Invesco Ltd. lessened its position in FTI Consulting, Inc. (NYSE:FCN - Free Report) by 7.8% during the fourth quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 56,206 shares of the business services provider's stock after selling 4,755 shares during the period. Invesco Ltd. owned 0.16% of FTI Consulting worth $10,743,000 at the end of the most recent reporting period.

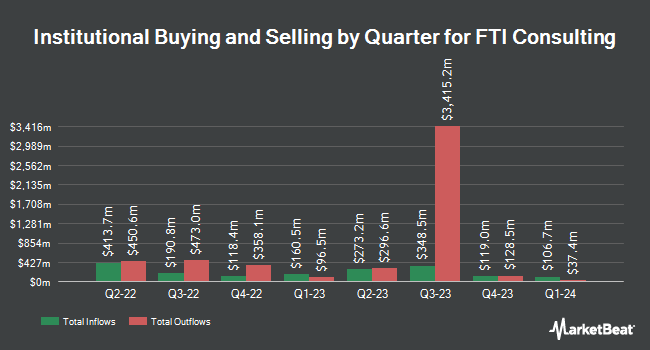

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Mawer Investment Management Ltd. lifted its holdings in FTI Consulting by 3.8% in the 4th quarter. Mawer Investment Management Ltd. now owns 4,065,609 shares of the business services provider's stock worth $777,060,000 after buying an additional 149,276 shares during the period. Vanguard Group Inc. boosted its holdings in FTI Consulting by 0.7% in the fourth quarter. Vanguard Group Inc. now owns 3,564,322 shares of the business services provider's stock valued at $681,249,000 after acquiring an additional 23,419 shares in the last quarter. Alliancebernstein L.P. increased its position in FTI Consulting by 9.3% during the 4th quarter. Alliancebernstein L.P. now owns 740,858 shares of the business services provider's stock valued at $141,600,000 after purchasing an additional 63,163 shares during the period. Pacer Advisors Inc. raised its holdings in FTI Consulting by 9,995.1% in the 4th quarter. Pacer Advisors Inc. now owns 518,687 shares of the business services provider's stock worth $99,137,000 after purchasing an additional 513,549 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. lifted its position in shares of FTI Consulting by 1.9% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 438,808 shares of the business services provider's stock worth $83,869,000 after purchasing an additional 8,032 shares during the period. 99.36% of the stock is owned by institutional investors.

FTI Consulting Price Performance

NYSE:FCN opened at $167.56 on Wednesday. The firm has a market capitalization of $6.02 billion, a P/E ratio of 21.48 and a beta of 0.21. FTI Consulting, Inc. has a one year low of $151.75 and a one year high of $243.60. The company's 50-day simple moving average is $165.36 and its 200 day simple moving average is $188.50.

FTI Consulting (NYSE:FCN - Get Free Report) last issued its quarterly earnings results on Thursday, February 20th. The business services provider reported $1.56 EPS for the quarter, missing analysts' consensus estimates of $1.73 by ($0.17). FTI Consulting had a return on equity of 13.15% and a net margin of 7.57%. The company had revenue of $894.92 million during the quarter, compared to the consensus estimate of $913.70 million. On average, equities research analysts expect that FTI Consulting, Inc. will post 8.55 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research firms recently issued reports on FCN. Truist Financial downgraded shares of FTI Consulting from a "buy" rating to a "hold" rating and decreased their price target for the stock from $225.00 to $178.00 in a research note on Wednesday, April 2nd. The Goldman Sachs Group decreased their target price on FTI Consulting from $194.00 to $173.00 and set a "neutral" rating for the company in a research report on Friday, February 21st. Finally, StockNews.com lowered FTI Consulting from a "buy" rating to a "hold" rating in a research report on Thursday, April 3rd.

View Our Latest Stock Analysis on FTI Consulting

About FTI Consulting

(

Free Report)

FTI Consulting, Inc provides business advisory services to manage change, mitigate risk, and resolve disputes worldwide. The company operates through Corporate Finance & Restructuring, Forensic and Litigation Consulting, Economic Consulting, Technology, and Strategic Communications segments. The Corporate Finance & Restructuring segment provides business transformation and strategy, transactions, and turnaround and restructuring services.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider FTI Consulting, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FTI Consulting wasn't on the list.

While FTI Consulting currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.