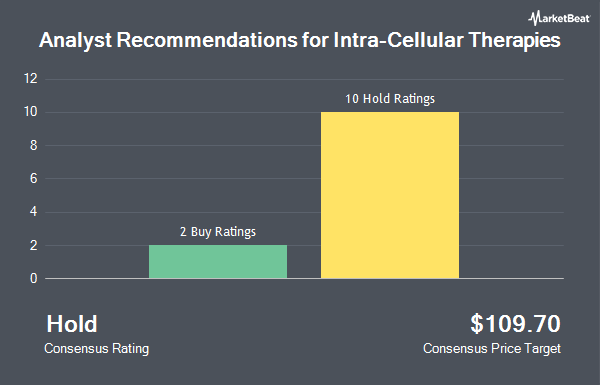

Intra-Cellular Therapies, Inc. (NASDAQ:ITCI - Get Free Report) has been given an average recommendation of "Moderate Buy" by the thirteen ratings firms that are covering the company, Marketbeat.com reports. Two equities research analysts have rated the stock with a hold rating and eleven have issued a buy rating on the company. The average 12-month price objective among analysts that have issued a report on the stock in the last year is $97.23.

Several equities analysts recently weighed in on ITCI shares. Needham & Company LLC reaffirmed a "buy" rating and set a $100.00 target price on shares of Intra-Cellular Therapies in a research note on Wednesday, October 30th. Morgan Stanley raised their price objective on Intra-Cellular Therapies from $92.00 to $95.00 and gave the company an "overweight" rating in a research report on Friday, October 11th. Royal Bank of Canada boosted their target price on Intra-Cellular Therapies from $106.00 to $108.00 and gave the stock an "outperform" rating in a research report on Friday, October 4th. Cantor Fitzgerald restated an "overweight" rating and set a $130.00 price target on shares of Intra-Cellular Therapies in a report on Monday, September 16th. Finally, Piper Sandler raised Intra-Cellular Therapies from a "neutral" rating to an "overweight" rating and upped their price objective for the stock from $68.00 to $92.00 in a report on Friday, September 6th.

Get Our Latest Stock Report on Intra-Cellular Therapies

Insider Activity

In related news, President Michael Halstead sold 22,869 shares of the firm's stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $89.12, for a total transaction of $2,038,085.28. The sale was disclosed in a filing with the SEC, which is available at this hyperlink. Also, CEO Sharon Mates sold 51,000 shares of Intra-Cellular Therapies stock in a transaction dated Wednesday, December 4th. The shares were sold at an average price of $85.80, for a total value of $4,375,800.00. Following the completion of the transaction, the chief executive officer now owns 1,070,329 shares in the company, valued at $91,834,228.20. This trade represents a 4.55 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 2.60% of the company's stock.

Institutional Trading of Intra-Cellular Therapies

Hedge funds have recently modified their holdings of the company. Perceptive Advisors LLC raised its stake in shares of Intra-Cellular Therapies by 62.6% during the 2nd quarter. Perceptive Advisors LLC now owns 1,716,407 shares of the biopharmaceutical company's stock worth $117,557,000 after acquiring an additional 661,052 shares in the last quarter. Millennium Management LLC increased its position in shares of Intra-Cellular Therapies by 214.5% during the second quarter. Millennium Management LLC now owns 889,102 shares of the biopharmaceutical company's stock worth $60,895,000 after purchasing an additional 606,358 shares in the last quarter. Avoro Capital Advisors LLC increased its position in shares of Intra-Cellular Therapies by 21.2% during the second quarter. Avoro Capital Advisors LLC now owns 3,000,000 shares of the biopharmaceutical company's stock worth $205,470,000 after purchasing an additional 525,000 shares in the last quarter. Marshall Wace LLP purchased a new stake in shares of Intra-Cellular Therapies during the 2nd quarter valued at $34,178,000. Finally, Hood River Capital Management LLC acquired a new stake in shares of Intra-Cellular Therapies in the 2nd quarter worth $33,390,000. 92.33% of the stock is owned by hedge funds and other institutional investors.

Intra-Cellular Therapies Price Performance

Shares of NASDAQ ITCI traded down $0.69 during mid-day trading on Friday, reaching $83.45. The company's stock had a trading volume of 1,120,463 shares, compared to its average volume of 827,488. Intra-Cellular Therapies has a 52 week low of $62.78 and a 52 week high of $93.45. The stock has a fifty day moving average of $83.49 and a two-hundred day moving average of $77.23. The firm has a market capitalization of $8.85 billion, a PE ratio of -95.92 and a beta of 0.95.

Intra-Cellular Therapies (NASDAQ:ITCI - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The biopharmaceutical company reported ($0.25) earnings per share for the quarter, missing the consensus estimate of ($0.18) by ($0.07). The business had revenue of $175.40 million during the quarter, compared to the consensus estimate of $172.30 million. Intra-Cellular Therapies had a negative return on equity of 9.93% and a negative net margin of 14.07%. The company's revenue for the quarter was up 39.0% compared to the same quarter last year. During the same quarter in the previous year, the company earned ($0.25) earnings per share. Analysts anticipate that Intra-Cellular Therapies will post -0.64 EPS for the current fiscal year.

Intra-Cellular Therapies Company Profile

(

Get Free ReportIntra-Cellular Therapies, Inc, a biopharmaceutical company, focuses on the discovery, clinical development, and commercialization of small molecule drugs that address medical needs primarily in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms in the central nervous system (CNS) in the United States.

Read More

Before you consider Intra-Cellular Therapies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intra-Cellular Therapies wasn't on the list.

While Intra-Cellular Therapies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.