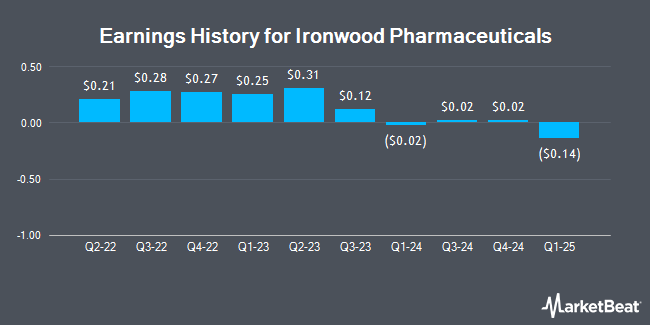

Ironwood Pharmaceuticals (NASDAQ:IRWD - Get Free Report) issued its quarterly earnings data on Thursday. The biotechnology company reported $0.02 earnings per share for the quarter, missing the consensus estimate of $0.10 by ($0.08), Zacks reports. The firm had revenue of $90.55 million during the quarter, compared to the consensus estimate of $93.85 million. Ironwood Pharmaceuticals had a negative net margin of 0.65% and a negative return on equity of 0.96%.

Ironwood Pharmaceuticals Stock Performance

Shares of IRWD stock traded down $0.09 during midday trading on Monday, reaching $1.52. 3,183,447 shares of the company were exchanged, compared to its average volume of 2,586,399. Ironwood Pharmaceuticals has a 12 month low of $1.48 and a 12 month high of $9.59. The company has a market cap of $243.24 million, a P/E ratio of -50.67 and a beta of 0.29. The company's 50 day moving average price is $3.10 and its two-hundred day moving average price is $3.81.

Insiders Place Their Bets

In other Ironwood Pharmaceuticals news, CEO Thomas A. Mccourt sold 139,064 shares of the business's stock in a transaction dated Monday, February 10th. The shares were sold at an average price of $1.76, for a total transaction of $244,752.64. Following the sale, the chief executive officer now directly owns 1,160,634 shares in the company, valued at approximately $2,042,715.84. The trade was a 10.70 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CMO Michael Shetzline sold 41,269 shares of the business's stock in a transaction that occurred on Monday, February 10th. The stock was sold at an average price of $1.76, for a total transaction of $72,633.44. Following the completion of the sale, the chief marketing officer now owns 554,007 shares in the company, valued at $975,052.32. The trade was a 6.93 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 192,381 shares of company stock worth $338,591. 12.90% of the stock is owned by corporate insiders.

Analyst Ratings Changes

Several analysts recently weighed in on the stock. Craig Hallum cut their price objective on shares of Ironwood Pharmaceuticals from $10.00 to $8.00 and set a "buy" rating on the stock in a research report on Wednesday, January 22nd. JMP Securities cut their price objective on shares of Ironwood Pharmaceuticals from $23.00 to $14.00 and set a "market outperform" rating on the stock in a research report on Thursday, January 30th. Finally, StockNews.com downgraded shares of Ironwood Pharmaceuticals from a "buy" rating to a "hold" rating in a research report on Friday. Four analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $8.60.

Read Our Latest Research Report on IRWD

About Ironwood Pharmaceuticals

(

Get Free Report)

Ironwood Pharmaceuticals, Inc, a healthcare company, focuses on the development and commercialization of gastrointestinal (GI) products. It markets linaclotide, a guanylate cyclase type-C (GC-C) agonist for the treatment of adults suffering from irritable bowel syndrome with constipation or chronic idiopathic constipation under the LINZESS name in the United States, Mexico, Japan, Saudi Arabia, and China, as well as under the CONSTELLA name in the Canada and European countries.

Read More

Before you consider Ironwood Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ironwood Pharmaceuticals wasn't on the list.

While Ironwood Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.