Ipswich Investment Management Co. Inc. trimmed its position in Edwards Lifesciences Co. (NYSE:EW - Free Report) by 61.3% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 7,259 shares of the medical research company's stock after selling 11,475 shares during the period. Ipswich Investment Management Co. Inc.'s holdings in Edwards Lifesciences were worth $479,000 at the end of the most recent reporting period.

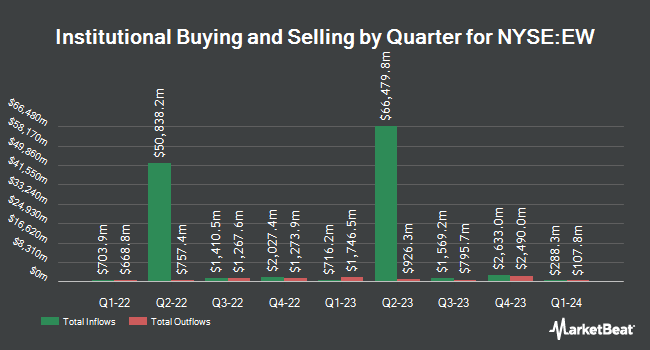

Other large investors also recently bought and sold shares of the company. Park Avenue Securities LLC lifted its holdings in Edwards Lifesciences by 0.5% in the 2nd quarter. Park Avenue Securities LLC now owns 23,484 shares of the medical research company's stock valued at $2,169,000 after purchasing an additional 108 shares in the last quarter. City State Bank lifted its holdings in Edwards Lifesciences by 16.5% in the 2nd quarter. City State Bank now owns 917 shares of the medical research company's stock valued at $85,000 after purchasing an additional 130 shares in the last quarter. Stableford Capital II LLC lifted its holdings in Edwards Lifesciences by 2.7% in the 2nd quarter. Stableford Capital II LLC now owns 6,104 shares of the medical research company's stock valued at $533,000 after purchasing an additional 159 shares in the last quarter. Purus Wealth Management LLC lifted its holdings in Edwards Lifesciences by 5.2% in the 2nd quarter. Purus Wealth Management LLC now owns 3,212 shares of the medical research company's stock valued at $297,000 after purchasing an additional 160 shares in the last quarter. Finally, Busey Bank lifted its holdings in Edwards Lifesciences by 1.9% in the 2nd quarter. Busey Bank now owns 8,838 shares of the medical research company's stock valued at $816,000 after purchasing an additional 165 shares in the last quarter. 79.46% of the stock is currently owned by hedge funds and other institutional investors.

Edwards Lifesciences Trading Up 2.4 %

NYSE EW traded up $1.60 during trading on Friday, hitting $67.76. The stock had a trading volume of 7,530,072 shares, compared to its average volume of 4,640,860. The company has a market capitalization of $39.96 billion, a PE ratio of 9.78, a PEG ratio of 3.74 and a beta of 1.12. The company has a quick ratio of 2.89, a current ratio of 3.46 and a debt-to-equity ratio of 0.06. The firm has a 50 day moving average price of $67.44 and a 200 day moving average price of $76.24. Edwards Lifesciences Co. has a twelve month low of $58.93 and a twelve month high of $96.12.

Edwards Lifesciences (NYSE:EW - Get Free Report) last released its earnings results on Thursday, October 24th. The medical research company reported $0.67 earnings per share for the quarter, meeting the consensus estimate of $0.67. The company had revenue of $1.35 billion during the quarter, compared to the consensus estimate of $1.57 billion. Edwards Lifesciences had a return on equity of 20.76% and a net margin of 70.82%. Edwards Lifesciences's revenue was up 8.9% compared to the same quarter last year. During the same period in the previous year, the company posted $0.59 EPS. As a group, equities research analysts forecast that Edwards Lifesciences Co. will post 2.57 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of research analysts have weighed in on EW shares. Canaccord Genuity Group decreased their price objective on Edwards Lifesciences from $66.00 to $63.00 and set a "hold" rating on the stock in a report on Friday, October 25th. Baird R W lowered Edwards Lifesciences from a "strong-buy" rating to a "hold" rating in a report on Thursday, July 25th. Truist Financial reduced their price target on Edwards Lifesciences from $71.00 to $70.00 and set a "hold" rating on the stock in a report on Friday, October 25th. Daiwa America lowered Edwards Lifesciences from a "strong-buy" rating to a "hold" rating in a report on Wednesday, October 30th. Finally, Wells Fargo & Company reduced their price target on Edwards Lifesciences from $90.00 to $80.00 and set an "overweight" rating on the stock in a report on Monday, September 9th. Seventeen investment analysts have rated the stock with a hold rating and ten have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $75.67.

Check Out Our Latest Stock Report on Edwards Lifesciences

Insider Transactions at Edwards Lifesciences

In related news, VP Donald E. Bobo, Jr. sold 5,000 shares of the business's stock in a transaction that occurred on Wednesday, November 13th. The stock was sold at an average price of $65.57, for a total transaction of $327,850.00. Following the completion of the sale, the vice president now owns 46,936 shares in the company, valued at $3,077,593.52. The trade was a 9.63 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Larry L. Wood sold 25,000 shares of the company's stock in a transaction that occurred on Tuesday, November 5th. The shares were sold at an average price of $65.91, for a total value of $1,647,750.00. Following the completion of the transaction, the insider now directly owns 198,526 shares of the company's stock, valued at $13,084,848.66. This trade represents a 11.18 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 41,250 shares of company stock valued at $2,744,438. 1.29% of the stock is currently owned by corporate insiders.

Edwards Lifesciences Profile

(

Free Report)

Edwards Lifesciences Corporation provides products and technologies for structural heart disease and critical care monitoring in the United States, Europe, Japan, and internationally. It offers transcatheter heart valve replacement products for the minimally invasive replacement of aortic heart valves under the Edwards SAPIEN family of valves system; and transcatheter heart valve repair and replacement products to treat mitral and tricuspid valve diseases under the PASCAL PRECISION and Cardioband names.

Read More

Before you consider Edwards Lifesciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Edwards Lifesciences wasn't on the list.

While Edwards Lifesciences currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.