Summit Midstream Corporation (NYSE:SMC - Get Free Report) CEO J Heath Deneke sold 1,000 shares of the stock in a transaction dated Wednesday, March 19th. The shares were sold at an average price of $37.68, for a total value of $37,680.00. Following the completion of the transaction, the chief executive officer now owns 273,170 shares of the company's stock, valued at $10,293,045.60. This represents a 0.36 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link.

J Heath Deneke also recently made the following trade(s):

- On Friday, March 21st, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The shares were sold at an average price of $36.30, for a total transaction of $36,300.00.

- On Monday, March 17th, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The stock was sold at an average price of $38.50, for a total transaction of $38,500.00.

- On Friday, March 14th, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The stock was sold at an average price of $37.47, for a total transaction of $37,470.00.

- On Wednesday, March 12th, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The shares were sold at an average price of $38.04, for a total transaction of $38,040.00.

- On Monday, March 10th, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The shares were sold at an average price of $38.52, for a total transaction of $38,520.00.

- On Friday, March 7th, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The shares were sold at an average price of $39.23, for a total transaction of $39,230.00.

- On Wednesday, March 5th, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The stock was sold at an average price of $40.55, for a total value of $40,550.00.

- On Monday, March 3rd, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The stock was sold at an average price of $43.50, for a total value of $43,500.00.

- On Friday, February 28th, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The shares were sold at an average price of $44.28, for a total transaction of $44,280.00.

- On Wednesday, February 26th, J Heath Deneke sold 1,000 shares of Summit Midstream stock. The shares were sold at an average price of $41.96, for a total value of $41,960.00.

Summit Midstream Stock Performance

Shares of SMC stock traded down $0.48 on Tuesday, reaching $35.72. The stock had a trading volume of 112,784 shares, compared to its average volume of 75,750. The company has a debt-to-equity ratio of 1.20, a quick ratio of 1.33 and a current ratio of 1.33. Summit Midstream Corporation has a 1 year low of $31.81 and a 1 year high of $45.89. The stock has a market cap of $666.00 million, a P/E ratio of -2.79 and a beta of 2.28. The company has a 50 day simple moving average of $41.15 and a 200 day simple moving average of $37.91.

Summit Midstream (NYSE:SMC - Get Free Report) last issued its quarterly earnings data on Friday, March 21st. The company reported ($2.40) earnings per share (EPS) for the quarter. Summit Midstream had a negative net margin of 23.01% and a positive return on equity of 0.71%. During the same period in the previous year, the company earned ($2.12) EPS.

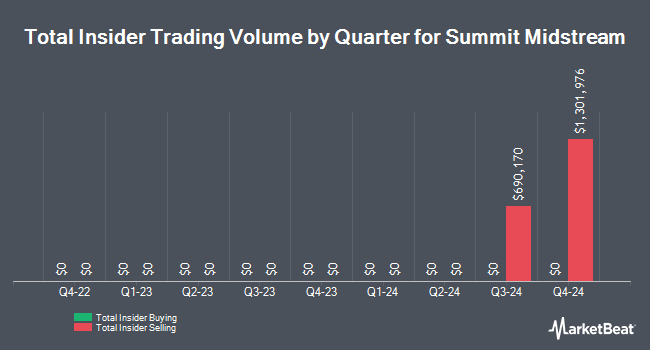

Institutional Trading of Summit Midstream

Several institutional investors and hedge funds have recently bought and sold shares of SMC. Pekin Hardy Strauss Inc. purchased a new stake in Summit Midstream during the third quarter worth $1,311,000. Virtus Fund Advisers LLC acquired a new stake in shares of Summit Midstream during the 3rd quarter valued at about $3,794,000. Jane Street Group LLC acquired a new position in Summit Midstream in the 3rd quarter worth about $227,000. Barclays PLC acquired a new position in Summit Midstream in the 3rd quarter worth about $194,000. Finally, Geode Capital Management LLC acquired a new stake in Summit Midstream in the third quarter valued at approximately $3,313,000. 42.97% of the stock is currently owned by institutional investors and hedge funds.

About Summit Midstream

(

Get Free Report)

Summit Midstream Corporation focuses on owning, developing, and operating midstream energy infrastructure assets primarily shale formations in the continental United States. It operates natural gas, crude oil, and produced water gathering systems in four unconventional resource basins, including the Williston Basin in North Dakota, which includes the Bakken and Three Forks shale formations; the Denver-Julesburg Basin that consists of the Niobrara and Codell shale formations in Colorado and Wyoming; the Fort Worth Basin in Texas, which comprises the Barnett Shale formation; and the Piceance Basin in Colorado, which includes the Mesaverde formation, as well as the emerging Mancos and Niobrara Shale formations.

Featured Articles

Before you consider Summit Midstream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Summit Midstream wasn't on the list.

While Summit Midstream currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.