IQ EQ FUND MANAGEMENT IRELAND Ltd purchased a new position in Pure Storage, Inc. (NYSE:PSTG - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm purchased 9,260 shares of the technology company's stock, valued at approximately $569,000.

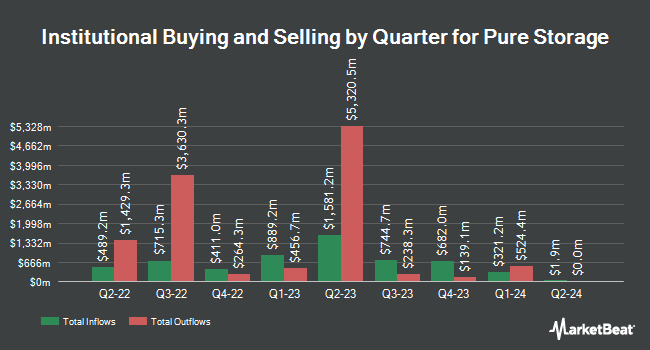

Several other large investors also recently added to or reduced their stakes in PSTG. Sugar Maple Asset Management LLC purchased a new stake in shares of Pure Storage in the fourth quarter valued at $29,000. Compass Financial Services Inc bought a new position in Pure Storage during the 4th quarter valued at about $29,000. Crowley Wealth Management Inc. purchased a new stake in Pure Storage in the 4th quarter worth about $31,000. Berbice Capital Management LLC bought a new stake in Pure Storage in the fourth quarter worth about $37,000. Finally, Larson Financial Group LLC lifted its stake in Pure Storage by 49.1% in the third quarter. Larson Financial Group LLC now owns 644 shares of the technology company's stock worth $32,000 after purchasing an additional 212 shares during the last quarter. 83.42% of the stock is owned by institutional investors.

Insider Activity at Pure Storage

In related news, insider Ajay Singh sold 19,972 shares of the company's stock in a transaction dated Tuesday, December 31st. The stock was sold at an average price of $61.58, for a total transaction of $1,229,875.76. Following the transaction, the insider now directly owns 262,144 shares of the company's stock, valued at $16,142,827.52. This represents a 7.08 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. 6.00% of the stock is currently owned by corporate insiders.

Pure Storage Price Performance

Shares of PSTG stock traded down $1.78 during mid-day trading on Monday, hitting $44.22. 4,276,208 shares of the stock traded hands, compared to its average volume of 3,092,780. Pure Storage, Inc. has a 52-week low of $43.73 and a 52-week high of $73.67. The stock has a market cap of $14.43 billion, a P/E ratio of 116.38, a P/E/G ratio of 5.12 and a beta of 1.09. The stock's fifty day moving average is $60.09 and its two-hundred day moving average is $57.50.

Analysts Set New Price Targets

Several equities research analysts have recently weighed in on the company. Stifel Nicolaus increased their price target on Pure Storage from $60.00 to $65.00 and gave the stock a "hold" rating in a report on Wednesday, December 4th. TD Cowen increased their target price on Pure Storage from $70.00 to $80.00 and gave the stock a "buy" rating in a research note on Wednesday, December 4th. Barclays lifted their target price on Pure Storage from $56.00 to $61.00 and gave the stock an "equal weight" rating in a research report on Wednesday, December 4th. Needham & Company LLC restated a "buy" rating and issued a $75.00 price target on shares of Pure Storage in a report on Thursday, February 27th. Finally, Northland Securities reiterated a "market perform" rating and set a $63.00 price objective (up previously from $59.00) on shares of Pure Storage in a report on Wednesday, December 4th. One investment analyst has rated the stock with a sell rating, seven have assigned a hold rating and fifteen have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $73.20.

Read Our Latest Stock Analysis on PSTG

Pure Storage Company Profile

(

Free Report)

Pure Storage, Inc engages in the provision of data storage and management technologies, products, and services in the United States and internationally. Its Purity software is shared across its products and provides enterprise-class data services, such as always-on data reduction, data protection, and encryption, as well as storage protocols, including block, file, and object.

Further Reading

Before you consider Pure Storage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pure Storage wasn't on the list.

While Pure Storage currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.