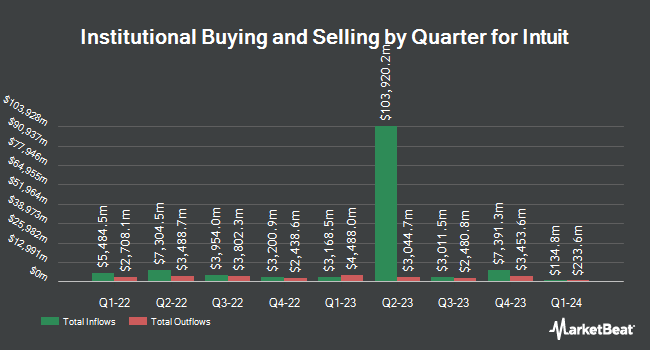

Connor Clark & Lunn Investment Management Ltd. boosted its position in Intuit Inc. (NASDAQ:INTU - Free Report) by 199.5% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 102,940 shares of the software maker's stock after purchasing an additional 68,575 shares during the quarter. Connor Clark & Lunn Investment Management Ltd.'s holdings in Intuit were worth $63,926,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds have also recently bought and sold shares of the stock. Howe & Rusling Inc. raised its position in Intuit by 8.0% in the 3rd quarter. Howe & Rusling Inc. now owns 10,857 shares of the software maker's stock valued at $6,742,000 after purchasing an additional 808 shares during the last quarter. NS Partners Ltd lifted its stake in shares of Intuit by 1.8% in the 3rd quarter. NS Partners Ltd now owns 101,263 shares of the software maker's stock valued at $62,884,000 after acquiring an additional 1,778 shares during the last quarter. Prospera Private Wealth LLC grew its holdings in Intuit by 1,748.0% during the 3rd quarter. Prospera Private Wealth LLC now owns 6,579 shares of the software maker's stock worth $4,086,000 after acquiring an additional 6,223 shares during the period. West Family Investments Inc. increased its position in Intuit by 64.8% in the 3rd quarter. West Family Investments Inc. now owns 740 shares of the software maker's stock valued at $460,000 after buying an additional 291 shares in the last quarter. Finally, PNC Financial Services Group Inc. boosted its stake in shares of Intuit by 2.0% in the 3rd quarter. PNC Financial Services Group Inc. now owns 127,892 shares of the software maker's stock worth $79,421,000 after buying an additional 2,498 shares during the last quarter. Hedge funds and other institutional investors own 83.66% of the company's stock.

Analyst Ratings Changes

INTU has been the subject of several analyst reports. Susquehanna restated a "positive" rating and set a $757.00 price target on shares of Intuit in a research report on Friday, August 16th. Morgan Stanley cut shares of Intuit from an "overweight" rating to an "equal weight" rating and lowered their price target for the stock from $750.00 to $685.00 in a research report on Wednesday, August 14th. StockNews.com raised shares of Intuit from a "hold" rating to a "buy" rating in a report on Monday, September 30th. Bank of America lifted their price target on shares of Intuit from $730.00 to $780.00 and gave the stock a "buy" rating in a research note on Friday, August 23rd. Finally, BMO Capital Markets increased their price target on shares of Intuit from $700.00 to $760.00 and gave the company an "outperform" rating in a report on Friday, August 23rd. Five analysts have rated the stock with a hold rating and fifteen have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $737.06.

Check Out Our Latest Report on Intuit

Insider Activity at Intuit

In other news, insider Scott D. Cook sold 2,461 shares of the firm's stock in a transaction that occurred on Wednesday, September 18th. The stock was sold at an average price of $637.19, for a total value of $1,568,124.59. Following the completion of the sale, the insider now directly owns 6,453,105 shares of the company's stock, valued at $4,111,853,974.95. This trade represents a 0.04 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Eve B. Burton sold 2,988 shares of the company's stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $649.87, for a total value of $1,941,811.56. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 55,297 shares of company stock valued at $35,220,046. Corporate insiders own 2.90% of the company's stock.

Intuit Stock Up 1.0 %

NASDAQ INTU traded up $6.43 on Wednesday, reaching $650.60. The company had a trading volume of 1,784,239 shares, compared to its average volume of 1,344,150. Intuit Inc. has a 1 year low of $557.29 and a 1 year high of $714.78. The firm has a 50-day moving average of $634.32 and a 200-day moving average of $630.75. The company has a debt-to-equity ratio of 0.30, a current ratio of 1.29 and a quick ratio of 1.29. The firm has a market capitalization of $182.36 billion, a PE ratio of 61.64, a P/E/G ratio of 3.36 and a beta of 1.25.

Intuit (NASDAQ:INTU - Get Free Report) last issued its quarterly earnings data on Thursday, August 22nd. The software maker reported $1.99 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.85 by $0.14. Intuit had a net margin of 18.19% and a return on equity of 18.64%. The firm had revenue of $3.18 billion during the quarter, compared to analysts' expectations of $3.08 billion. During the same period in the prior year, the company posted $0.40 earnings per share. Intuit's revenue for the quarter was up 17.4% on a year-over-year basis. On average, equities research analysts anticipate that Intuit Inc. will post 14.05 EPS for the current fiscal year.

Intuit Company Profile

(

Free Report)

Intuit Inc provides financial management and compliance products and services for consumers, small businesses, self-employed, and accounting professionals in the United States, Canada, and internationally. The company operates in four segments: Small Business & Self-Employed, Consumer, Credit Karma, and ProTax.

Featured Stories

Before you consider Intuit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intuit wasn't on the list.

While Intuit currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.