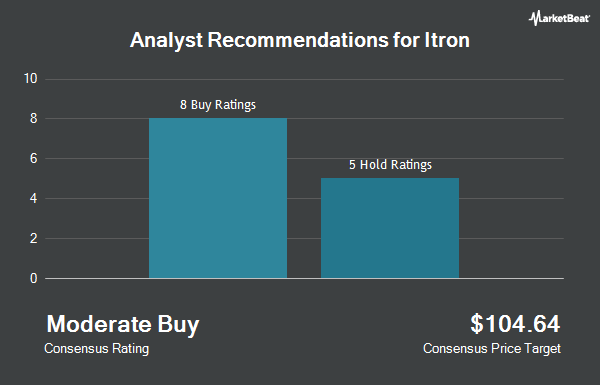

Itron, Inc. (NASDAQ:ITRI - Get Free Report) has earned an average recommendation of "Moderate Buy" from the thirteen analysts that are presently covering the stock, Marketbeat.com reports. Four research analysts have rated the stock with a hold rating and nine have given a buy rating to the company. The average 1 year price target among analysts that have covered the stock in the last year is $123.92.

ITRI has been the topic of a number of recent research reports. Roth Mkm raised their target price on Itron from $125.00 to $130.00 and gave the company a "buy" rating in a report on Friday, November 1st. Piper Sandler raised their target price on Itron from $110.00 to $119.00 and gave the company a "neutral" rating in a report on Friday, November 1st. JPMorgan Chase & Co. raised their target price on Itron from $104.00 to $112.00 and gave the company a "neutral" rating in a report on Tuesday, July 16th. Oppenheimer raised their target price on Itron from $120.00 to $124.00 and gave the company an "outperform" rating in a report on Friday, November 1st. Finally, BNP Paribas initiated coverage on Itron in a report on Thursday, September 5th. They issued an "outperform" rating and a $133.00 target price on the stock.

Read Our Latest Analysis on Itron

Insiders Place Their Bets

In other news, CEO Thomas Deitrich sold 37,500 shares of the firm's stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $104.83, for a total value of $3,931,125.00. Following the completion of the transaction, the chief executive officer now directly owns 205,276 shares of the company's stock, valued at $21,519,083.08. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. In other news, CFO Joan S. Hooper sold 509 shares of the firm's stock in a transaction on Monday, August 26th. The stock was sold at an average price of $102.15, for a total value of $51,994.35. Following the completion of the transaction, the chief financial officer now directly owns 72,338 shares of the company's stock, valued at $7,389,326.70. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Thomas Deitrich sold 37,500 shares of Itron stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $104.83, for a total value of $3,931,125.00. Following the sale, the chief executive officer now directly owns 205,276 shares of the company's stock, valued at $21,519,083.08. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 43,276 shares of company stock valued at $4,515,846 over the last ninety days. 1.45% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Itron

Large investors have recently added to or reduced their stakes in the business. Jupiter Asset Management Ltd. bought a new stake in Itron during the first quarter valued at $2,029,000. Sculptor Capital LP bought a new stake in Itron during the second quarter valued at $5,255,000. UniSuper Management Pty Ltd bought a new stake in Itron during the first quarter worth about $904,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. lifted its stake in Itron by 113.0% during the first quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 30,988 shares of the scientific and technical instruments company's stock worth $2,867,000 after purchasing an additional 16,441 shares during the last quarter. Finally, Assenagon Asset Management S.A. lifted its stake in Itron by 7.8% during the second quarter. Assenagon Asset Management S.A. now owns 268,379 shares of the scientific and technical instruments company's stock worth $26,559,000 after purchasing an additional 19,387 shares during the last quarter. Institutional investors own 96.19% of the company's stock.

Itron Stock Up 3.8 %

NASDAQ:ITRI traded up $4.44 on Wednesday, hitting $122.12. The stock had a trading volume of 844,359 shares, compared to its average volume of 525,695. The business's fifty day moving average is $104.46 and its 200 day moving average is $103.10. The company has a market cap of $5.51 billion, a PE ratio of 25.12, a P/E/G ratio of 0.81 and a beta of 1.46. The company has a quick ratio of 2.83, a current ratio of 3.36 and a debt-to-equity ratio of 0.91. Itron has a 52 week low of $62.45 and a 52 week high of $123.65.

Itron (NASDAQ:ITRI - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The scientific and technical instruments company reported $1.84 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.13 by $0.71. The business had revenue of $615.46 million for the quarter, compared to analyst estimates of $596.41 million. Itron had a return on equity of 19.03% and a net margin of 9.37%. The company's quarterly revenue was up 9.8% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.98 earnings per share. On average, equities research analysts expect that Itron will post 5.33 EPS for the current fiscal year.

Itron Company Profile

(

Get Free ReportItron, Inc, a technology, solutions, and service company, provides end-to-end solutions that help manage energy, water, and smart city operations worldwide. It operates in three segments: Device Solutions, Networked Solutions, and Outcomes. The Device Solutions segment offers hardware products that are used for measurement, control, or sensing, such as standard gas, electricity, water, and communicating meters, as well as heat and allocation products.

Featured Articles

Before you consider Itron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Itron wasn't on the list.

While Itron currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.