International Flavors & Fragrances (NYSE:IFF - Get Free Report) had its price objective dropped by investment analysts at Bank of America from $105.00 to $101.00 in a report issued on Thursday,Benzinga reports. The brokerage presently has a "buy" rating on the specialty chemicals company's stock. Bank of America's price objective points to a potential upside of 26.37% from the company's current price.

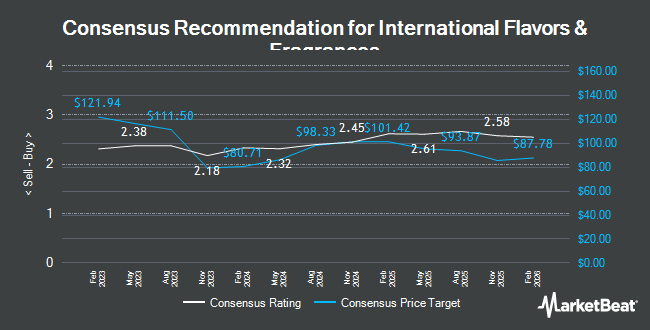

Several other research analysts have also recently commented on IFF. Oppenheimer cut their price target on International Flavors & Fragrances from $117.00 to $114.00 and set an "outperform" rating on the stock in a research note on Tuesday, January 28th. Vertical Research upgraded International Flavors & Fragrances from a "hold" rating to a "buy" rating and set a $109.00 price target on the stock in a research note on Thursday, November 7th. Wells Fargo & Company cut their price target on International Flavors & Fragrances from $115.00 to $105.00 and set an "overweight" rating on the stock in a research note on Thursday. Citigroup cut their price target on International Flavors & Fragrances from $110.00 to $105.00 and set a "buy" rating on the stock in a research note on Wednesday, December 18th. Finally, Barclays lowered their price objective on International Flavors & Fragrances from $90.00 to $88.00 and set an "equal weight" rating for the company in a report on Friday, January 17th. Two research analysts have rated the stock with a sell rating, three have issued a hold rating and twelve have given a buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $103.50.

Check Out Our Latest Stock Report on IFF

International Flavors & Fragrances Stock Down 0.3 %

Shares of IFF traded down $0.22 during midday trading on Thursday, reaching $79.92. 1,571,210 shares of the company were exchanged, compared to its average volume of 1,501,512. The stock has a 50-day moving average price of $84.71 and a 200-day moving average price of $93.45. The company has a market cap of $20.43 billion, a price-to-earnings ratio of 85.02, a P/E/G ratio of 1.48 and a beta of 1.19. International Flavors & Fragrances has a 1-year low of $72.94 and a 1-year high of $106.77. The company has a current ratio of 1.84, a quick ratio of 1.93 and a debt-to-equity ratio of 0.54.

International Flavors & Fragrances (NYSE:IFF - Get Free Report) last issued its quarterly earnings data on Tuesday, February 18th. The specialty chemicals company reported $0.97 EPS for the quarter, topping analysts' consensus estimates of $0.83 by $0.14. The company had revenue of $2.77 billion for the quarter, compared to analysts' expectations of $2.67 billion. International Flavors & Fragrances had a return on equity of 7.72% and a net margin of 2.12%. Research analysts expect that International Flavors & Fragrances will post 4.35 earnings per share for the current year.

Hedge Funds Weigh In On International Flavors & Fragrances

Institutional investors have recently made changes to their positions in the stock. SBI Securities Co. Ltd. bought a new position in shares of International Flavors & Fragrances during the fourth quarter valued at approximately $32,000. Fairway Wealth LLC bought a new position in shares of International Flavors & Fragrances during the fourth quarter valued at approximately $34,000. Point72 Hong Kong Ltd bought a new position in shares of International Flavors & Fragrances during the third quarter valued at approximately $42,000. Rialto Wealth Management LLC bought a new position in shares of International Flavors & Fragrances during the fourth quarter valued at approximately $42,000. Finally, Eastern Bank bought a new position in International Flavors & Fragrances in the 3rd quarter worth approximately $46,000. 96.02% of the stock is owned by institutional investors.

About International Flavors & Fragrances

(

Get Free Report)

International Flavors & Fragrances, Inc engages in the manufacture and supply of flavors and fragrances used in the food, beverage, personal care, and household products industries. It operates through the following segments: Nourish, Health & Biosciences, Scent and Pharma Solutions. The Nourish segment consists of legacy Taste segment combined with N&B's Food & Beverage division and the food protection business of N&B's Health & Biosciences division.

See Also

Before you consider International Flavors & Fragrances, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Flavors & Fragrances wasn't on the list.

While International Flavors & Fragrances currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.