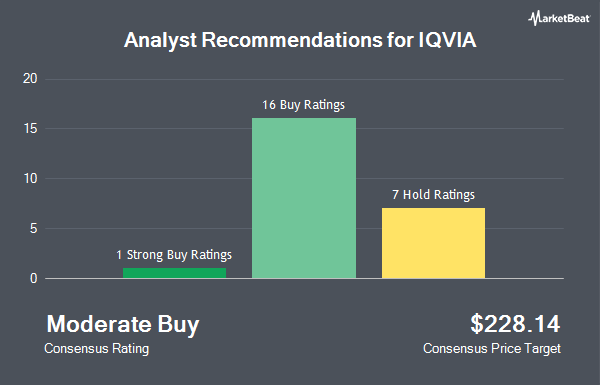

Shares of IQVIA Holdings Inc. (NYSE:IQV - Get Free Report) have been given an average recommendation of "Moderate Buy" by the nineteen analysts that are currently covering the company, MarketBeat Ratings reports. Four investment analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has assigned a strong buy rating to the company. The average 1 year price objective among analysts that have issued ratings on the stock in the last year is $259.13.

Several research analysts recently issued reports on the company. BTIG Research cut their target price on IQVIA from $290.00 to $260.00 and set a "buy" rating on the stock in a research report on Friday, November 1st. Robert W. Baird dropped their target price on shares of IQVIA from $256.00 to $223.00 and set a "neutral" rating on the stock in a research report on Friday, November 1st. UBS Group boosted their price objective on IQVIA from $295.00 to $300.00 and gave the stock a "buy" rating in a research note on Tuesday, July 23rd. Barclays decreased their target price on IQVIA from $260.00 to $255.00 and set an "overweight" rating for the company in a research report on Friday, November 1st. Finally, Morgan Stanley lowered their price target on shares of IQVIA from $280.00 to $265.00 and set an "overweight" rating for the company in a research report on Monday, November 4th.

Get Our Latest Stock Report on IQV

IQVIA Stock Down 1.6 %

NYSE:IQV traded down $3.42 during mid-day trading on Tuesday, reaching $213.57. The stock had a trading volume of 1,960,896 shares, compared to its average volume of 1,108,235. The stock has a market cap of $38.76 billion, a P/E ratio of 28.48, a PEG ratio of 2.25 and a beta of 1.51. IQVIA has a fifty-two week low of $191.45 and a fifty-two week high of $261.73. The business's 50 day moving average is $230.31 and its 200 day moving average is $229.04. The company has a debt-to-equity ratio of 1.76, a current ratio of 0.81 and a quick ratio of 0.81.

Insider Buying and Selling at IQVIA

In related news, insider Eric Sherbet sold 1,300 shares of the firm's stock in a transaction on Tuesday, August 27th. The shares were sold at an average price of $246.33, for a total transaction of $320,229.00. Following the completion of the sale, the insider now directly owns 19,536 shares of the company's stock, valued at approximately $4,812,302.88. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 1.60% of the company's stock.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the stock. PGGM Investments boosted its holdings in shares of IQVIA by 55.8% in the 2nd quarter. PGGM Investments now owns 12,073 shares of the medical research company's stock valued at $2,553,000 after purchasing an additional 4,326 shares in the last quarter. Quadrature Capital Ltd purchased a new position in IQVIA in the first quarter valued at $3,365,000. Raymond James & Associates lifted its position in IQVIA by 0.7% during the second quarter. Raymond James & Associates now owns 800,374 shares of the medical research company's stock worth $169,231,000 after buying an additional 5,417 shares during the period. UniSuper Management Pty Ltd boosted its position in shares of IQVIA by 253.0% during the first quarter. UniSuper Management Pty Ltd now owns 6,029 shares of the medical research company's stock worth $1,525,000 after buying an additional 4,321 shares during the period. Finally, Sei Investments Co. increased its stake in shares of IQVIA by 4.8% in the first quarter. Sei Investments Co. now owns 57,887 shares of the medical research company's stock worth $14,638,000 after purchasing an additional 2,638 shares during the period. Institutional investors own 89.62% of the company's stock.

About IQVIA

(

Get Free ReportIQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Featured Stories

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.