Pacer Advisors Inc. lessened its stake in Iridium Communications Inc. (NASDAQ:IRDM - Free Report) by 7.4% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 711,756 shares of the technology company's stock after selling 56,591 shares during the quarter. Pacer Advisors Inc. owned approximately 0.63% of Iridium Communications worth $21,673,000 at the end of the most recent quarter.

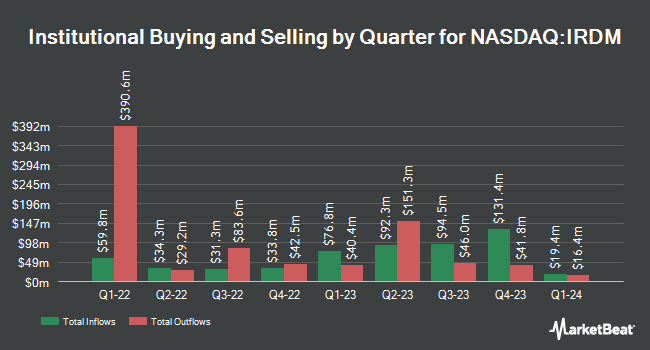

A number of other hedge funds also recently modified their holdings of the stock. Vanguard Group Inc. raised its stake in shares of Iridium Communications by 2.9% in the first quarter. Vanguard Group Inc. now owns 12,090,326 shares of the technology company's stock valued at $316,283,000 after buying an additional 336,989 shares during the period. Van Berkom & Associates Inc. raised its stake in Iridium Communications by 4.6% in the 2nd quarter. Van Berkom & Associates Inc. now owns 3,480,051 shares of the technology company's stock valued at $92,639,000 after acquiring an additional 152,232 shares during the period. Sumitomo Mitsui Trust Group Inc. raised its stake in Iridium Communications by 1.3% in the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 2,508,546 shares of the technology company's stock valued at $76,385,000 after acquiring an additional 33,074 shares during the period. Sumitomo Mitsui Trust Holdings Inc. lifted its holdings in Iridium Communications by 18.5% during the second quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 2,475,472 shares of the technology company's stock valued at $65,897,000 after purchasing an additional 385,872 shares during the last quarter. Finally, Victory Capital Management Inc. boosted its position in Iridium Communications by 0.7% during the third quarter. Victory Capital Management Inc. now owns 1,609,649 shares of the technology company's stock worth $49,014,000 after purchasing an additional 11,117 shares during the period. Institutional investors own 84.36% of the company's stock.

Iridium Communications Price Performance

IRDM traded up $0.93 during trading on Friday, reaching $29.40. 874,093 shares of the company were exchanged, compared to its average volume of 1,020,787. The company has a quick ratio of 2.01, a current ratio of 2.62 and a debt-to-equity ratio of 2.68. The company has a market cap of $3.35 billion, a price-to-earnings ratio of 31.28 and a beta of 0.65. Iridium Communications Inc. has a 12-month low of $24.14 and a 12-month high of $41.66. The company's 50-day moving average is $29.53 and its two-hundred day moving average is $28.26.

Iridium Communications (NASDAQ:IRDM - Get Free Report) last released its quarterly earnings data on Thursday, October 17th. The technology company reported $0.21 EPS for the quarter, beating analysts' consensus estimates of $0.20 by $0.01. The company had revenue of $212.77 million during the quarter, compared to analyst estimates of $205.68 million. Iridium Communications had a net margin of 14.09% and a return on equity of 14.34%. Research analysts forecast that Iridium Communications Inc. will post 0.8 earnings per share for the current fiscal year.

Iridium Communications announced that its board has authorized a share buyback plan on Thursday, September 19th that permits the company to buyback $500.00 million in outstanding shares. This buyback authorization permits the technology company to reacquire up to 14.2% of its stock through open market purchases. Stock buyback plans are typically a sign that the company's leadership believes its stock is undervalued.

Insider Activity

In other news, Director Robert H. Niehaus sold 38,355 shares of the stock in a transaction on Wednesday, October 23rd. The shares were sold at an average price of $29.39, for a total value of $1,127,253.45. Following the transaction, the director now owns 254,824 shares of the company's stock, valued at $7,489,277.36. This represents a 13.08 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, insider Suzanne E. Mcbride sold 4,420 shares of the firm's stock in a transaction on Monday, November 4th. The shares were sold at an average price of $29.48, for a total transaction of $130,301.60. Following the sale, the insider now owns 182,797 shares in the company, valued at approximately $5,388,855.56. This trade represents a 2.36 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 2.00% of the company's stock.

Analyst Upgrades and Downgrades

Separately, BWS Financial reissued a "neutral" rating and issued a $30.00 price target on shares of Iridium Communications in a research report on Monday, October 21st. Two equities research analysts have rated the stock with a hold rating, one has issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $41.00.

Read Our Latest Stock Report on Iridium Communications

About Iridium Communications

(

Free Report)

Iridium Communications Inc provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide. The company offers postpaid mobile voice and data satellite communications; prepaid mobile voice satellite communications; push-to-talk; broadband data; and Internet of Things (IoT) services.

Featured Stories

Before you consider Iridium Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iridium Communications wasn't on the list.

While Iridium Communications currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.