Jack Henry & Associates (NASDAQ:JKHY - Get Free Report) updated its FY25 earnings guidance on Tuesday. The company provided EPS guidance of $5.78-5.87 for the period, compared to the consensus EPS estimate of $5.83. The company issued revenue guidance of $2.369-2.391 billion, compared to the consensus revenue estimate of $2.37 billion.

Jack Henry & Associates Trading Up 0.7 %

Jack Henry & Associates stock traded up $1.20 during trading hours on Tuesday, hitting $185.52. The stock had a trading volume of 601,281 shares, compared to its average volume of 439,620. The company has a quick ratio of 1.00, a current ratio of 1.00 and a debt-to-equity ratio of 0.03. Jack Henry & Associates has a one year low of $142.93 and a one year high of $186.93. The stock has a market cap of $13.53 billion, a price-to-earnings ratio of 35.31, a P/E/G ratio of 3.36 and a beta of 0.63. The business's 50 day simple moving average is $178.55 and its 200-day simple moving average is $170.23.

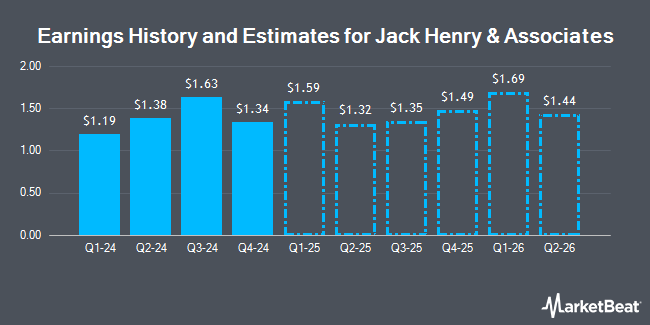

Jack Henry & Associates (NASDAQ:JKHY - Get Free Report) last released its quarterly earnings results on Tuesday, August 20th. The technology company reported $1.38 earnings per share for the quarter, topping the consensus estimate of $1.30 by $0.08. Jack Henry & Associates had a net margin of 17.23% and a return on equity of 21.63%. The business had revenue of $559.91 million for the quarter, compared to analysts' expectations of $563.37 million. During the same period in the previous year, the company earned $1.34 earnings per share. On average, equities analysts predict that Jack Henry & Associates will post 5.82 EPS for the current fiscal year.

Jack Henry & Associates Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, September 27th. Shareholders of record on Friday, September 6th were given a $0.55 dividend. The ex-dividend date of this dividend was Friday, September 6th. This represents a $2.20 annualized dividend and a yield of 1.19%. Jack Henry & Associates's payout ratio is currently 42.15%.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently commented on JKHY shares. StockNews.com upgraded shares of Jack Henry & Associates from a "hold" rating to a "buy" rating in a report on Thursday, August 15th. Oppenheimer began coverage on Jack Henry & Associates in a report on Tuesday, October 1st. They set an "outperform" rating and a $206.00 price objective on the stock. Royal Bank of Canada reaffirmed a "sector perform" rating and set a $181.00 price target on shares of Jack Henry & Associates in a research note on Friday, September 6th. Robert W. Baird upped their target price on shares of Jack Henry & Associates from $186.00 to $195.00 and gave the stock a "neutral" rating in a research note on Thursday, October 17th. Finally, Keefe, Bruyette & Woods increased their target price on Jack Henry & Associates from $178.00 to $180.00 and gave the company a "market perform" rating in a research report on Thursday, August 22nd. Seven research analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. Based on data from MarketBeat, Jack Henry & Associates currently has a consensus rating of "Hold" and an average target price of $187.11.

Check Out Our Latest Stock Analysis on Jack Henry & Associates

About Jack Henry & Associates

(

Get Free Report)

Jack Henry & Associates, Inc, a financial technology company that connects people and financial institutions through technology solutions and payment processing services that reduce the barriers to financial health. It operates through four segments: Core, Payments, Complementary, and Corporate and Other.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Jack Henry & Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jack Henry & Associates wasn't on the list.

While Jack Henry & Associates currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.