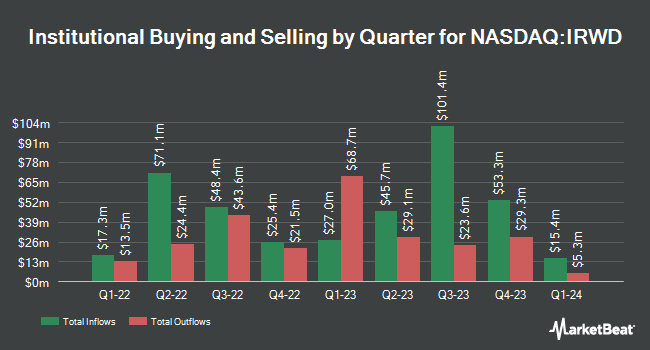

Charles Schwab Investment Management Inc. raised its holdings in Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD - Free Report) by 23.7% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 1,904,271 shares of the biotechnology company's stock after buying an additional 364,841 shares during the quarter. Charles Schwab Investment Management Inc. owned 1.19% of Ironwood Pharmaceuticals worth $7,846,000 as of its most recent SEC filing.

Other institutional investors have also recently added to or reduced their stakes in the company. KBC Group NV raised its stake in Ironwood Pharmaceuticals by 59.3% during the 3rd quarter. KBC Group NV now owns 8,593 shares of the biotechnology company's stock worth $35,000 after buying an additional 3,198 shares during the period. CWM LLC raised its holdings in Ironwood Pharmaceuticals by 55.1% during the second quarter. CWM LLC now owns 6,600 shares of the biotechnology company's stock worth $43,000 after buying an additional 2,345 shares during the last quarter. Diversified Trust Co acquired a new position in Ironwood Pharmaceuticals during the third quarter worth $52,000. Legacy Capital Group California Inc. acquired a new position in Ironwood Pharmaceuticals during the third quarter worth $59,000. Finally, First Dallas Securities Inc. purchased a new stake in shares of Ironwood Pharmaceuticals in the second quarter worth approximately $73,000.

Ironwood Pharmaceuticals Stock Down 0.8 %

Ironwood Pharmaceuticals stock traded down $0.03 during midday trading on Wednesday, reaching $3.69. The stock had a trading volume of 1,355,719 shares, compared to its average volume of 2,833,397. Ironwood Pharmaceuticals, Inc. has a 12 month low of $3.06 and a 12 month high of $15.70. The firm's 50-day moving average price is $4.05 and its 200 day moving average price is $5.04. The firm has a market capitalization of $590.51 million, a PE ratio of -115.00 and a beta of 0.41.

Ironwood Pharmaceuticals (NASDAQ:IRWD - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The biotechnology company reported $0.02 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.09 by ($0.07). Ironwood Pharmaceuticals had a negative net margin of 0.65% and a negative return on equity of 0.96%. The company had revenue of $91.60 million for the quarter, compared to the consensus estimate of $91.22 million. During the same quarter in the previous year, the firm posted $0.12 earnings per share. The business's revenue for the quarter was down 19.4% compared to the same quarter last year. Equities research analysts expect that Ironwood Pharmaceuticals, Inc. will post 0.08 EPS for the current year.

Analysts Set New Price Targets

A number of equities research analysts recently commented on the company. Leerink Partners assumed coverage on Ironwood Pharmaceuticals in a research report on Monday, September 9th. They issued a "market perform" rating and a $5.00 price target for the company. Leerink Partnrs upgraded shares of Ironwood Pharmaceuticals to a "hold" rating in a report on Monday, September 9th. Finally, StockNews.com downgraded shares of Ironwood Pharmaceuticals from a "strong-buy" rating to a "buy" rating in a report on Tuesday, November 12th. Three research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat.com, Ironwood Pharmaceuticals presently has a consensus rating of "Moderate Buy" and a consensus price target of $10.40.

View Our Latest Research Report on Ironwood Pharmaceuticals

Insider Buying and Selling

In other Ironwood Pharmaceuticals news, CFO Sravan Kumar Emany sold 11,001 shares of the company's stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $4.08, for a total value of $44,884.08. Following the transaction, the chief financial officer now directly owns 309,572 shares in the company, valued at $1,263,053.76. This represents a 3.43 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 12.90% of the stock is currently owned by insiders.

Ironwood Pharmaceuticals Company Profile

(

Free Report)

Ironwood Pharmaceuticals, Inc, a healthcare company, focuses on the development and commercialization of gastrointestinal (GI) products. It markets linaclotide, a guanylate cyclase type-C (GC-C) agonist for the treatment of adults suffering from irritable bowel syndrome with constipation or chronic idiopathic constipation under the LINZESS name in the United States, Mexico, Japan, Saudi Arabia, and China, as well as under the CONSTELLA name in the Canada and European countries.

Read More

Before you consider Ironwood Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ironwood Pharmaceuticals wasn't on the list.

While Ironwood Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.