Investment Management Corp of Ontario raised its position in Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) by 50.3% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 3,587 shares of the biopharmaceutical company's stock after purchasing an additional 1,200 shares during the period. Investment Management Corp of Ontario's holdings in Regeneron Pharmaceuticals were worth $3,771,000 at the end of the most recent reporting period.

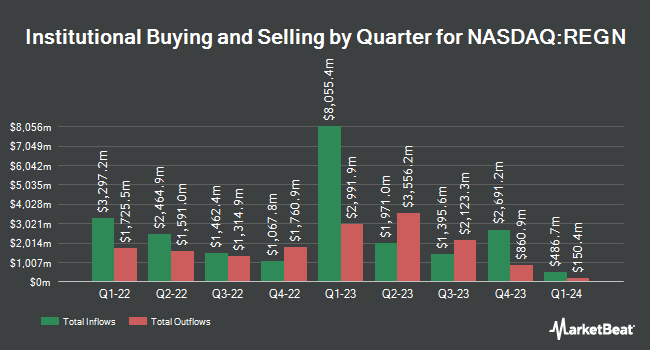

Several other hedge funds also recently modified their holdings of the company. International Assets Investment Management LLC grew its stake in Regeneron Pharmaceuticals by 86,013.3% during the third quarter. International Assets Investment Management LLC now owns 880,939 shares of the biopharmaceutical company's stock worth $926,078,000 after buying an additional 879,916 shares during the period. Charles Schwab Investment Management Inc. increased its holdings in Regeneron Pharmaceuticals by 1.7% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 673,261 shares of the biopharmaceutical company's stock valued at $707,759,000 after purchasing an additional 11,499 shares in the last quarter. Massachusetts Financial Services Co. MA raised its position in Regeneron Pharmaceuticals by 12.4% in the second quarter. Massachusetts Financial Services Co. MA now owns 540,293 shares of the biopharmaceutical company's stock valued at $567,864,000 after purchasing an additional 59,769 shares during the period. BNP PARIBAS ASSET MANAGEMENT Holding S.A. lifted its stake in shares of Regeneron Pharmaceuticals by 23.8% during the second quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 500,274 shares of the biopharmaceutical company's stock worth $525,804,000 after purchasing an additional 96,266 shares in the last quarter. Finally, TD Asset Management Inc boosted its position in shares of Regeneron Pharmaceuticals by 30.4% in the second quarter. TD Asset Management Inc now owns 351,545 shares of the biopharmaceutical company's stock worth $369,484,000 after buying an additional 82,034 shares during the period. 83.31% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

REGN has been the topic of several recent research reports. Leerink Partners reissued a "market perform" rating and set a $1,077.00 price target (down from $1,175.00) on shares of Regeneron Pharmaceuticals in a research report on Tuesday, September 24th. Truist Financial decreased their target price on shares of Regeneron Pharmaceuticals from $1,137.00 to $1,126.00 and set a "buy" rating for the company in a research note on Friday, November 1st. JPMorgan Chase & Co. dropped their price target on shares of Regeneron Pharmaceuticals from $1,200.00 to $1,150.00 and set an "overweight" rating on the stock in a research note on Thursday, October 24th. Barclays decreased their price objective on shares of Regeneron Pharmaceuticals from $1,080.00 to $1,065.00 and set an "overweight" rating for the company in a research report on Friday, November 1st. Finally, BMO Capital Markets dropped their target price on Regeneron Pharmaceuticals from $1,300.00 to $1,190.00 and set an "outperform" rating on the stock in a research report on Friday, November 1st. One research analyst has rated the stock with a sell rating, four have given a hold rating, seventeen have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, Regeneron Pharmaceuticals presently has a consensus rating of "Moderate Buy" and a consensus price target of $1,107.29.

View Our Latest Analysis on Regeneron Pharmaceuticals

Regeneron Pharmaceuticals Stock Performance

NASDAQ REGN traded down $12.77 during trading hours on Wednesday, hitting $749.57. The company had a trading volume of 649,997 shares, compared to its average volume of 544,991. Regeneron Pharmaceuticals, Inc. has a fifty-two week low of $735.95 and a fifty-two week high of $1,211.20. The firm has a market cap of $82.37 billion, a P/E ratio of 18.55, a price-to-earnings-growth ratio of 2.94 and a beta of 0.08. The company has a quick ratio of 4.46, a current ratio of 5.28 and a debt-to-equity ratio of 0.09. The business has a fifty day simple moving average of $893.12 and a 200-day simple moving average of $1,016.56.

Regeneron Pharmaceuticals Profile

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

See Also

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.