Hodges Capital Management Inc. lowered its stake in Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD - Free Report) by 66.6% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 347,500 shares of the biotechnology company's stock after selling 693,500 shares during the period. Hodges Capital Management Inc. owned approximately 0.22% of Ironwood Pharmaceuticals worth $1,432,000 as of its most recent SEC filing.

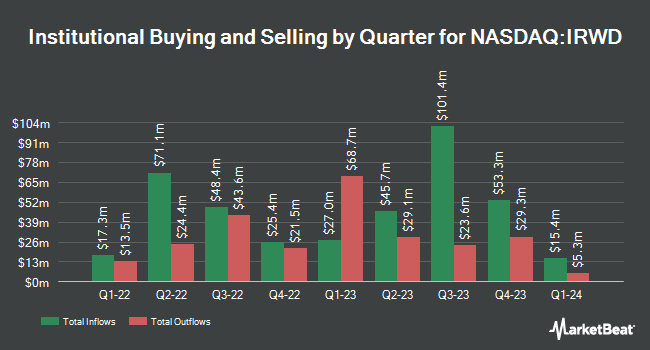

Several other large investors have also recently modified their holdings of IRWD. Robeco Institutional Asset Management B.V. increased its holdings in Ironwood Pharmaceuticals by 1,293.6% during the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 380,960 shares of the biotechnology company's stock valued at $1,570,000 after purchasing an additional 353,624 shares during the period. Connor Clark & Lunn Investment Management Ltd. increased its holdings in Ironwood Pharmaceuticals by 150.7% during the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 126,289 shares of the biotechnology company's stock valued at $520,000 after purchasing an additional 75,917 shares during the period. Pacer Advisors Inc. increased its holdings in Ironwood Pharmaceuticals by 26.6% during the 3rd quarter. Pacer Advisors Inc. now owns 11,279,822 shares of the biotechnology company's stock valued at $46,473,000 after purchasing an additional 2,372,183 shares during the period. KBC Group NV increased its holdings in Ironwood Pharmaceuticals by 59.3% during the 3rd quarter. KBC Group NV now owns 8,593 shares of the biotechnology company's stock valued at $35,000 after purchasing an additional 3,198 shares during the period. Finally, Walleye Capital LLC increased its holdings in Ironwood Pharmaceuticals by 264.2% during the 3rd quarter. Walleye Capital LLC now owns 280,299 shares of the biotechnology company's stock valued at $1,155,000 after purchasing an additional 203,331 shares during the period.

Wall Street Analysts Forecast Growth

IRWD has been the topic of several research reports. StockNews.com cut Ironwood Pharmaceuticals from a "strong-buy" rating to a "buy" rating in a research report on Tuesday, November 12th. Leerink Partners initiated coverage on Ironwood Pharmaceuticals in a research report on Monday, September 9th. They set a "market perform" rating and a $5.00 price objective on the stock. Finally, Leerink Partnrs raised Ironwood Pharmaceuticals to a "hold" rating in a research report on Monday, September 9th. Three analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $10.40.

Read Our Latest Stock Analysis on IRWD

Ironwood Pharmaceuticals Stock Performance

Shares of IRWD traded up $0.55 during mid-day trading on Monday, reaching $3.98. The company had a trading volume of 2,597,509 shares, compared to its average volume of 2,842,510. The firm has a 50-day moving average price of $4.06 and a 200 day moving average price of $5.06. Ironwood Pharmaceuticals, Inc. has a 52 week low of $3.06 and a 52 week high of $15.70. The company has a market capitalization of $636.92 million, a price-to-earnings ratio of -132.67 and a beta of 0.41.

Ironwood Pharmaceuticals (NASDAQ:IRWD - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The biotechnology company reported $0.02 EPS for the quarter, missing analysts' consensus estimates of $0.09 by ($0.07). The company had revenue of $91.60 million during the quarter, compared to the consensus estimate of $91.22 million. Ironwood Pharmaceuticals had a negative return on equity of 0.96% and a negative net margin of 0.65%. The business's revenue for the quarter was down 19.4% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.12 earnings per share. As a group, research analysts forecast that Ironwood Pharmaceuticals, Inc. will post 0.08 earnings per share for the current fiscal year.

Insider Activity at Ironwood Pharmaceuticals

In other Ironwood Pharmaceuticals news, CFO Sravan Kumar Emany sold 11,001 shares of the business's stock in a transaction on Monday, November 18th. The shares were sold at an average price of $4.08, for a total transaction of $44,884.08. Following the completion of the sale, the chief financial officer now directly owns 309,572 shares in the company, valued at approximately $1,263,053.76. The trade was a 3.43 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 12.90% of the stock is currently owned by insiders.

Ironwood Pharmaceuticals Company Profile

(

Free Report)

Ironwood Pharmaceuticals, Inc, a healthcare company, focuses on the development and commercialization of gastrointestinal (GI) products. It markets linaclotide, a guanylate cyclase type-C (GC-C) agonist for the treatment of adults suffering from irritable bowel syndrome with constipation or chronic idiopathic constipation under the LINZESS name in the United States, Mexico, Japan, Saudi Arabia, and China, as well as under the CONSTELLA name in the Canada and European countries.

Further Reading

Before you consider Ironwood Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ironwood Pharmaceuticals wasn't on the list.

While Ironwood Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.