traded down C$0.70 on Thursday, hitting C$14.79. 136,351 shares of the company's stock traded hands, compared to its average volume of 212,220. The stock has a market cap of C$765.91 million, a price-to-earnings ratio of -1.81 and a beta of 2.54. The company has a current ratio of 1.69, a quick ratio of 1.15 and a debt-to-equity ratio of 61.24. The stock has a fifty day moving average of C$16.34 and a 200-day moving average of C$18.01. Interfor has a 1-year low of C$14.58 and a 1-year high of C$21.44.

Insiders Place Their Bets

In other news, Director Ian Fillinger bought 3,400 shares of the stock in a transaction dated Monday, March 17th. The shares were bought at an average cost of C$14.95 per share, with a total value of C$50,820.14. Insiders own 0.94% of the company's stock.

Interfor Company Profile

(

Get Free ReportInterfor Corporation, together with its subsidiaries, produces and sells wood products in Canada, the United States, Japan, China, Taiwan, and internationally. It offers decking, fascia and board, framing, v-joint paneling, fineline paneling, and siding products, as well as appearance, structural, studs, timbers, and machine stress related products.

See Also

Before you consider Interfor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interfor wasn't on the list.

While Interfor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.