SG Americas Securities LLC boosted its stake in shares of Ionis Pharmaceuticals, Inc. (NASDAQ:IONS - Free Report) by 222.5% during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 23,927 shares of the company's stock after purchasing an additional 16,508 shares during the period. SG Americas Securities LLC's holdings in Ionis Pharmaceuticals were worth $836,000 at the end of the most recent reporting period.

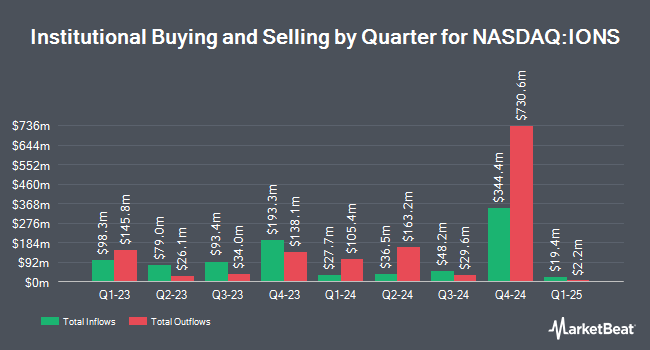

A number of other hedge funds have also bought and sold shares of IONS. International Assets Investment Management LLC grew its holdings in shares of Ionis Pharmaceuticals by 3,287.0% during the third quarter. International Assets Investment Management LLC now owns 328,772 shares of the company's stock valued at $13,171,000 after buying an additional 319,065 shares during the last quarter. Baker BROS. Advisors LP purchased a new stake in Ionis Pharmaceuticals during the 3rd quarter valued at about $8,952,000. Geode Capital Management LLC grew its stake in Ionis Pharmaceuticals by 7.4% during the 3rd quarter. Geode Capital Management LLC now owns 2,668,358 shares of the company's stock valued at $106,922,000 after purchasing an additional 183,814 shares during the last quarter. Assenagon Asset Management S.A. increased its holdings in shares of Ionis Pharmaceuticals by 967.2% in the fourth quarter. Assenagon Asset Management S.A. now owns 141,917 shares of the company's stock valued at $4,961,000 after purchasing an additional 128,619 shares during the period. Finally, Charles Schwab Investment Management Inc. raised its stake in shares of Ionis Pharmaceuticals by 8.7% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,443,020 shares of the company's stock worth $57,807,000 after purchasing an additional 114,914 shares during the last quarter. Institutional investors and hedge funds own 93.86% of the company's stock.

Ionis Pharmaceuticals Trading Up 1.3 %

Shares of IONS stock traded up $0.44 on Thursday, hitting $33.32. 2,135,404 shares of the stock traded hands, compared to its average volume of 1,619,769. Ionis Pharmaceuticals, Inc. has a twelve month low of $31.40 and a twelve month high of $52.49. The stock has a market capitalization of $5.26 billion, a PE ratio of -13.66 and a beta of 0.35. The firm's 50-day moving average price is $35.19 and its two-hundred day moving average price is $40.39. The company has a debt-to-equity ratio of 1.86, a quick ratio of 8.82 and a current ratio of 8.91.

Analyst Ratings Changes

Several brokerages recently weighed in on IONS. Wells Fargo & Company cut their price target on shares of Ionis Pharmaceuticals from $82.00 to $77.00 and set an "overweight" rating on the stock in a report on Thursday, November 7th. William Blair reiterated an "outperform" rating on shares of Ionis Pharmaceuticals in a research note on Friday, December 20th. StockNews.com downgraded shares of Ionis Pharmaceuticals from a "hold" rating to a "sell" rating in a research report on Tuesday, November 12th. Guggenheim cut their price target on Ionis Pharmaceuticals from $70.00 to $65.00 and set a "buy" rating on the stock in a research report on Wednesday, October 9th. Finally, Needham & Company LLC reissued a "buy" rating and issued a $60.00 price objective on shares of Ionis Pharmaceuticals in a report on Friday, December 20th. Two equities research analysts have rated the stock with a sell rating, five have issued a hold rating, twelve have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $60.65.

Get Our Latest Report on IONS

Insider Buying and Selling at Ionis Pharmaceuticals

In other Ionis Pharmaceuticals news, CFO Elizabeth L. Hougen sold 8,870 shares of the company's stock in a transaction dated Thursday, January 16th. The shares were sold at an average price of $32.81, for a total value of $291,024.70. Following the transaction, the chief financial officer now owns 107,885 shares of the company's stock, valued at $3,539,706.85. This represents a 7.60 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, CEO Brett P. Monia sold 6,630 shares of Ionis Pharmaceuticals stock in a transaction dated Tuesday, November 12th. The shares were sold at an average price of $38.05, for a total transaction of $252,271.50. Following the sale, the chief executive officer now owns 167,393 shares of the company's stock, valued at approximately $6,369,303.65. This represents a 3.81 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 57,293 shares of company stock worth $1,914,820 in the last ninety days. 2.71% of the stock is owned by insiders.

About Ionis Pharmaceuticals

(

Free Report)

Ionis Pharmaceuticals, Inc discovers and develops RNA-targeted therapeutics in the United States. The company offers SPINRAZA for spinal muscular atrophy (SMA) in pediatric and adult patients; TEGSEDI, an antisense injection for the treatment of polyneuropathy caused by hereditary transthyretin amyloidosis in adults; and WAYLIVRA, an antisense medicine for treatment for familial chylomicronemia syndrome (FCS) and familial partial lipodystrophy.

Further Reading

Before you consider Ionis Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ionis Pharmaceuticals wasn't on the list.

While Ionis Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.