HighTower Advisors LLC lessened its position in shares of Iradimed Corporation (NASDAQ:IRMD - Free Report) by 20.0% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 82,356 shares of the medical equipment provider's stock after selling 20,644 shares during the quarter. HighTower Advisors LLC owned approximately 0.65% of Iradimed worth $4,142,000 at the end of the most recent quarter.

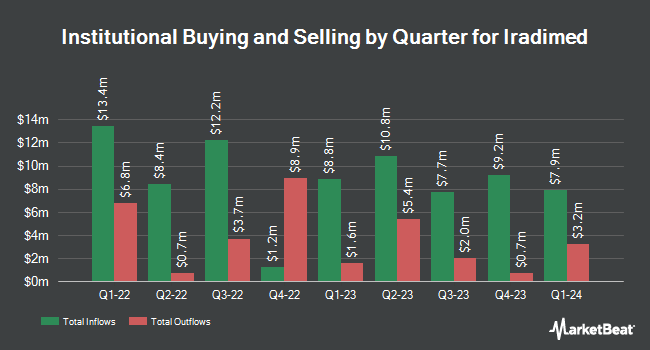

Several other institutional investors and hedge funds have also made changes to their positions in IRMD. Copeland Capital Management LLC grew its holdings in Iradimed by 0.3% during the 3rd quarter. Copeland Capital Management LLC now owns 422,425 shares of the medical equipment provider's stock valued at $21,244,000 after buying an additional 1,433 shares during the last quarter. Dimensional Fund Advisors LP increased its position in Iradimed by 1.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 218,924 shares of the medical equipment provider's stock worth $9,620,000 after purchasing an additional 2,079 shares in the last quarter. Isthmus Partners LLC raised its stake in Iradimed by 1.1% in the 2nd quarter. Isthmus Partners LLC now owns 72,664 shares of the medical equipment provider's stock valued at $32,000 after purchasing an additional 759 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its holdings in Iradimed by 189.7% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 66,632 shares of the medical equipment provider's stock valued at $3,351,000 after purchasing an additional 43,635 shares in the last quarter. Finally, Liontrust Investment Partners LLP acquired a new position in shares of Iradimed in the second quarter valued at approximately $2,830,000. 92.34% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity

In other news, CFO John Glenn sold 2,500 shares of Iradimed stock in a transaction that occurred on Monday, December 2nd. The shares were sold at an average price of $54.18, for a total transaction of $135,450.00. Following the sale, the chief financial officer now owns 4,383 shares in the company, valued at $237,470.94. This trade represents a 36.32 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Corporate insiders own 37.10% of the company's stock.

Iradimed Price Performance

IRMD traded down $0.76 during trading on Thursday, hitting $54.43. The company's stock had a trading volume of 34,303 shares, compared to its average volume of 48,410. Iradimed Corporation has a twelve month low of $40.18 and a twelve month high of $57.95. The stock has a market cap of $689.79 million, a PE ratio of 37.28 and a beta of 0.82. The firm's 50 day moving average price is $52.52 and its 200-day moving average price is $47.86.

Iradimed Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, November 25th. Shareholders of record on Friday, November 15th were issued a $0.15 dividend. This represents a $0.60 annualized dividend and a yield of 1.10%. The ex-dividend date of this dividend was Friday, November 15th. Iradimed's dividend payout ratio (DPR) is 41.10%.

Iradimed Company Profile

(

Free Report)

IRADIMED CORPORATION develops, manufactures, markets, and distributes magnetic resonance imaging (MRI) compatible medical devices and related accessories, and disposables and services in the United States and internationally. It offers MRidium MRI compatible intravenous (IV) infusion pump system with associated disposable IV tubing sets; MRI compatible patient vital signs monitoring system; and 3600 FMD1 with RALU ferromagnetic detection device.

Further Reading

Before you consider Iradimed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iradimed wasn't on the list.

While Iradimed currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.