Investidor Profissional Gestao de Recursos Ltda. decreased its holdings in shares of IAC Inc. (NASDAQ:IAC - Free Report) by 20.1% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 72,300 shares of the company's stock after selling 18,153 shares during the period. IAC comprises about 1.8% of Investidor Profissional Gestao de Recursos Ltda.'s portfolio, making the stock its 11th largest holding. Investidor Profissional Gestao de Recursos Ltda. owned approximately 0.09% of IAC worth $3,891,000 as of its most recent SEC filing.

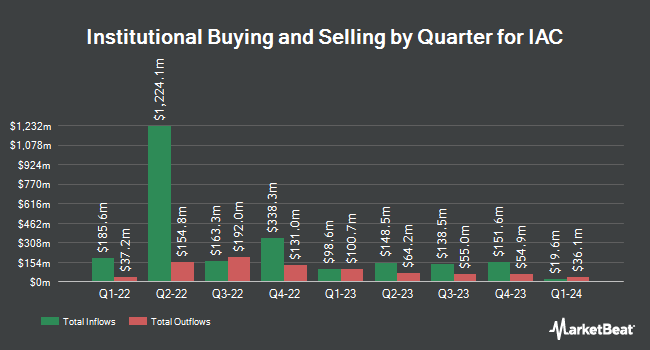

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Edgestream Partners L.P. acquired a new stake in shares of IAC in the first quarter valued at approximately $575,000. Louisiana State Employees Retirement System bought a new stake in IAC during the 2nd quarter valued at $1,649,000. Highbridge Capital Management LLC boosted its position in IAC by 70.4% during the 2nd quarter. Highbridge Capital Management LLC now owns 165,329 shares of the company's stock worth $7,746,000 after acquiring an additional 68,291 shares during the period. Thompson Siegel & Walmsley LLC grew its stake in shares of IAC by 5.1% in the second quarter. Thompson Siegel & Walmsley LLC now owns 1,633,452 shares of the company's stock worth $76,527,000 after purchasing an additional 79,951 shares in the last quarter. Finally, Royce & Associates LP increased its holdings in shares of IAC by 5.1% during the third quarter. Royce & Associates LP now owns 278,679 shares of the company's stock valued at $14,999,000 after purchasing an additional 13,400 shares during the period. Institutional investors and hedge funds own 88.90% of the company's stock.

IAC Trading Up 0.6 %

IAC stock traded up $0.27 during mid-day trading on Monday, reaching $47.22. 277,783 shares of the stock traded hands, compared to its average volume of 663,834. The stock's fifty day moving average is $51.97 and its 200-day moving average is $50.91. The company has a market cap of $3.80 billion, a P/E ratio of -109.19 and a beta of 1.33. The company has a current ratio of 2.75, a quick ratio of 2.68 and a debt-to-equity ratio of 0.30. IAC Inc. has a 52-week low of $43.51 and a 52-week high of $58.29.

IAC (NASDAQ:IAC - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The company reported ($2.93) earnings per share for the quarter, missing analysts' consensus estimates of ($0.20) by ($2.73). The business had revenue of $938.70 million for the quarter, compared to analysts' expectations of $922.62 million. IAC had a negative net margin of 0.34% and a negative return on equity of 5.63%. The business's quarterly revenue was down 15.5% compared to the same quarter last year. During the same quarter in the prior year, the firm posted ($0.30) EPS. As a group, sell-side analysts expect that IAC Inc. will post -3.97 earnings per share for the current year.

Analysts Set New Price Targets

Several equities research analysts recently weighed in on the stock. UBS Group raised shares of IAC to a "hold" rating in a report on Monday, October 28th. Macquarie reiterated an "outperform" rating and issued a $14.00 price objective on shares of IAC in a report on Thursday. Barclays lowered their price objective on shares of IAC from $70.00 to $66.00 and set an "overweight" rating on the stock in a research note on Wednesday, November 13th. KeyCorp cut their target price on IAC from $67.00 to $66.00 and set an "overweight" rating for the company in a research report on Friday, August 16th. Finally, Truist Financial dropped their price objective on IAC from $88.00 to $80.00 and set a "buy" rating on the stock in a research note on Wednesday, November 13th. Two research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $70.91.

Read Our Latest Stock Analysis on IAC

IAC Company Profile

(

Free Report)

IAC Inc, together with its subsidiaries, operates as a media and internet company worldwide. The company publishes original and engaging digital content in the form of articles, illustrations, and videos and images across entertainment, food, home, beauty, travel, health, family, luxury, and fashion areas; and magazines related to women and lifestyle.

Featured Stories

Before you consider IAC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IAC wasn't on the list.

While IAC currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.