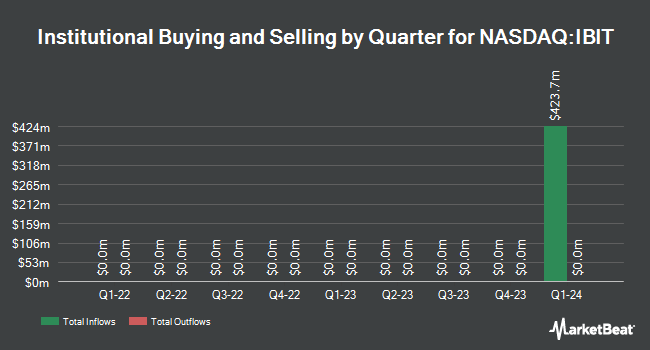

Scotia Capital Inc. increased its stake in shares of iShares Bitcoin Trust (NASDAQ:IBIT - Free Report) by 27.7% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund owned 63,885 shares of the company's stock after buying an additional 13,847 shares during the period. Scotia Capital Inc.'s holdings in iShares Bitcoin Trust were worth $3,389,000 as of its most recent SEC filing.

Other hedge funds have also added to or reduced their stakes in the company. Kovitz Investment Group Partners LLC bought a new position in iShares Bitcoin Trust during the third quarter valued at $526,000. XTX Topco Ltd bought a new position in shares of iShares Bitcoin Trust during the 3rd quarter worth $303,000. Orion Portfolio Solutions LLC increased its holdings in iShares Bitcoin Trust by 9.4% in the 3rd quarter. Orion Portfolio Solutions LLC now owns 8,101 shares of the company's stock worth $293,000 after acquiring an additional 694 shares during the last quarter. SOA Wealth Advisors LLC. increased its holdings in iShares Bitcoin Trust by 38.5% in the 3rd quarter. SOA Wealth Advisors LLC. now owns 1,619 shares of the company's stock worth $58,000 after acquiring an additional 450 shares during the last quarter. Finally, Pine Valley Investments Ltd Liability Co bought a new stake in iShares Bitcoin Trust in the 3rd quarter valued at about $353,000.

iShares Bitcoin Trust Price Performance

NASDAQ:IBIT traded up $0.61 on Monday, reaching $48.28. 32,387,362 shares of the company's stock were exchanged, compared to its average volume of 46,368,098. iShares Bitcoin Trust has a 52 week low of $28.23 and a 52 week high of $61.75. The stock has a fifty day simple moving average of $49.70 and a 200-day simple moving average of $49.75.

iShares Bitcoin Trust Company Profile

(

Free Report)

The IShares Bitcoin Trust Registered (IBIT) is an exchange-traded fund that mostly invests in long btc, short usd currency. The fund is a passively managed fund that seeks to track the spot price of Bitcoin. IBIT was launched on Jan 5, 2024 and is issued by BlackRock.

See Also

Before you consider iShares Bitcoin Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iShares Bitcoin Trust wasn't on the list.

While iShares Bitcoin Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.