Barclays downgraded shares of International Consolidated Airlines Group (LON:IAG - Free Report) to an underweight rating in a research note issued to investors on Wednesday, MarketBeat reports. Barclays currently has GBX 250 ($3.23) price objective on the stock, down from their previous price objective of GBX 420 ($5.43).

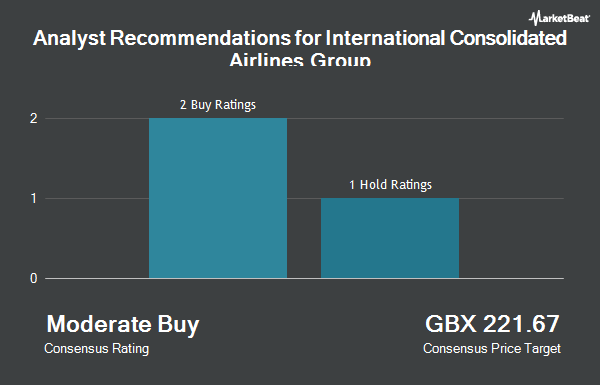

Several other equities analysts also recently commented on IAG. JPMorgan Chase & Co. restated an "overweight" rating on shares of International Consolidated Airlines Group in a research report on Monday, March 3rd. Deutsche Bank Aktiengesellschaft upgraded International Consolidated Airlines Group to a "buy" rating and raised their target price for the stock from GBX 215 ($2.78) to GBX 400 ($5.17) in a research report on Wednesday, December 11th. Finally, Jefferies Financial Group lifted their price objective on International Consolidated Airlines Group from GBX 350 ($4.52) to GBX 400 ($5.17) and gave the company a "buy" rating in a research report on Monday, March 3rd. One analyst has rated the stock with a sell rating and four have issued a buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of GBX 320 ($4.14).

Check Out Our Latest Stock Report on International Consolidated Airlines Group

International Consolidated Airlines Group Price Performance

Shares of International Consolidated Airlines Group stock traded up GBX 7.10 ($0.09) during midday trading on Wednesday, hitting GBX 283.20 ($3.66). 17,167,709 shares of the company were exchanged, compared to its average volume of 25,977,416. The company has a debt-to-equity ratio of 338.12, a current ratio of 0.70 and a quick ratio of 0.63. The firm has a market cap of £16.73 billion, a P/E ratio of 5.98, a PEG ratio of 0.21 and a beta of 2.31. International Consolidated Airlines Group has a 52 week low of GBX 151.91 ($1.96) and a 52 week high of GBX 368.06 ($4.76). The firm has a 50 day simple moving average of GBX 325.77 and a 200-day simple moving average of GBX 264.56.

International Consolidated Airlines Group Company Profile

(

Get Free Report)

International Consolidated Airlines Group SA, together with its subsidiaries, engages in the provision of passenger and cargo transportation services in the United Kingdom, Spain, the United States, and rest of the world. It also provides aircraft leasing, aircraft maintenance, tour operation, air freight operations, call centre, ground handling, trustee, retail, IT, finance, procurement, storage and custody, aircraft technical assistance, human resources support, and airport infrastructure development services; and manages airline loyalty programmes.

Featured Articles

Before you consider International Consolidated Airlines Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Consolidated Airlines Group wasn't on the list.

While International Consolidated Airlines Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.