Investment Management Corp of Ontario lifted its holdings in Parker-Hannifin Co. (NYSE:PH - Free Report) by 48.7% in the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 4,275 shares of the industrial products company's stock after purchasing an additional 1,400 shares during the period. Investment Management Corp of Ontario's holdings in Parker-Hannifin were worth $2,701,000 at the end of the most recent reporting period.

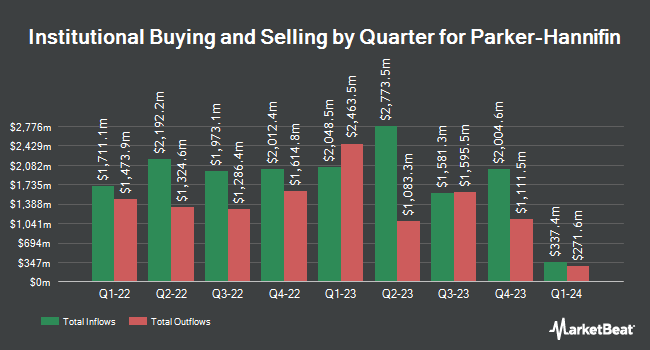

Other institutional investors have also recently made changes to their positions in the company. CWM LLC lifted its stake in Parker-Hannifin by 9.0% in the second quarter. CWM LLC now owns 4,017 shares of the industrial products company's stock worth $2,032,000 after acquiring an additional 330 shares during the last quarter. Valeo Financial Advisors LLC lifted its stake in Parker-Hannifin by 1.8% in the second quarter. Valeo Financial Advisors LLC now owns 1,684 shares of the industrial products company's stock worth $852,000 after acquiring an additional 30 shares during the last quarter. CX Institutional lifted its stake in Parker-Hannifin by 4.3% in the second quarter. CX Institutional now owns 2,379 shares of the industrial products company's stock worth $1,203,000 after acquiring an additional 99 shares during the last quarter. U.S. Capital Wealth Advisors LLC lifted its stake in Parker-Hannifin by 0.5% in the second quarter. U.S. Capital Wealth Advisors LLC now owns 4,440 shares of the industrial products company's stock worth $2,246,000 after acquiring an additional 22 shares during the last quarter. Finally, Capital Investment Advisors LLC purchased a new position in Parker-Hannifin in the second quarter worth approximately $208,000. Institutional investors and hedge funds own 82.44% of the company's stock.

Parker-Hannifin Price Performance

NYSE:PH traded down $1.68 during mid-day trading on Thursday, hitting $694.81. 465,696 shares of the company's stock traded hands, compared to its average volume of 635,827. The company has a debt-to-equity ratio of 0.52, a quick ratio of 0.57 and a current ratio of 0.96. The firm's 50 day simple moving average is $662.19 and its 200 day simple moving average is $589.65. Parker-Hannifin Co. has a 1 year low of $431.98 and a 1 year high of $712.42. The company has a market cap of $89.44 billion, a PE ratio of 31.38, a price-to-earnings-growth ratio of 2.83 and a beta of 1.43.

Parker-Hannifin (NYSE:PH - Get Free Report) last posted its earnings results on Thursday, October 31st. The industrial products company reported $6.20 earnings per share for the quarter, beating the consensus estimate of $6.14 by $0.06. Parker-Hannifin had a net margin of 14.47% and a return on equity of 27.95%. The firm had revenue of $4.90 billion during the quarter, compared to the consensus estimate of $4.90 billion. During the same period last year, the firm posted $5.96 EPS. The firm's revenue for the quarter was up 1.2% on a year-over-year basis. Sell-side analysts expect that Parker-Hannifin Co. will post 26.77 EPS for the current year.

Parker-Hannifin Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Shareholders of record on Friday, November 8th will be paid a dividend of $1.63 per share. The ex-dividend date is Friday, November 8th. This represents a $6.52 annualized dividend and a dividend yield of 0.94%. Parker-Hannifin's dividend payout ratio is currently 29.45%.

Insiders Place Their Bets

In related news, VP Thomas C. Gentile sold 2,430 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $701.16, for a total value of $1,703,818.80. Following the sale, the vice president now directly owns 5,465 shares of the company's stock, valued at approximately $3,831,839.40. This trade represents a 30.78 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, COO Andrew D. Ross sold 4,864 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $706.04, for a total transaction of $3,434,178.56. Following the completion of the sale, the chief operating officer now directly owns 13,120 shares in the company, valued at $9,263,244.80. This represents a 27.05 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 18,077 shares of company stock valued at $12,303,829 in the last ninety days. Insiders own 0.39% of the company's stock.

Analyst Ratings Changes

Several brokerages have recently weighed in on PH. StockNews.com upgraded shares of Parker-Hannifin from a "hold" rating to a "buy" rating in a research report on Saturday, October 12th. KeyCorp lifted their target price on shares of Parker-Hannifin from $725.00 to $775.00 and gave the company an "overweight" rating in a report on Thursday, November 21st. Raymond James lifted their target price on shares of Parker-Hannifin from $610.00 to $650.00 and gave the company an "outperform" rating in a report on Wednesday, September 4th. Argus boosted their price objective on shares of Parker-Hannifin from $650.00 to $710.00 and gave the company a "buy" rating in a research note on Tuesday, November 5th. Finally, Evercore ISI boosted their price objective on shares of Parker-Hannifin from $620.00 to $656.00 and gave the company an "outperform" rating in a research note on Monday, August 19th. Three equities research analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the company's stock. Based on data from MarketBeat, Parker-Hannifin has a consensus rating of "Moderate Buy" and a consensus target price of $697.87.

Check Out Our Latest Stock Analysis on Parker-Hannifin

About Parker-Hannifin

(

Free Report)

Parker-Hannifin Corporation manufactures and sells motion and control technologies and systems for various mobile, industrial, and aerospace markets worldwide. The company operates through two segments: Diversified Industrial and Aerospace Systems. The Diversified Industrial segment offers sealing, shielding, thermal products and systems, adhesives, coatings, and noise vibration and harshness solutions; filters, systems, and diagnostics solutions to ensure purity and remove contaminants from fuel, air, oil, water, and other liquids and gases; connectors used in fluid and gas handling; and hydraulic, pneumatic, and electromechanical components and systems for builders and users of mobile and industrial machinery and equipment.

Further Reading

Before you consider Parker-Hannifin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parker-Hannifin wasn't on the list.

While Parker-Hannifin currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.