Jacobs Levy Equity Management Inc. boosted its holdings in shares of PubMatic, Inc. (NASDAQ:PUBM - Free Report) by 17.4% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 676,464 shares of the company's stock after purchasing an additional 100,479 shares during the period. Jacobs Levy Equity Management Inc. owned about 1.36% of PubMatic worth $10,059,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

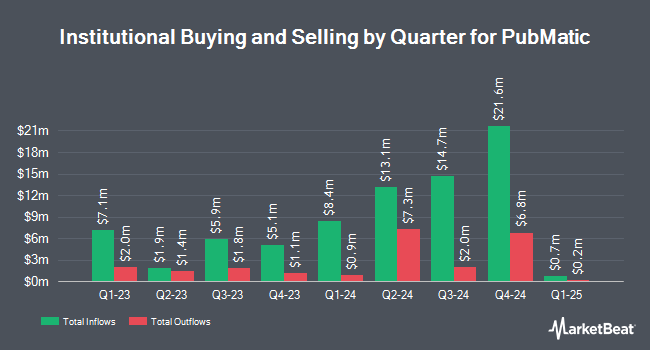

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the business. Redwood Wealth Management Group LLC acquired a new position in shares of PubMatic in the second quarter worth about $29,000. Founders Capital Management raised its position in shares of PubMatic by 100.0% in the third quarter. Founders Capital Management now owns 2,000 shares of the company's stock worth $30,000 after acquiring an additional 1,000 shares during the period. Headlands Technologies LLC acquired a new position in shares of PubMatic in the second quarter worth about $38,000. New York State Teachers Retirement System acquired a new position in shares of PubMatic in the third quarter worth about $51,000. Finally, FMR LLC raised its position in shares of PubMatic by 201.6% in the third quarter. FMR LLC now owns 4,053 shares of the company's stock worth $60,000 after acquiring an additional 2,709 shares during the period. 64.26% of the stock is currently owned by institutional investors and hedge funds.

PubMatic Price Performance

NASDAQ PUBM traded up $0.71 during trading hours on Friday, hitting $16.81. 319,933 shares of the company's stock traded hands, compared to its average volume of 462,765. PubMatic, Inc. has a 52-week low of $13.18 and a 52-week high of $25.36. The company has a market capitalization of $802.96 million, a PE ratio of 51.94 and a beta of 1.40. The firm's 50-day moving average is $15.35 and its 200-day moving average is $17.58.

Analysts Set New Price Targets

A number of research analysts have weighed in on PUBM shares. Evercore ISI upped their price objective on shares of PubMatic from $20.00 to $22.00 and gave the stock an "outperform" rating in a research report on Wednesday, November 13th. Macquarie reissued a "neutral" rating and set a $19.00 target price on shares of PubMatic in a research note on Thursday, November 14th. Royal Bank of Canada cut their target price on shares of PubMatic from $26.00 to $23.00 and set an "outperform" rating for the company in a research note on Tuesday, August 20th. Jefferies Financial Group cut their target price on shares of PubMatic from $26.00 to $16.00 and set a "hold" rating for the company in a research note on Friday, August 9th. Finally, Scotiabank assumed coverage on shares of PubMatic in a research note on Thursday. They set a "sector perform" rating and a $17.00 target price for the company. Four investment analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, PubMatic presently has an average rating of "Moderate Buy" and a consensus target price of $21.13.

Read Our Latest Analysis on PubMatic

Insider Activity at PubMatic

In other PubMatic news, General Counsel Andrew Woods sold 3,076 shares of the business's stock in a transaction dated Wednesday, October 2nd. The shares were sold at an average price of $14.52, for a total value of $44,663.52. Following the transaction, the general counsel now directly owns 32,349 shares in the company, valued at $469,707.48. The trade was a 8.68 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CEO Rajeev K. Goel sold 25,000 shares of the business's stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $14.46, for a total transaction of $361,500.00. Following the completion of the transaction, the chief executive officer now owns 24,222 shares in the company, valued at $350,250.12. The trade was a 50.79 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 108,459 shares of company stock valued at $1,636,246. Corporate insiders own 2.90% of the company's stock.

PubMatic Profile

(

Free Report)

PubMatic, Inc, a technology company, engages in the provision of a cloud infrastructure platform that enables real-time programmatic advertising transactions for digital content creators, advertisers, agencies, agency trading desks, and demand side platforms worldwide. Its PubMatic SSP, a sell-side platform, used for the purchase and sale of digital advertising inventory for publishers and buyers.

See Also

Before you consider PubMatic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PubMatic wasn't on the list.

While PubMatic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.