Algert Global LLC boosted its position in shares of iTeos Therapeutics, Inc. (NASDAQ:ITOS - Free Report) by 92.0% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 256,139 shares of the company's stock after purchasing an additional 122,730 shares during the period. Algert Global LLC owned about 0.70% of iTeos Therapeutics worth $2,615,000 as of its most recent SEC filing.

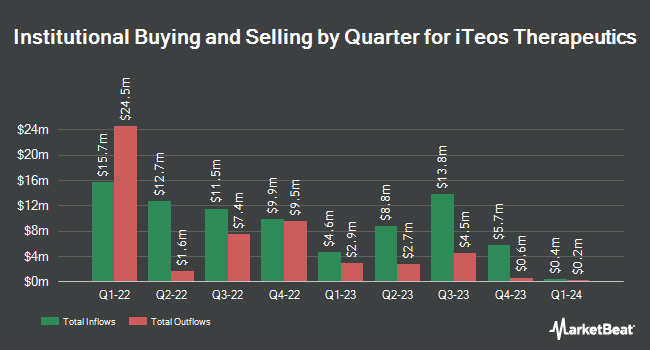

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. The Manufacturers Life Insurance Company grew its holdings in shares of iTeos Therapeutics by 6.6% in the second quarter. The Manufacturers Life Insurance Company now owns 11,071 shares of the company's stock worth $164,000 after purchasing an additional 690 shares during the last quarter. Creative Planning grew its stake in iTeos Therapeutics by 6.5% in the 3rd quarter. Creative Planning now owns 19,636 shares of the company's stock worth $200,000 after acquiring an additional 1,196 shares in the last quarter. nVerses Capital LLC increased its position in shares of iTeos Therapeutics by 212.5% during the third quarter. nVerses Capital LLC now owns 2,500 shares of the company's stock worth $26,000 after acquiring an additional 1,700 shares during the period. Public Employees Retirement System of Ohio raised its stake in shares of iTeos Therapeutics by 4.9% during the first quarter. Public Employees Retirement System of Ohio now owns 39,003 shares of the company's stock valued at $532,000 after acquiring an additional 1,817 shares in the last quarter. Finally, China Universal Asset Management Co. Ltd. boosted its holdings in shares of iTeos Therapeutics by 60.4% in the third quarter. China Universal Asset Management Co. Ltd. now owns 7,024 shares of the company's stock valued at $72,000 after purchasing an additional 2,646 shares during the period. 97.16% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at iTeos Therapeutics

In related news, CFO Matthew Gall acquired 5,000 shares of the stock in a transaction on Tuesday, November 19th. The shares were acquired at an average price of $7.73 per share, for a total transaction of $38,650.00. Following the transaction, the chief financial officer now owns 65,429 shares in the company, valued at approximately $505,766.17. This trade represents a 8.27 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 12.50% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have weighed in on the company. JPMorgan Chase & Co. decreased their target price on iTeos Therapeutics from $27.00 to $24.00 and set an "overweight" rating for the company in a research report on Monday, August 12th. Wells Fargo & Company initiated coverage on shares of iTeos Therapeutics in a research note on Tuesday, August 13th. They issued an "overweight" rating and a $31.00 price objective for the company. Wedbush reissued an "outperform" rating and set a $25.00 target price on shares of iTeos Therapeutics in a research report on Tuesday, November 12th. Finally, HC Wainwright reiterated a "buy" rating and set a $46.00 price objective on shares of iTeos Therapeutics in a research note on Friday, November 15th.

Check Out Our Latest Analysis on ITOS

iTeos Therapeutics Trading Up 4.3 %

Shares of ITOS stock traded up $0.35 during trading hours on Wednesday, reaching $8.54. 543,257 shares of the company's stock were exchanged, compared to its average volume of 446,327. iTeos Therapeutics, Inc. has a fifty-two week low of $7.54 and a fifty-two week high of $18.75. The stock's 50 day moving average is $9.23 and its 200-day moving average is $13.74. The company has a market cap of $312.00 million, a price-to-earnings ratio of -2.71 and a beta of 1.39.

iTeos Therapeutics (NASDAQ:ITOS - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The company reported ($1.05) EPS for the quarter, beating analysts' consensus estimates of ($1.18) by $0.13. Equities analysts anticipate that iTeos Therapeutics, Inc. will post -3.46 EPS for the current year.

About iTeos Therapeutics

(

Free Report)

Iteos Therapeutics, Inc, a clinical-stage biopharmaceutical company, engages in the discovery and development of immuno-oncology therapeutics for patients with cancer. The company's lead antibody product candidate, belrestotug, an antagonist of TIGIT or T-cell immunoreceptor with Ig and ITIM domains, which is in Phase 1b clinical trial, as well as used to engage the Fc gamma receptor, or Fc?R to activate dendritic cells, natural killer cells, and macrophages and to promote antibody-dependent cellular cytotoxicity, or ADCC activity.

Further Reading

Before you consider iTeos Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and iTeos Therapeutics wasn't on the list.

While iTeos Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.