Jack Henry & Associates (NASDAQ:JKHY - Get Free Report) was upgraded by stock analysts at StockNews.com from a "hold" rating to a "buy" rating in a note issued to investors on Friday.

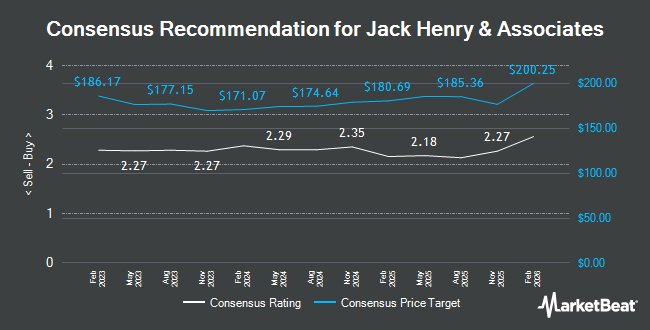

Other equities analysts also recently issued reports about the stock. Oppenheimer began coverage on shares of Jack Henry & Associates in a research note on Tuesday, October 1st. They set an "outperform" rating and a $206.00 price objective for the company. Stephens reissued an "equal weight" rating and issued a $170.00 price objective on shares of Jack Henry & Associates in a research report on Wednesday, November 6th. Robert W. Baird boosted their price target on Jack Henry & Associates from $186.00 to $195.00 and gave the company a "neutral" rating in a research note on Thursday, October 17th. Keefe, Bruyette & Woods increased their target price on shares of Jack Henry & Associates from $180.00 to $190.00 and gave the stock a "market perform" rating in a research report on Thursday, November 7th. Finally, Royal Bank of Canada raised their price target on Jack Henry & Associates from $181.00 to $203.00 and gave the stock a "sector perform" rating in a research report on Thursday, November 7th. Ten analysts have rated the stock with a hold rating and four have issued a buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $188.73.

Get Our Latest Analysis on JKHY

Jack Henry & Associates Trading Up 0.4 %

JKHY traded up $0.76 during trading on Friday, reaching $173.21. 1,734,081 shares of the company's stock were exchanged, compared to its average volume of 454,831. The company's fifty day moving average price is $179.39 and its 200-day moving average price is $170.88. The firm has a market capitalization of $12.64 billion, a PE ratio of 31.72, a P/E/G ratio of 3.29 and a beta of 0.63. Jack Henry & Associates has a fifty-two week low of $151.05 and a fifty-two week high of $189.63. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.00 and a current ratio of 1.11.

Jack Henry & Associates (NASDAQ:JKHY - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The technology company reported $1.63 EPS for the quarter, beating analysts' consensus estimates of $1.61 by $0.02. The business had revenue of $600.98 million during the quarter, compared to the consensus estimate of $599.56 million. Jack Henry & Associates had a return on equity of 21.81% and a net margin of 17.79%. The firm's revenue was up 5.2% on a year-over-year basis. During the same quarter in the prior year, the company posted $1.39 earnings per share. As a group, equities analysts forecast that Jack Henry & Associates will post 5.8 EPS for the current year.

Institutional Inflows and Outflows

Several large investors have recently bought and sold shares of JKHY. Vanguard Group Inc. grew its holdings in Jack Henry & Associates by 0.5% during the 1st quarter. Vanguard Group Inc. now owns 8,688,433 shares of the technology company's stock worth $1,509,441,000 after acquiring an additional 39,456 shares during the period. State Street Corp lifted its stake in Jack Henry & Associates by 1.7% during the 3rd quarter. State Street Corp now owns 3,976,658 shares of the technology company's stock valued at $702,039,000 after acquiring an additional 67,716 shares in the last quarter. Kayne Anderson Rudnick Investment Management LLC raised its holdings in shares of Jack Henry & Associates by 1.7% in the second quarter. Kayne Anderson Rudnick Investment Management LLC now owns 3,958,305 shares of the technology company's stock valued at $657,158,000 after purchasing an additional 67,386 shares during the last quarter. Envestnet Asset Management Inc. increased its stake in Jack Henry & Associates by 2.3% in the 2nd quarter. Envestnet Asset Management Inc. now owns 1,056,151 shares of the technology company's stock valued at $175,342,000 after buying an additional 23,617 shares during the last quarter. Finally, Handelsbanken Fonder AB lifted its holdings in Jack Henry & Associates by 8.4% during the third quarter. Handelsbanken Fonder AB now owns 863,800 shares of the technology company's stock worth $152,495,000 after acquiring an additional 66,600 shares during the period. 98.75% of the stock is owned by institutional investors.

Jack Henry & Associates Company Profile

(

Get Free Report)

Jack Henry & Associates, Inc, a financial technology company that connects people and financial institutions through technology solutions and payment processing services that reduce the barriers to financial health. It operates through four segments: Core, Payments, Complementary, and Corporate and Other.

Featured Articles

Before you consider Jack Henry & Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jack Henry & Associates wasn't on the list.

While Jack Henry & Associates currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.