International Assets Investment Management LLC lifted its stake in shares of Under Armour, Inc. (NYSE:UAA - Free Report) by 2,413.5% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 71,636 shares of the company's stock after acquiring an additional 68,786 shares during the quarter. International Assets Investment Management LLC's holdings in Under Armour were worth $638,000 at the end of the most recent reporting period.

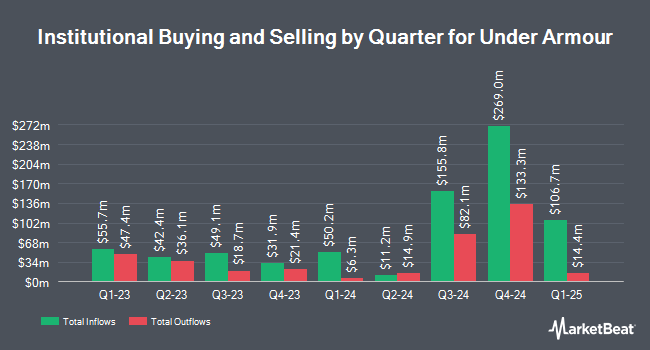

Several other large investors also recently made changes to their positions in UAA. Commonwealth Equity Services LLC boosted its stake in Under Armour by 24.0% in the 1st quarter. Commonwealth Equity Services LLC now owns 89,941 shares of the company's stock worth $664,000 after purchasing an additional 17,399 shares during the period. Texas Permanent School Fund Corp increased its holdings in shares of Under Armour by 1.1% during the 1st quarter. Texas Permanent School Fund Corp now owns 164,760 shares of the company's stock valued at $1,216,000 after acquiring an additional 1,746 shares during the last quarter. Duality Advisers LP lifted its stake in shares of Under Armour by 386.0% in the first quarter. Duality Advisers LP now owns 100,280 shares of the company's stock worth $740,000 after buying an additional 79,646 shares during the last quarter. SG Americas Securities LLC lifted its position in Under Armour by 1,334.2% during the 1st quarter. SG Americas Securities LLC now owns 181,616 shares of the company's stock worth $1,340,000 after acquiring an additional 168,953 shares during the last quarter. Finally, AMH Equity Ltd bought a new stake in Under Armour during the 1st quarter valued at approximately $922,000. Institutional investors own 34.58% of the company's stock.

Under Armour Stock Down 1.2 %

UAA stock traded down $0.11 during mid-day trading on Wednesday, reaching $8.75. The company had a trading volume of 14,254,211 shares, compared to its average volume of 10,053,371. The company has a market capitalization of $3.78 billion, a price-to-earnings ratio of -48.61, a PEG ratio of 4.02 and a beta of 1.66. The company has a debt-to-equity ratio of 0.33, a current ratio of 1.73 and a quick ratio of 1.08. Under Armour, Inc. has a 52 week low of $6.17 and a 52 week high of $9.58. The stock has a 50 day simple moving average of $8.37 and a two-hundred day simple moving average of $7.47.

Under Armour (NYSE:UAA - Get Free Report) last issued its earnings results on Thursday, August 8th. The company reported $0.01 EPS for the quarter, beating the consensus estimate of ($0.08) by $0.09. The company had revenue of $1.18 billion during the quarter, compared to analysts' expectations of $1.14 billion. Under Armour had a negative net margin of 1.35% and a positive return on equity of 11.98%. The business's revenue for the quarter was down 10.1% compared to the same quarter last year. During the same period in the previous year, the company earned $0.02 EPS. As a group, equities analysts predict that Under Armour, Inc. will post 0.22 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

UAA has been the topic of several recent research reports. UBS Group increased their price target on shares of Under Armour from $11.00 to $12.00 and gave the stock a "buy" rating in a research report on Thursday, October 24th. Truist Financial increased their target price on shares of Under Armour from $7.00 to $8.00 and gave the stock a "hold" rating in a research report on Friday, August 9th. Barclays upped their price objective on shares of Under Armour from $6.00 to $8.00 and gave the stock an "equal weight" rating in a research note on Friday, August 9th. TD Cowen raised their price objective on shares of Under Armour from $7.00 to $8.00 and gave the stock a "hold" rating in a report on Monday. Finally, Argus upgraded Under Armour to a "strong-buy" rating in a research report on Thursday, August 15th. Three investment analysts have rated the stock with a sell rating, twelve have issued a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $7.94.

Read Our Latest Stock Report on UAA

About Under Armour

(

Free Report)

Under Armour, Inc, together with its subsidiaries, engages developing, marketing, and distributing performance apparel, footwear, and accessories for men, women, and youth. The company provides its apparel in compression, fitted, and loose fit types. It also offers footwear products for running, training, basketball, cleated sports, recovery, and outdoor applications.

Read More

Before you consider Under Armour, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Under Armour wasn't on the list.

While Under Armour currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.