Equities researchers at StockNews.com initiated coverage on shares of Intra-Cellular Therapies (NASDAQ:ITCI - Get Free Report) in a research note issued on Friday. The firm set a "hold" rating on the biopharmaceutical company's stock.

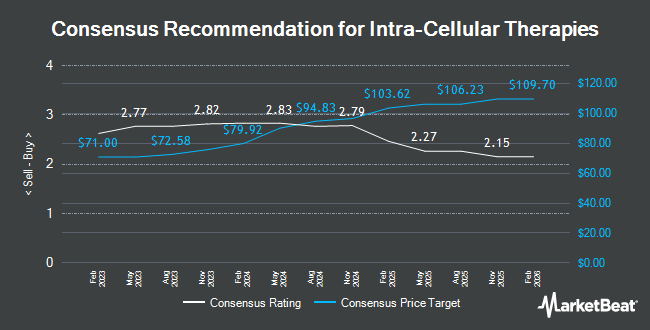

Several other research firms have also recently commented on ITCI. Baird R W cut Intra-Cellular Therapies from a "strong-buy" rating to a "hold" rating in a research note on Monday, January 13th. Mizuho downgraded Intra-Cellular Therapies from an "outperform" rating to a "neutral" rating and lowered their price objective for the stock from $140.00 to $132.00 in a research report on Monday, February 24th. Canaccord Genuity Group cut shares of Intra-Cellular Therapies from a "buy" rating to a "hold" rating and raised their target price for the company from $119.00 to $132.00 in a report on Friday, January 31st. Cantor Fitzgerald upgraded shares of Intra-Cellular Therapies from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, January 14th. Finally, Piper Sandler reissued a "neutral" rating and issued a $132.00 price objective (up from $107.00) on shares of Intra-Cellular Therapies in a research report on Tuesday, January 14th. Ten investment analysts have rated the stock with a hold rating, five have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, Intra-Cellular Therapies currently has a consensus rating of "Hold" and an average price target of $106.08.

Check Out Our Latest Analysis on Intra-Cellular Therapies

Intra-Cellular Therapies Stock Up 0.1 %

NASDAQ:ITCI traded up $0.11 on Friday, reaching $131.92. 2,957,650 shares of the company's stock were exchanged, compared to its average volume of 1,397,765. The firm has a market capitalization of $14.05 billion, a price-to-earnings ratio of -151.63 and a beta of 0.69. Intra-Cellular Therapies has a 52-week low of $64.09 and a 52-week high of $131.95. The business has a fifty day moving average of $129.23 and a 200-day moving average of $100.20.

Intra-Cellular Therapies (NASDAQ:ITCI - Get Free Report) last released its earnings results on Friday, February 21st. The biopharmaceutical company reported ($0.16) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.08) by ($0.08). The business had revenue of $199.22 million for the quarter, compared to analyst estimates of $205.08 million. Intra-Cellular Therapies had a negative return on equity of 9.93% and a negative net margin of 14.07%. As a group, equities analysts anticipate that Intra-Cellular Therapies will post -0.64 earnings per share for the current year.

Institutional Trading of Intra-Cellular Therapies

Hedge funds and other institutional investors have recently made changes to their positions in the company. Wellington Management Group LLP grew its stake in Intra-Cellular Therapies by 1.6% during the 4th quarter. Wellington Management Group LLP now owns 1,033,743 shares of the biopharmaceutical company's stock worth $86,338,000 after buying an additional 16,096 shares during the last quarter. Wealth Enhancement Advisory Services LLC boosted its holdings in shares of Intra-Cellular Therapies by 36.3% in the fourth quarter. Wealth Enhancement Advisory Services LLC now owns 12,010 shares of the biopharmaceutical company's stock valued at $1,003,000 after acquiring an additional 3,200 shares during the period. Universal Beteiligungs und Servicegesellschaft mbH purchased a new position in shares of Intra-Cellular Therapies during the fourth quarter worth approximately $7,951,000. GF Fund Management CO. LTD. acquired a new position in shares of Intra-Cellular Therapies in the 4th quarter valued at $186,000. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in Intra-Cellular Therapies by 3.7% in the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 335,319 shares of the biopharmaceutical company's stock valued at $28,006,000 after purchasing an additional 12,111 shares during the last quarter. Institutional investors and hedge funds own 92.33% of the company's stock.

Intra-Cellular Therapies Company Profile

(

Get Free Report)

Intra-Cellular Therapies, Inc, a biopharmaceutical company, focuses on the discovery, clinical development, and commercialization of small molecule drugs that address medical needs primarily in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms in the central nervous system (CNS) in the United States.

Further Reading

Before you consider Intra-Cellular Therapies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intra-Cellular Therapies wasn't on the list.

While Intra-Cellular Therapies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.