State Street Corp raised its stake in shares of IonQ, Inc. (NYSE:IONQ - Free Report) by 1.8% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 4,260,880 shares of the company's stock after buying an additional 75,596 shares during the quarter. State Street Corp owned about 1.99% of IonQ worth $37,240,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

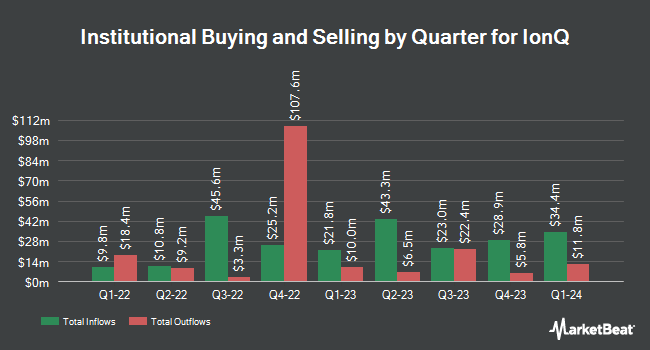

Several other hedge funds have also recently modified their holdings of IONQ. Charles Schwab Investment Management Inc. boosted its stake in IonQ by 9.2% during the third quarter. Charles Schwab Investment Management Inc. now owns 1,614,034 shares of the company's stock valued at $14,107,000 after buying an additional 135,851 shares during the last quarter. Carnegie Investment Counsel purchased a new position in shares of IonQ in the third quarter valued at $5,036,000. Yong Rong HK Asset Management Ltd bought a new stake in IonQ in the third quarter worth $3,749,000. Rockefeller Capital Management L.P. lifted its position in IonQ by 34.2% during the third quarter. Rockefeller Capital Management L.P. now owns 437,596 shares of the company's stock valued at $3,825,000 after purchasing an additional 111,435 shares during the last quarter. Finally, Prospera Financial Services Inc grew its stake in shares of IonQ by 196.1% in the 3rd quarter. Prospera Financial Services Inc now owns 38,508 shares of the company's stock worth $337,000 after buying an additional 25,502 shares in the last quarter. Hedge funds and other institutional investors own 41.42% of the company's stock.

Wall Street Analyst Weigh In

IONQ has been the subject of a number of recent research reports. Needham & Company LLC lifted their target price on IonQ from $13.00 to $18.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. DA Davidson initiated coverage on shares of IonQ in a research note on Thursday. They set a "buy" rating and a $50.00 price objective for the company. Benchmark raised their target price on shares of IonQ from $12.00 to $22.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. Finally, Craig Hallum upped their price target on shares of IonQ from $22.00 to $45.00 and gave the company a "buy" rating in a report on Friday. One analyst has rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $28.60.

Check Out Our Latest Research Report on IONQ

IonQ Stock Up 17.6 %

Shares of NYSE IONQ traded up $6.66 during midday trading on Friday, reaching $44.42. 47,582,746 shares of the company's stock traded hands, compared to its average volume of 10,486,463. The company has a market cap of $9.61 billion, a price-to-earnings ratio of -54.84 and a beta of 2.49. IonQ, Inc. has a one year low of $6.22 and a one year high of $47.41. The stock's 50 day simple moving average is $25.74 and its 200-day simple moving average is $14.03.

IonQ (NYSE:IONQ - Get Free Report) last issued its quarterly earnings data on Wednesday, November 6th. The company reported ($0.24) earnings per share for the quarter, missing analysts' consensus estimates of ($0.22) by ($0.02). The company had revenue of $12.40 million for the quarter, compared to the consensus estimate of $10.56 million. IonQ had a negative net margin of 457.85% and a negative return on equity of 36.82%. IonQ's revenue for the quarter was up 102.1% compared to the same quarter last year. During the same period in the previous year, the business earned ($0.22) EPS. Equities analysts predict that IonQ, Inc. will post -0.86 EPS for the current fiscal year.

Insider Activity

In other news, CFO Thomas G. Kramer sold 9,780 shares of the business's stock in a transaction on Wednesday, December 11th. The shares were sold at an average price of $29.72, for a total transaction of $290,661.60. Following the sale, the chief financial officer now directly owns 926,114 shares of the company's stock, valued at $27,524,108.08. The trade was a 1.04 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CRO Rima Alameddine sold 9,159 shares of the firm's stock in a transaction on Monday, October 14th. The stock was sold at an average price of $10.72, for a total value of $98,184.48. Following the completion of the transaction, the executive now owns 648,783 shares of the company's stock, valued at $6,954,953.76. This trade represents a 1.39 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 110,223 shares of company stock worth $2,286,983. Insiders own 11.60% of the company's stock.

IonQ Company Profile

(

Free Report)

IonQ, Inc engages in the development of general-purpose quantum computing systems in the United States. It sells access to quantum computers of various qubit capacities. The company makes access to its quantum computers through cloud platforms, such as Amazon Web Services (AWS) Amazon Braket, Microsoft's Azure Quantum, and Google's Cloud Marketplace, as well as through its cloud service.

Featured Stories

Before you consider IonQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IonQ wasn't on the list.

While IonQ currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.