Natixis Advisors LLC cut its holdings in shares of Intra-Cellular Therapies, Inc. (NASDAQ:ITCI - Free Report) by 22.4% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 24,583 shares of the biopharmaceutical company's stock after selling 7,077 shares during the quarter. Natixis Advisors LLC's holdings in Intra-Cellular Therapies were worth $1,799,000 at the end of the most recent quarter.

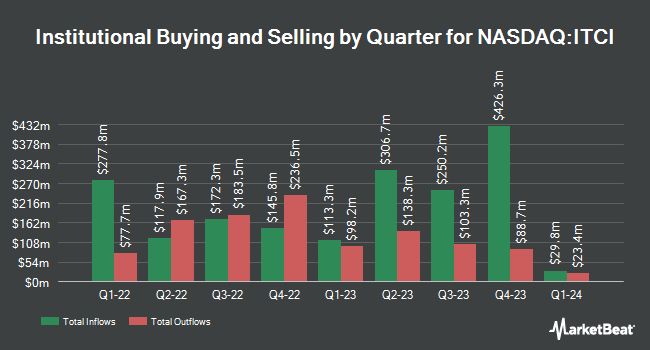

Other institutional investors have also recently bought and sold shares of the company. Simplify Asset Management Inc. raised its stake in shares of Intra-Cellular Therapies by 66.6% during the 3rd quarter. Simplify Asset Management Inc. now owns 30,883 shares of the biopharmaceutical company's stock worth $2,260,000 after purchasing an additional 12,346 shares in the last quarter. CIBC Asset Management Inc purchased a new stake in shares of Intra-Cellular Therapies during the 3rd quarter worth about $205,000. KBC Group NV raised its stake in shares of Intra-Cellular Therapies by 17.3% during the 3rd quarter. KBC Group NV now owns 2,864 shares of the biopharmaceutical company's stock worth $210,000 after purchasing an additional 423 shares in the last quarter. Oppenheimer Asset Management Inc. raised its stake in shares of Intra-Cellular Therapies by 9.5% during the 3rd quarter. Oppenheimer Asset Management Inc. now owns 38,850 shares of the biopharmaceutical company's stock worth $2,843,000 after purchasing an additional 3,358 shares in the last quarter. Finally, MQS Management LLC purchased a new stake in shares of Intra-Cellular Therapies during the 3rd quarter worth about $269,000. 92.33% of the stock is currently owned by institutional investors and hedge funds.

Intra-Cellular Therapies Stock Up 1.7 %

NASDAQ ITCI traded up $1.44 during trading on Tuesday, hitting $86.43. The company's stock had a trading volume of 293,640 shares, compared to its average volume of 851,956. The firm has a 50 day moving average price of $79.45 and a 200 day moving average price of $74.98. The firm has a market cap of $9.16 billion, a P/E ratio of -99.23 and a beta of 0.97. Intra-Cellular Therapies, Inc. has a 52 week low of $58.14 and a 52 week high of $93.45.

Intra-Cellular Therapies (NASDAQ:ITCI - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The biopharmaceutical company reported ($0.25) EPS for the quarter, missing the consensus estimate of ($0.18) by ($0.07). The business had revenue of $175.40 million during the quarter, compared to the consensus estimate of $172.30 million. Intra-Cellular Therapies had a negative return on equity of 9.93% and a negative net margin of 14.07%. The business's quarterly revenue was up 39.0% on a year-over-year basis. During the same period in the prior year, the firm earned ($0.25) earnings per share. On average, equities analysts expect that Intra-Cellular Therapies, Inc. will post -0.64 earnings per share for the current year.

Analyst Ratings Changes

A number of research firms have recently weighed in on ITCI. UBS Group cut their price target on Intra-Cellular Therapies from $83.00 to $79.00 and set a "neutral" rating for the company in a research note on Thursday, August 8th. The Goldman Sachs Group cut their price target on Intra-Cellular Therapies from $77.00 to $74.00 and set a "neutral" rating for the company in a research note on Thursday, August 8th. Morgan Stanley raised their price objective on Intra-Cellular Therapies from $92.00 to $95.00 and gave the company an "overweight" rating in a research note on Friday, October 11th. Piper Sandler raised Intra-Cellular Therapies from a "neutral" rating to an "overweight" rating and raised their price objective for the company from $68.00 to $92.00 in a research note on Friday, September 6th. Finally, Cantor Fitzgerald reissued an "overweight" rating and issued a $130.00 price objective on shares of Intra-Cellular Therapies in a research note on Monday, September 16th. Two research analysts have rated the stock with a hold rating and eleven have given a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $97.23.

Get Our Latest Stock Report on Intra-Cellular Therapies

Insiders Place Their Bets

In other news, CEO Sharon Mates sold 34,396 shares of Intra-Cellular Therapies stock in a transaction that occurred on Friday, August 30th. The stock was sold at an average price of $72.84, for a total transaction of $2,505,404.64. Following the sale, the chief executive officer now owns 1,070,329 shares of the company's stock, valued at approximately $77,962,764.36. This trade represents a 3.11 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, President Michael Halstead sold 22,869 shares of Intra-Cellular Therapies stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $89.12, for a total value of $2,038,085.28. The disclosure for this sale can be found here. Company insiders own 2.60% of the company's stock.

Intra-Cellular Therapies Company Profile

(

Free Report)

Intra-Cellular Therapies, Inc, a biopharmaceutical company, focuses on the discovery, clinical development, and commercialization of small molecule drugs that address medical needs primarily in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms in the central nervous system (CNS) in the United States.

Featured Articles

Before you consider Intra-Cellular Therapies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intra-Cellular Therapies wasn't on the list.

While Intra-Cellular Therapies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.