Investidor Profissional Gestao de Recursos Ltda. trimmed its holdings in shares of Itaú Unibanco Holding S.A. (NYSE:ITUB - Free Report) by 50.9% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 189,678 shares of the bank's stock after selling 196,329 shares during the period. Itaú Unibanco accounts for about 0.6% of Investidor Profissional Gestao de Recursos Ltda.'s holdings, making the stock its 14th largest holding. Investidor Profissional Gestao de Recursos Ltda.'s holdings in Itaú Unibanco were worth $1,261,000 as of its most recent SEC filing.

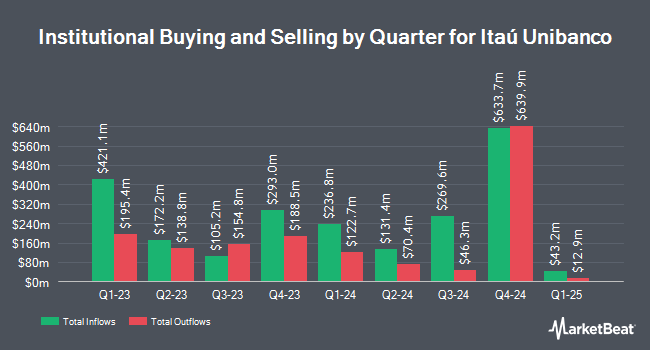

Several other institutional investors and hedge funds have also made changes to their positions in the business. Capital World Investors raised its stake in Itaú Unibanco by 64.4% during the 1st quarter. Capital World Investors now owns 8,654,237 shares of the bank's stock worth $59,974,000 after acquiring an additional 3,390,463 shares in the last quarter. Driehaus Capital Management LLC increased its position in shares of Itaú Unibanco by 77.5% during the second quarter. Driehaus Capital Management LLC now owns 7,114,571 shares of the bank's stock worth $41,549,000 after purchasing an additional 3,106,130 shares in the last quarter. Perpetual Ltd increased its position in shares of Itaú Unibanco by 9.0% during the third quarter. Perpetual Ltd now owns 13,629,806 shares of the bank's stock worth $90,638,000 after purchasing an additional 1,126,695 shares in the last quarter. Itau Unibanco Holding S.A. lifted its holdings in shares of Itaú Unibanco by 2.3% in the 2nd quarter. Itau Unibanco Holding S.A. now owns 23,818,027 shares of the bank's stock valued at $134,606,000 after purchasing an additional 529,600 shares during the last quarter. Finally, Teachers Retirement System of The State of Kentucky boosted its position in shares of Itaú Unibanco by 20.9% in the 1st quarter. Teachers Retirement System of The State of Kentucky now owns 2,917,740 shares of the bank's stock valued at $20,220,000 after purchasing an additional 504,500 shares during the period.

Analysts Set New Price Targets

A number of equities research analysts have weighed in on ITUB shares. JPMorgan Chase & Co. reduced their price objective on Itaú Unibanco from $8.00 to $7.00 and set an "overweight" rating for the company in a research note on Thursday, November 7th. UBS Group cut shares of Itaú Unibanco from a "buy" rating to a "neutral" rating in a research note on Thursday, August 22nd. Two investment analysts have rated the stock with a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $7.50.

Read Our Latest Stock Analysis on Itaú Unibanco

Itaú Unibanco Stock Up 0.8 %

Itaú Unibanco stock opened at $5.96 on Monday. The stock has a market capitalization of $58.41 billion, a price-to-earnings ratio of 7.64, a PEG ratio of 0.77 and a beta of 0.98. The company has a current ratio of 1.75, a quick ratio of 1.75 and a debt-to-equity ratio of 2.28. The stock has a 50 day moving average of $6.35 and a two-hundred day moving average of $6.27. Itaú Unibanco Holding S.A. has a twelve month low of $5.62 and a twelve month high of $7.27.

Itaú Unibanco Cuts Dividend

The company also recently disclosed a dividend, which will be paid on Thursday, January 9th. Investors of record on Monday, December 2nd will be given a $0.0031 dividend. The ex-dividend date of this dividend is Monday, December 2nd. Itaú Unibanco's dividend payout ratio (DPR) is 3.85%.

Itaú Unibanco Company Profile

(

Free Report)

Itaú Unibanco Holding SA offers a range of financial products and services to individuals and corporate customers in Brazil and internationally. The company operates through three segments: Retail Banking, Wholesale Banking, and Activities with the Market + Corporation. It offers current account; loans; credit and debit cards; investment and commercial banking services; real estate lending services; financing and investment services; economic, financial and brokerage advisory; and leasing and foreign exchange services.

Recommended Stories

Want to see what other hedge funds are holding ITUB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Itaú Unibanco Holding S.A. (NYSE:ITUB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Itaú Unibanco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Itaú Unibanco wasn't on the list.

While Itaú Unibanco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.