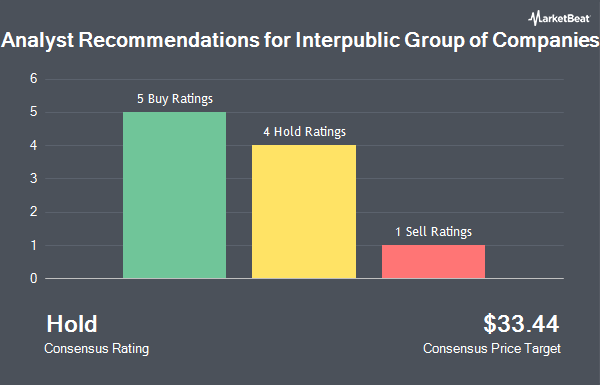

StockNews.com initiated coverage on shares of Interpublic Group of Companies (NYSE:IPG - Get Free Report) in a report released on Thursday. The brokerage set a "hold" rating on the business services provider's stock.

Several other research firms have also commented on IPG. Barclays cut their price objective on Interpublic Group of Companies from $32.50 to $32.00 and set an "equal weight" rating on the stock in a research report on Wednesday, October 23rd. Bank of America cut their target price on shares of Interpublic Group of Companies from $36.00 to $35.00 and set a "buy" rating on the stock in a report on Thursday, September 5th. UBS Group cut Interpublic Group of Companies from a "neutral" rating to a "sell" rating and cut their target price for the company from $34.00 to $29.00 in a research note on Thursday, September 12th. Macquarie reaffirmed a "neutral" rating and issued a $31.00 price objective on shares of Interpublic Group of Companies in a report on Tuesday, October 22nd. Finally, Wells Fargo & Company upgraded shares of Interpublic Group of Companies from an "underweight" rating to an "equal weight" rating and raised their price objective for the company from $26.00 to $34.00 in a research note on Tuesday, December 10th. Three investment analysts have rated the stock with a sell rating, five have given a hold rating and one has assigned a buy rating to the company. According to MarketBeat.com, Interpublic Group of Companies presently has a consensus rating of "Hold" and an average price target of $31.71.

Get Our Latest Stock Analysis on Interpublic Group of Companies

Interpublic Group of Companies Price Performance

Shares of Interpublic Group of Companies stock traded down $0.44 during trading on Thursday, hitting $28.63. 8,359,468 shares of the company were exchanged, compared to its average volume of 4,277,593. Interpublic Group of Companies has a fifty-two week low of $26.88 and a fifty-two week high of $35.17. The company has a quick ratio of 1.09, a current ratio of 1.09 and a debt-to-equity ratio of 0.77. The firm has a 50 day moving average price of $29.96 and a 200 day moving average price of $30.33. The stock has a market capitalization of $10.66 billion, a price-to-earnings ratio of 13.50 and a beta of 1.10.

Interpublic Group of Companies (NYSE:IPG - Get Free Report) last posted its quarterly earnings data on Tuesday, October 22nd. The business services provider reported $0.70 earnings per share (EPS) for the quarter, hitting the consensus estimate of $0.70. Interpublic Group of Companies had a return on equity of 27.76% and a net margin of 7.44%. The business had revenue of $2.24 billion for the quarter, compared to analysts' expectations of $2.30 billion. During the same quarter last year, the firm earned $0.70 earnings per share. The business's revenue was down 2.9% on a year-over-year basis. On average, equities analysts expect that Interpublic Group of Companies will post 2.81 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Interpublic Group of Companies

Several institutional investors have recently bought and sold shares of the stock. State Street Corp boosted its stake in Interpublic Group of Companies by 15.1% in the 3rd quarter. State Street Corp now owns 29,844,859 shares of the business services provider's stock valued at $943,993,000 after buying an additional 3,920,975 shares in the last quarter. Millennium Management LLC lifted its stake in shares of Interpublic Group of Companies by 571.7% during the second quarter. Millennium Management LLC now owns 1,466,376 shares of the business services provider's stock valued at $42,657,000 after acquiring an additional 1,248,062 shares during the period. Canada Pension Plan Investment Board boosted its holdings in Interpublic Group of Companies by 19.8% in the second quarter. Canada Pension Plan Investment Board now owns 5,436,803 shares of the business services provider's stock valued at $158,157,000 after acquiring an additional 899,332 shares during the last quarter. Dimensional Fund Advisors LP lifted its holdings in Interpublic Group of Companies by 13.8% in the second quarter. Dimensional Fund Advisors LP now owns 6,842,846 shares of the business services provider's stock valued at $199,063,000 after buying an additional 828,150 shares during the period. Finally, Squarepoint Ops LLC lifted its stake in shares of Interpublic Group of Companies by 168.3% in the 2nd quarter. Squarepoint Ops LLC now owns 831,434 shares of the business services provider's stock valued at $24,186,000 after purchasing an additional 521,546 shares during the period. 98.43% of the stock is currently owned by institutional investors.

Interpublic Group of Companies Company Profile

(

Get Free Report)

The Interpublic Group of Companies, Inc provides advertising and marketing services worldwide. It operates in three segments: Media, Data & Engagement Solutions, Integrated Advertising & Creativity Led Solutions, and Specialized Communications & Experiential Solutions. The Media, Data & Engagement Solutions segment provides media and communications services, digital services and products, advertising and marketing technology, e-commerce services, data management and analytics, strategic consulting, and digital brand experience under the IPG Mediabrands, UM, Initiative, Kinesso, Acxiom, Huge, MRM, and R/GA brand names.

Recommended Stories

Before you consider Interpublic Group of Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interpublic Group of Companies wasn't on the list.

While Interpublic Group of Companies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.