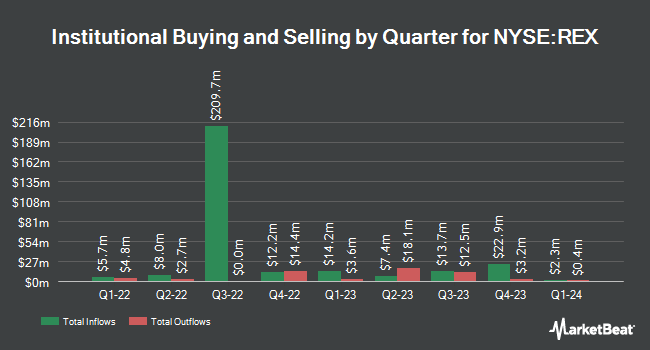

Invesco Ltd. cut its stake in shares of REX American Resources Co. (NYSE:REX - Free Report) by 27.3% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 234,463 shares of the energy company's stock after selling 88,135 shares during the quarter. Invesco Ltd. owned approximately 1.33% of REX American Resources worth $9,775,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds have also recently modified their holdings of the company. Cerity Partners LLC increased its holdings in REX American Resources by 35.1% during the 4th quarter. Cerity Partners LLC now owns 13,770 shares of the energy company's stock worth $582,000 after purchasing an additional 3,580 shares during the period. Wells Fargo & Company MN increased its stake in shares of REX American Resources by 26.9% during the fourth quarter. Wells Fargo & Company MN now owns 8,955 shares of the energy company's stock valued at $373,000 after buying an additional 1,897 shares during the period. Trexquant Investment LP increased its stake in shares of REX American Resources by 177.4% during the fourth quarter. Trexquant Investment LP now owns 71,037 shares of the energy company's stock valued at $2,962,000 after buying an additional 45,425 shares during the period. Geode Capital Management LLC raised its holdings in shares of REX American Resources by 0.8% in the fourth quarter. Geode Capital Management LLC now owns 368,638 shares of the energy company's stock valued at $15,372,000 after acquiring an additional 2,858 shares in the last quarter. Finally, Brandywine Global Investment Management LLC lifted its stake in REX American Resources by 382.0% in the fourth quarter. Brandywine Global Investment Management LLC now owns 59,530 shares of the energy company's stock worth $2,482,000 after acquiring an additional 47,180 shares during the period. Institutional investors own 88.12% of the company's stock.

Wall Street Analyst Weigh In

Separately, Truist Financial restated a "buy" rating and issued a $50.00 price target (down previously from $55.00) on shares of REX American Resources in a report on Thursday, March 27th.

View Our Latest Stock Analysis on REX

REX American Resources Price Performance

Shares of NYSE REX opened at $40.08 on Thursday. REX American Resources Co. has a 1-year low of $33.45 and a 1-year high of $60.41. The business has a fifty day moving average price of $38.29 and a 200 day moving average price of $41.64. The stock has a market capitalization of $681.88 million, a P/E ratio of 10.49 and a beta of 0.69.

REX American Resources (NYSE:REX - Get Free Report) last released its quarterly earnings results on Wednesday, March 26th. The energy company reported $0.63 EPS for the quarter, beating the consensus estimate of $0.27 by $0.36. The business had revenue of $158.23 million during the quarter, compared to analyst estimates of $163.00 million. REX American Resources had a net margin of 10.07% and a return on equity of 11.05%. During the same period in the prior year, the firm posted $1.16 earnings per share. As a group, equities research analysts anticipate that REX American Resources Co. will post 2.93 earnings per share for the current fiscal year.

REX American Resources announced that its board has approved a share repurchase plan on Wednesday, March 26th that allows the company to repurchase 1,500,000 shares. This repurchase authorization allows the energy company to purchase shares of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's board believes its stock is undervalued.

REX American Resources Profile

(

Free Report)

REX American Resources Corporation, together with its subsidiaries, produces and sells ethanol in the United States. The company also offers corn, distillers grains, ethanol, distillers corn oil, gasoline, and natural gas. In addition, it provides dry distillers grains with solubles, which is used as a protein in animal feed.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider REX American Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and REX American Resources wasn't on the list.

While REX American Resources currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.